Data shows that Bitcoin trading volume has plummeted to extreme lows recently, a sign that investor interest in trading the asset is low.

Bitcoin Trading Volume Plunges As Price Continues To Move Sideways

According to data shared by CryptoQuant author IT Tech in an X post, the BTC trading volume has been quite low recently. The “trading volume” here refers to the total amount of Bitcoin that’s becoming involved in trades on all centralized exchanges on any given day.

When the value of this metric is high, it means that investors are currently making a large number of moves on these platforms. Such a trend implies that traders are interested in the coin.

On the other hand, the low metric can suggest that investors aren’t paying much attention to the cryptocurrency at the moment as they aren’t actively making trades.

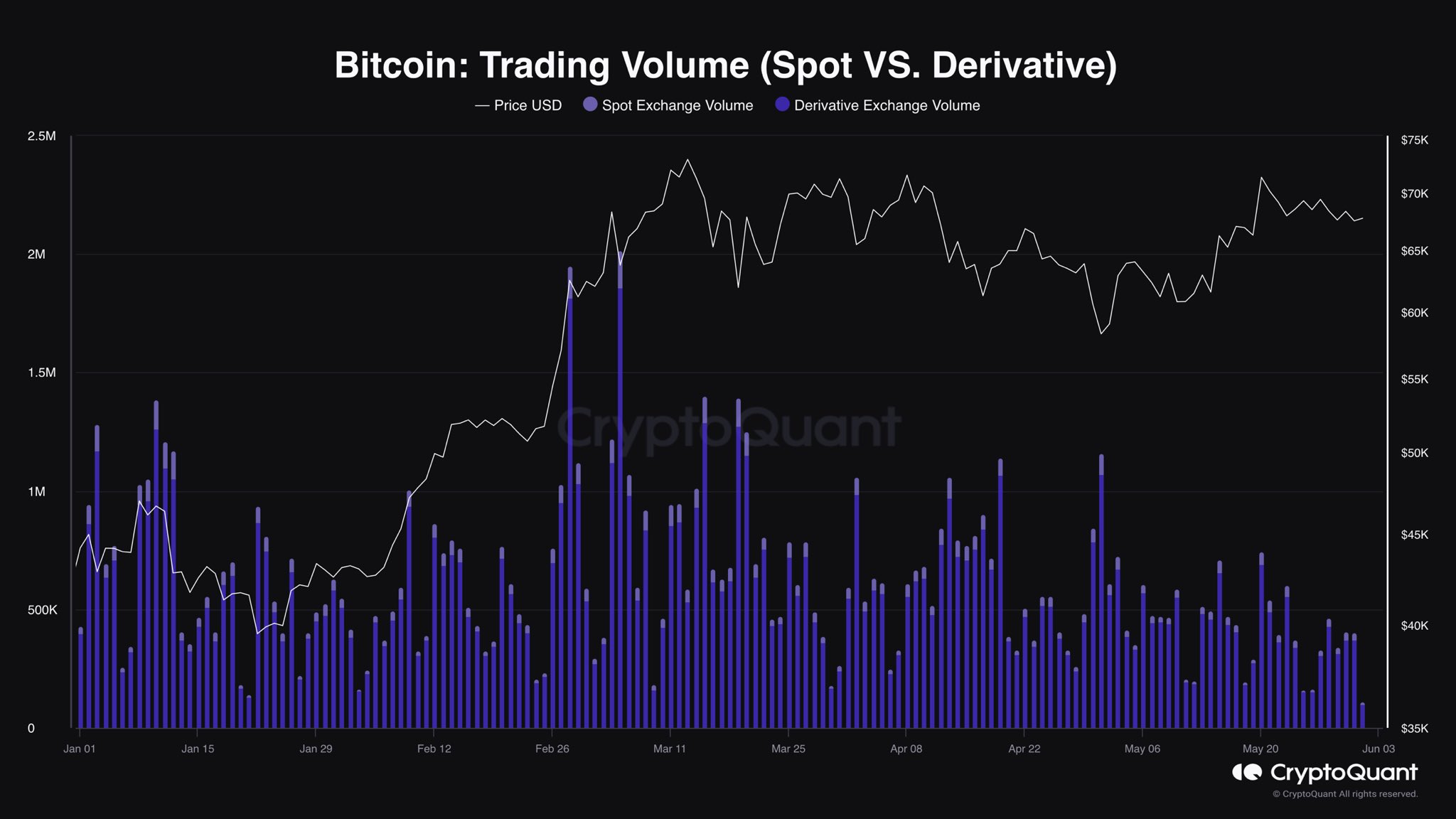

Now, here is a chart that shows how the spot and derivatives trading volumes have looked for Bitcoin since the start of the year:

As the above graph shows, the Bitcoin trading volume has been primarily dominated by derivatives exchanges in the year so far, implying that futures and other products have seen the most interest.

Although the spot exchange trading volume has generally been much lower than the derivatives volume, it has still been sizeable at different points in the year.

Recently, however, the spot volume has become very low. It has also been similarly low before in the year, but what’s different this time is that the latest derivatives volume has also been pretty low. Thus, the volume as a whole has dried up in the Bitcoin market.

As for what could be driving this trend, the answer may lie in the recent price action. Usually, investors find phases where price moves fast to be exciting, so volume tends to rise in such periods as they jump to make trades and participate in speculation.

When an asset is stale, though, traders get bored and start paying attention to greener pastures instead. For a while now, Bitcoin has been stuck in consolidation, so it’s not surprising that investors have lost interest.

It remains to be seen how long these low volumes persist before a volatile move inevitably arrives to spark a renewal of interest in the cryptocurrency.

BTC Price

After witnessing a setback earlier, Bitcoin has surged back above the $70,000 level with a 3% rally during the last 24 hours. It’s unknown, though, whether this move will finally take BTC out of its recent tight range or if the asset will soon lose this recovery, continuing its sideways trend.