Data shows that Bitcoin traders have started this week with an optimistic sentiment, but here’s why this could fire back for the cryptocurrency.

Bitcoin Investors Show Spike In Bullish Sentiment

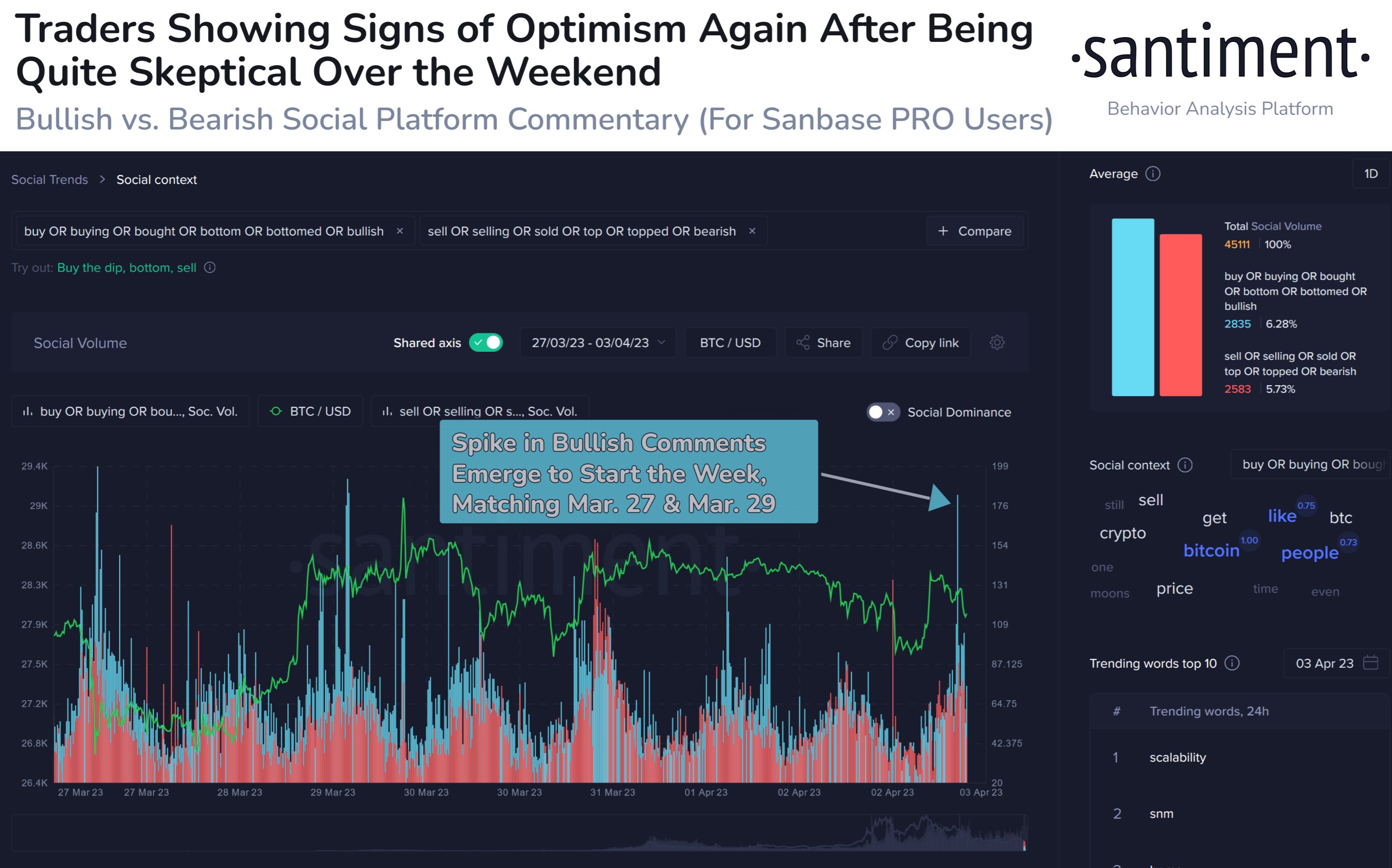

According to data from the on-chain analytics firm Santiment, a big uptick in trader optimism in the BTC and the wider cryptocurrency market has been seen recently. The relevant indicator here is the “social volume,” which measures the total amount of text documents that mention a keyword or a set of terms at least once.

Here, the text documents refer to a collection of social media text files that Santiment has pulled off the internet from sources like tweets, Reddit threads, forum posts, etc. The social volume indicator, therefore, tells us about the degree of discussions that are taking place around a given topic on social media websites.

Something to keep in mind about this indicator is that it doesn’t count the pure number of mentions that are occurring of the term in question, but rather the number of documents/posts containing it. This means that if there are two documents and one of them contains the keyword once, while the other does it twice, the social volume will still be just two here, and not three.

Now, here is a chart that shows the trend in the social volumes of both positive and negative keywords related to the Bitcoin and cryptocurrency market over the last week or so:

To get an idea about the positive sentiment in the market, the Bitcoin social volume is filtered for keywords like buy, bottom, bullish, etc. Similarly, sell, top, bearish, etc, represent the negative sentiment.

From the chart, it’s visible that the positive sentiment had cooled down over this past weekend, and only a significant spike in the negative social volume took place.

With the start of this week, however, the social volume of the bullish sentiment has sharply surged, meaning that discussions taking place on the internet right now have a majority positive view on BTC and digital assets in general.

A particularly large spike in the indicator was observed yesterday, similar in scale to the positive sentiment surges seen on March 27 and 29. The first of these came while BTC was already in the middle of a plunge and the other one appeared when BTC had nearly hit a local top.

This means that neither of these spikes seemed to have provided any bullish effect on the price. This is also something that has been observed many times throughout history, as too much positive sentiment can be a sign of euphoria among investors, which often ends up being bearish for the price.

If these past examples are anything to go by, the latest spike in positive sentiment may also have a similar effect on the price. “Watch for the crowd getting too prematurely excited about $30,000,” notes Santiment.

BTC Price

At the time of writing, Bitcoin is trading around $28,200, up 4% in the last week.