Volatility remains the norm in the Bitcoin market, with aggressive price swings defining the past few days. On Monday, BTC dropped to $97K before surging to $106K yesterday. However, the price has since retraced and now consolidates around the $102K mark, keeping investors on edge about its next move.

Top analyst Daan shared key insights from Coinglass, revealing that Bitcoin has mostly traded with a Coinbase discount over the past month, as indicated by the Coinbase premium index. This means that other spot exchanges are pricing BTC higher than Coinbase, signaling increased selling pressure from US investors. A Coinbase premium typically indicates strong demand from institutional and ETF buyers, reinforcing bullish sentiment. However, with the index currently flat, the US market seems indecisive.

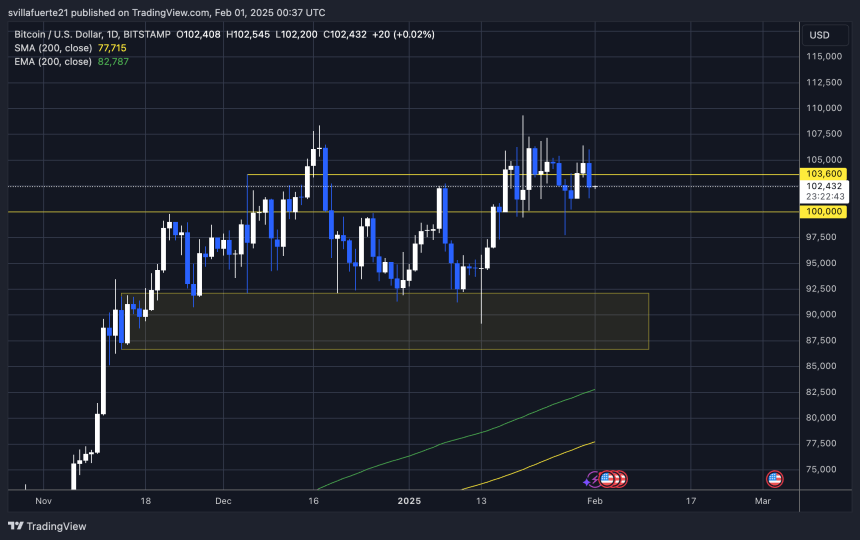

As Bitcoin consolidates below all-time highs, traders are closely watching whether it can reclaim key resistance levels or face another wave of selling pressure. If BTC breaks above $106K again, a test of the all-time high could follow. However, losing the $100K support level could lead to further downside and extended consolidation. The coming days will be crucial in determining the next phase for Bitcoin.

Bitcoin At A Crucial Level As Market Awaits Next Move

Bitcoin is at a pivotal moment after failing to retest its all-time high (ATH) and now seeking support to fuel the next leg up. The $110K level remains the key psychological target above ATH, and once BTC breaks and holds above it, the entire market could enter a new bullish phase.

Despite recent upside momentum, BTC has struggled to gain a clear breakout, leading to uncertainty among investors. Analysts remain divided—some see this as a natural consolidation before Bitcoin makes its next big move, while others worry about a deeper correction if BTC fails to hold key support levels.

Top analyst Daan shared key insights from Coinglass, revealing that Bitcoin has mostly traded with a Coinbase discount over the past month. This means that BTC is priced lower on Coinbase compared to other spot exchanges, indicating that selling pressure is coming primarily from US investors.

Historically, a Coinbase premium has signaled strong institutional demand, particularly from ETFs and major financial players. However, with the index currently flat, the US market seems cautious. For BTC to confirm a bullish breakout, holding above $102K and reclaiming $106K is critical. If Bitcoin loses these levels, a retest of $100K support could be imminent, delaying a breakout into price discovery.

Bitcoin Price Consolidates Below Key Levels

Bitcoin is currently trading at $102,400, showing signs of consolidation as the price remains bounded between the $106K resistance and the $100K support levels. This range has defined Bitcoin’s short-term movements, and a breakout in either direction will likely dictate the next trend.

A breakdown below $100K could lead to further consolidation or even a deeper correction, delaying Bitcoin’s bullish breakout. If BTC fails to hold this psychological level, selling pressure could increase, pushing prices lower before any attempt at recovery.

On the other hand, reclaiming and holding above $106K would be a major bullish signal, suggesting that price discovery is imminent. This would clear the path for Bitcoin to test its all-time high (ATH) and target the $110K mark, potentially triggering a fresh rally.

For now, uncertainty remains the dominant theme as the market waits for a decisive price move to confirm short-term direction. With volatility increasing, traders are closely monitoring these key levels, knowing that a clean breakout or breakdown will set the tone for Bitcoin’s next major move.

Featured image from Dall-E, chart from TradingView