After dropping from the $102,000 price level earlier this week, Bitcoin continues to struggle to initiate a rebound toward the $100,000 mark. Its weak performance is attributed to a broader bearish action in the general crypto market. However, retail investors’ interest in the flagship asset has increased significantly during this volatile period.

Retail Interest In Bitcoin Sees Sharp Growth

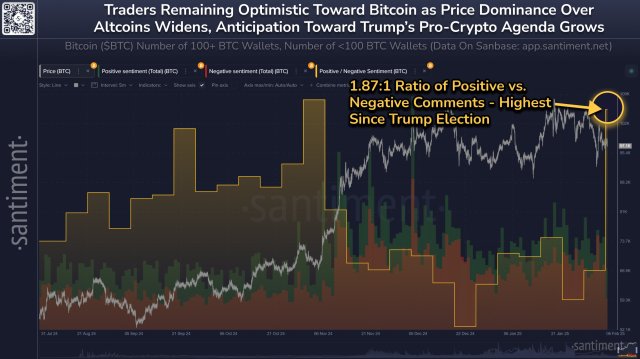

Bitcoin’s price has been moving in a negative direction in the past few days. Nonetheless, retail sentiment has been showing a positive trend over the same period. Leading market intelligence and on-chain data firm Santiment reported the positive advancement in a recent post on the X (formerly Twitter) platform.

Santiment highlighted that retail sentiment about Bitcoin remains high even as the crypto asset drops by about 11% from its all-time high of $109,000 on January 20. This suggests that smaller investors are increasingly accumulating BTC, even as its price undergoes periods of consolidation and fluctuations.

With retail sentiment and interest holding strong, the development could set the stage for BTC’s next major move to its current all-time high since it can translate into renewed buying pressure. If strong enough, it might trigger a rebound from the current price consolidation.

These retail participants maintain an optimistic view of BTC as its price dominance over altcoins expands. According to the platform, many investors have returned to the flagship asset as a sort of safe haven in volatile periods while altcoins are declining sharply.

Furthermore, the surge in sentiment is also driven by the hope that Donald Trump‘s pro-crypto policies would inevitably provide Bitcoin once again with robust bullish momentum, enough to spur a renewed uptrend.

Since prices typically move in the opposite direction of the crowd expectations, Santiment hopes that some of the retail euphoria will decrease shortly. The platform expects a further retracement to cause small traders to start overreacting and panic selling again, but there is no guarantee that it could occur.

Naturally, there are so many positives pointing to a bullish long-term crypto future such as continued key stakeholder accumulation during this volatility. Meanwhile, the emotional whirlpool of the crowd plays only a limited role in the direction of the crypto industry.

A Surge In Demand Among Whale Investors

Optimism toward BTC is rising as prices move to retest key support levels. Santiment outlined that large investors or whales are accumulating more Bitcoin during crypto’s mid-sized decline and significant volatility.

While the volatility is causing whales to acquire more BTC, it is liquidating small traders, especially those that initially entered the market in the past 6 months. Overall, there has been a rise of 135 more 100+ BTC wallets in February, indicating 0.8% growth.

Meanwhile, 138,680 wallets holding less than 100 BTC have exited the market, representing a 0.03% decline. Even though it takes a few more weeks or months, Santiment sees this development as a great setup for crypto market caps to surge again.