Data shows the Bitcoin transfer volume has observed a rise recently, but still remains around 65% lower than the 2021 all-time high.

Bitcoin Transfer Volume Remains Significantly Lower Than 2021 Bull Run Levels

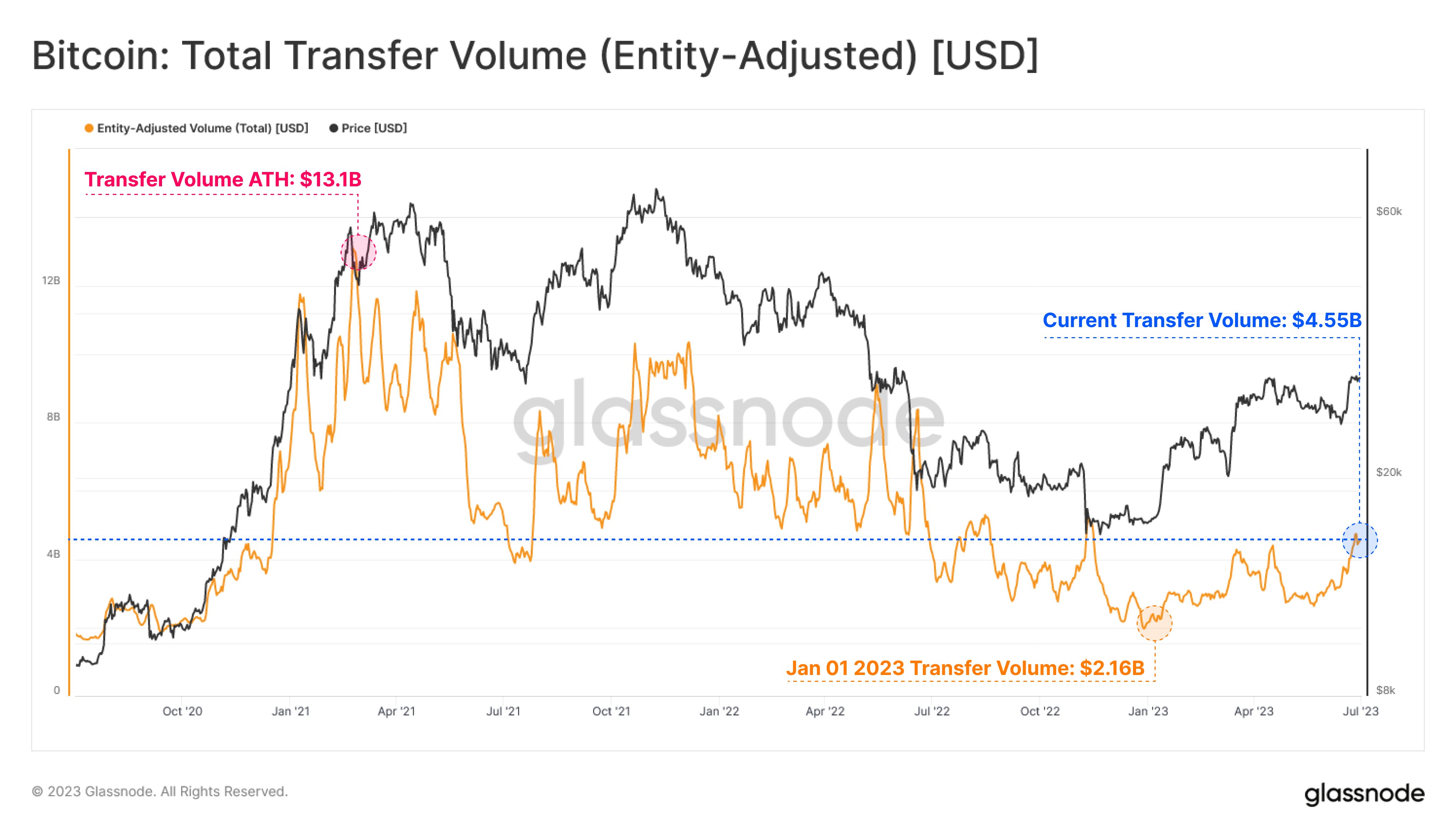

According to data from the on-chain analytics firm Glassnode, BTC transfer volume has increased to $4.56 billion recently. The “transfer volume” here is a measure of the daily total amount of Bitcoin (in USD) that’s getting involved in transactions on the network.

When the value of this indicator is high, it means that the investors are moving around a large number of coins on the network right now. Such a trend is generally a sign that the traders are active in the market currently.

On the other hand, low values of the metric can be a sign that blockchain activity is low at the moment. This kind of trend may suggest that there isn’t much interest in the cryptocurrency among general investors.

Now, here is a chart that shows the trend in the Bitcoin transfer volume over the last few years:

The version of the Bitcoin transfer volume being used here is the “entity-adjusted” one, meaning that the indicator is only accounting for the transactions taking place between different entities, rather than different individual wallets.

An “entity” is a single address or a collection of addresses that belongs to the same investor. Since a holder moving coins from one wallet of theirs to another isn’t relevant to the market at all, it makes sense to exclude such transfers from the volume data.

As displayed in the above graph, the entity-adjusted Bitcoin transfer volume has been going up recently. This increase in the indicator has come as the rally above the $30,000 level has taken place.

Generally, sharp price actions like rallies can attract a lot of attention to the network, as investors find such price moves exciting. This interest naturally leads to more transactions happening on the network, which can lead to the transfer volume registering an uptick.

Such price moves are also in turn only sustainable with the backing of such activity, as these moves require a large number of traders to provide fuel for them. Thus, if a rally fails to attract any sizeable attention (or if interest dies down partway through), then the price surge can run out of steam.

As the current rally has been able to bring eyes to the blockchain, it’s a positive sign for its sustainability. From the chart, however, it’s visible that while the current transfer volume of 4.65 billion is significantly more than the 2.16 billion figure from the start of the year, it’s still quite a bit lower than the norm during the 2021 bull market.

At its all-time high, the entity-adjusted Bitcoin transfer volume had a value of 13.1 billion, which suggests that the current value of the indicator is still 65% lower.

BTC Price

At the time of writing, Bitcoin is trading around $30,600, up 1% in the last week.