Data shows that Bitcoin investor sentiment has cooled to the lowest level since February, something that could facilitate a rebound in the price.

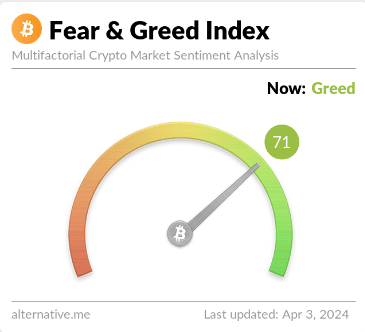

Bitcoin Fear & Greed Index Now Points At Just ‘Greed’

The “Fear & Greed Index” is an indicator created by Alternative that tells us about the general sentiment among investors in the Bitcoin and broader cryptocurrency sector.

This metric uses a numeric scale from zero to hundred to represent the sentiment. To calculate the score, the index considers the data of five factors: volatility, trading volume, social media sentiment, market cap dominance, and Google Trends.

All values of the indicator above the 53 mark suggest the presence of greed among the investors, while below the 47 level implies a fearful market. The region between these two corresponds to the neutral sentiment.

Here is how the latest value of the Bitcoin Fear & Greed Index looks:

As is visible above, the Bitcoin Fear & Greed Index currently has a value of 71, implying that the investors share a majority sentiment of greed. Just yesterday, the index’s value had been notably higher than this, implying that there has been a bit of a cooldown of sentiment in the past 24 hours.

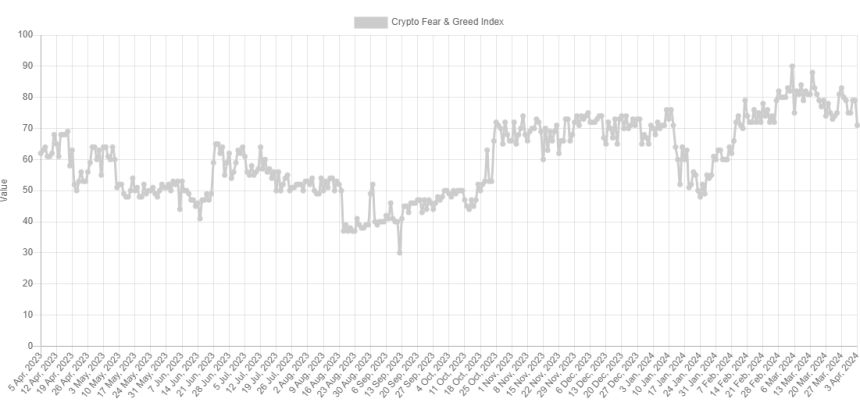

Below is a chart that shows the trend in the index over the past year.

Besides the three core sentiments, there are also two “extreme” sentiments: extreme greed and extreme fear. The former occurs at values above 75, while the latter occurs under 25.

The Bitcoin Fear & Greed Index was 79 yesterday, implying that the market had been extremely greedy. The indicator has been regularly inside this zone for the past month, so the current normal greed values go against the trend.

The sentiment among investors has naturally been so high recently because the BTC price has gone through a sharp rally in this period and has explored fresh all-time highs (ATHs).

The Bitcoin price has historically tended to go against the majority’s expectations. And the stronger this expectation has been, the more likely such a contrary move will occur.

Due to this reason, the extreme sentiments have been where reversals in the asset have been the most probable to take place in the past. For instance, the current ATH of the asset formed when the index was at a value of 88.

With the recent price drawdown, sentiment has also taken a hit. The fact that it has fallen out of the extreme greed zone, though, may be conducive to a bottom forming. The earlier bottom, around 20 March, also formed when the index exited the zone.

The current level of the Bitcoin Fear & Greed Index is not only lower than it was then but also the lowest since 11 February, when the asset was still trading around $48,000.

BTC Price

Bitcoin is now down to the $65,800 level after facing a drawdown of more than 7% over the last few days.