Data shows that Bitcoin traders’ sentiment has declined into ‘fear’ after the price crash the cryptocurrency has seen during the past 24 hours.

Bitcoin Fear & Greed Index Is Now Suggesting A Fearful Market

The “Fear & Greed Index” is an indicator created by Alternative that tells us about the average sentiment currently held by traders in the Bitcoin and wider cryptocurrency market.

The index uses a scale from zero to a hundred to represent the sentiment. The score is calculated based on five factors: volatility, trading volume, social media sentiment, market cap dominance, and Google Trends.

All values of the indicator above 53 signify the presence of greed among the investors, while those below 47 imply fear in the market. The region between these two cutoffs naturally corresponds to a neutral mentality.

Now, here is what the Bitcoin Fear & Greed Index looks like currently:

As is visible above, the Bitcoin Fear & Greed Index has a value of 44, suggesting that the sentiment is just inside the fear territory. This is a change from what it has been like during the last few days.

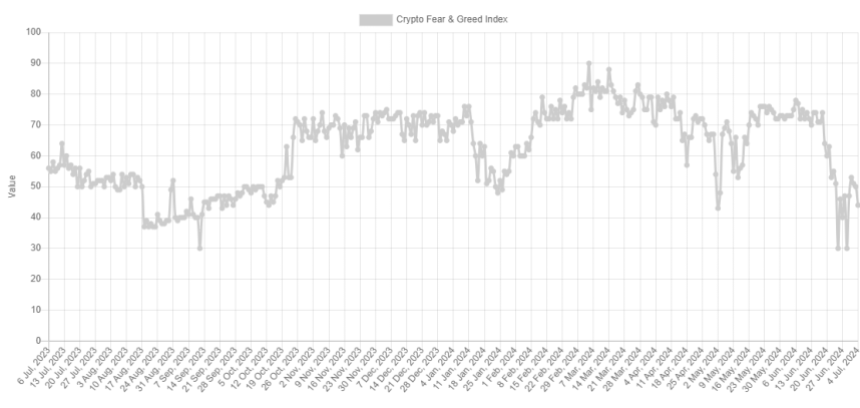

The chart below shows how the indicator’s value fluctuated over the past year.

The graph shows that the Bitcoin Fear & Greed Index had been in neutral territory during the first three days of this month, but today, on the fourth, the sentiment has plunged.

The reason behind this worsening mentality is the crash that the cryptocurrency’s price has witnessed during the past day, which has taken its price under the $58,000 level.

It’s also visible in the chart that the neutral sentiment in the first three days of July showed a sharp improvement over how June had ended. The metric had hit a low of 30 on two occasions to end the month as a culmination of the bearish momentum BTC had been facing.

As the bearish winds seem to be picking back up for the asset now, the recovery in the sentiment may be lost soon. This may not entirely be, however, bad news for the coin.

The Bitcoin price has historically tended to move against the crowd’s expectations. The chances of such a contrary move to take place grow the larger this expectation becomes. That is the more the Fear & Greed Index points in any direction.

Major tops and bottoms have generally occurred when the asset has been inside the extreme greed and fear regions, respectively. Extreme greed is the territory where the index attains values higher than 75. Similarly, extreme fear occurs under 25.

If the indicator’s value continues to decline from here, it falls into the extreme fear it could be to watch for, as they may also lead towards a potential bottom for Bitcoin this time.

BTC Price

At the time of writing, Bitcoin is trading at around $57,900, down almost 6% in the past seven days.