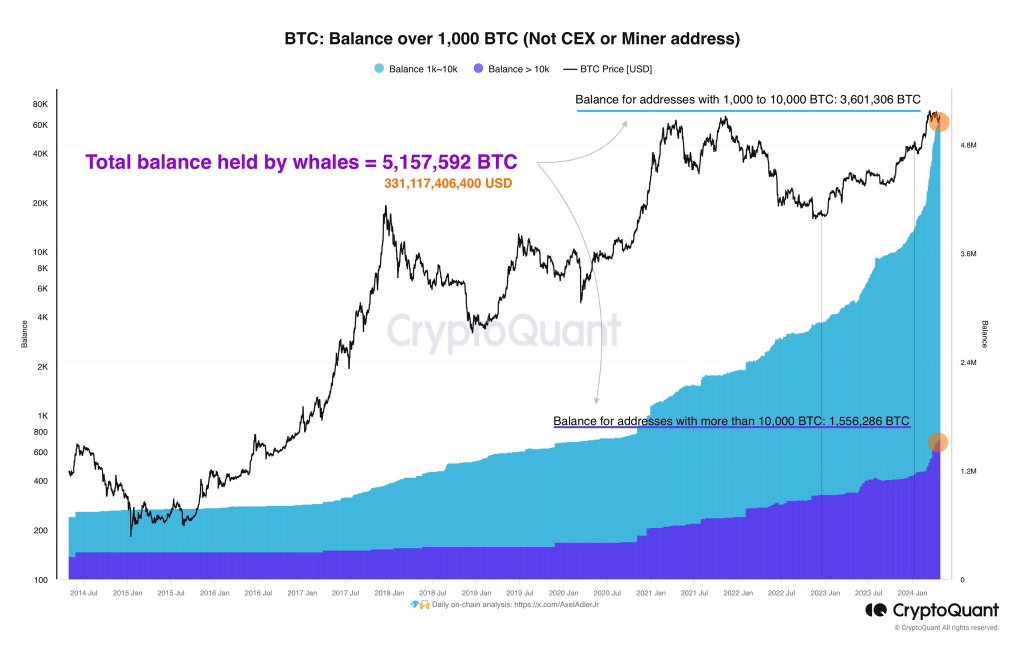

While Bitcoin prices struggle for momentum and are caged inside a narrow range, on-chain data tells a different story. Taking to X, one analyst notes that whales, which are large crypto holders, are actively accumulating the world’s largest coin by market cap.

Bitcoin Whales Accumulating Despite Weakness

By the time this data was shared, Bitcoin whales held over 5.1 million BTC worth a staggering $331 billion. That there is still demand when the coin moves in a narrow range flies in the face of recent market weakness and skeptics betting on even more price dumps.

Currently, Bitcoin is inside a range, with caps at $73,800 and $60,000. Despite overall market confidence, the coin has failed to pull higher, breaking above $70,000 even after Halving on April 20. Even though prices are firm, the absence of follow-through after April 21 and 22 hints at weakness.

From the BTCUSDT price chart, the coin could explode should it break above the middle BB. If the leg up is accompanied by positive fundamental events, momentum could push the coin to all-time highs.

On the flip side, BTC is likely to slip even lower should sellers flow back. The sharp rejection of bulls on April 24 is bearish. As such, this might set a wave of lower lows in motion, taking the coin below April 2023 lows.

Traders Panicked Sold, Register Huge Losses

Parallel market data shows panic sellers on Binance and OKX, two major crypto exchanges by trading volumes, have dumped a combined 5,137 BTC at a loss over the past two weeks. As data shows, prices have been weaving lower during this time, with bulls failing to counter the dump, especially after two consecutive losses on April 12 and 13.

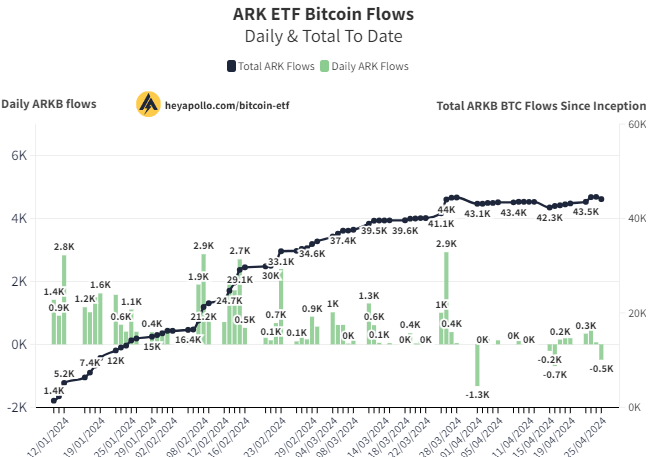

Meanwhile, there have been sharp outflows from ARKB, the spot Bitcoin exchange-traded fund (ETF). Data shows that ARKB sold 490 BTC, worth $31 million, on April 25. This is the third-largest single-day outflow in history.

Recent price pressures on BTC coincide with a marked drop in spot ETF inflows in the second half of April. On April 25, Lookonchain data revealed that GBTC and all the nine spot ETF issuers decreased over 2,100 BTC worth roughly $135 million.