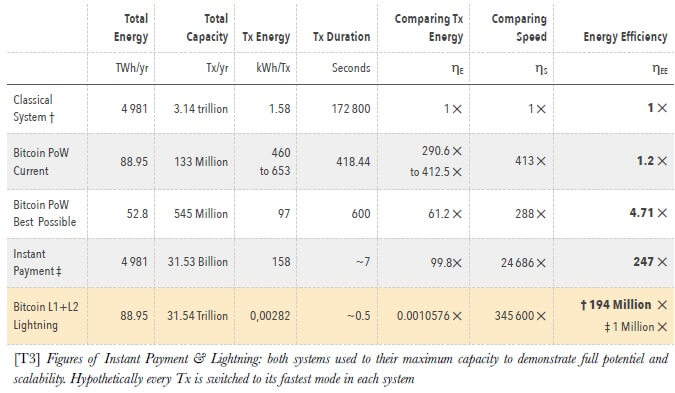

A recently published study compared Bitcoin’s and traditional finance’s energy requirements to find that Bitcoin currently uses 56 times less energy. Even with the current PoW system, one Bitcoin transaction is five times more energy-efficient than a classical transaction.

On the other hand, Bitcoin Lightning is 194 million and 1 million times more energy-efficient than traditional and instant payments, respectively.

The study defines money with three utilities as being a unit of account, a medium of exchange, and a store of value. In this respect, both Bitcoin and fiat currencies become comparable.

Energy consumption

The authors first calculate the energy consumption of fiat currencies and Bitcoin.

Fiat money

When calculating the energy consumption of banknotes and coins, the authors take the energy needed for printing paper money, renewing coins, running ATM systems, transmitting cash, using electronic payments systems (EPOS), issuing card payments, running banking offices, employing banking staff and managing inter-banking into consideration.

As a result of a detailed calculation of each category, the authors estimate that the classical monetary system consumes 4,981 Terawatt-hours per year.

Bitcoin

Bitcoin’s layer-2 solution, Bitcoin Lightning, is excluded, and the current PoW system is considered. After calculating the energy consumption of different mining equipment, the authors conclude that the upper bound energy Bitcoin uses 88.95 Terawatt-hours per year.

The paper states:

“We can conclude that the cryptopayment system of Bitcoin PoW consumes at least ~56 times less energy than the classical electronic monetary and payment system.”

Energy efficiency

After calculating the energy consumption, the authors use that input to calculate the energy efficiency of each system by evaluating the quantity of work and power involved.

When deciding on the energy efficiency levels of each system, the authors include the time it takes for each to complete one transaction into consideration.

Bitcoin vs. traditional finance

A Bitcoin transaction usually takes about 10 minutes to be confirmed and completed. On the other hand, a traditional payment usually occurs within one to five business days. This means that a classic payment transaction is 288 times slower than a Bitcoin transaction.

The duration for a traditional payment can go up as high as seven business days when it’s cross-border payments. In these cases, Bitcoin transactions emerge 1,008 times faster than classical transactions.

Bitcoin lightning vs. instant payments

Finally, the authors compare the best-case scenarios of both systems: instant payment of the traditional finance to Bitcoin’s lightning network.

Traditional finance’s instant payment network uses the same hardware and accelerates the payment process only by prioritizing specific tasks. Therefore the energy consumption of instant payment networks remains more or less the same as classical finance itself, while the duration shortens.

However, Bitcoin lightning scales way higher than instant payments, with 31 Trillion transactions per year. The comparing results reflect that as well. The report states:

“Lightning at a single transaction level allows Bitcoin to become 194 Million X more energy efficient than a classical payment and up to 1 million X more energy efficient than an instant payment Tx.”

The post Bitcoin uses 56 times less energy than classical system appeared first on CryptoSlate.