Crypto analyst Tony Severino has revealed that the Bitcoin Percentage Price Oscillator (PPO) has turned red after reaching $102,000. He further explained what this development means for the flagship crypto in relation to the ongoing bull market.

Bitcoin’s Weekly PPO Turns Red At $102,000

In an X post, Severino revealed that the Bitcoin weekly PPO just turned red after reaching $102,000. The analyst had mentioned before that when the weekly PPO turns red, the end is near for Bitcoin’s bull run. He warned back then that this indicator could be pointing to the top soon.

As to how this market top could happen now, the crypto analyst explained that the Bitcoin price will keep running once the red ticks begin, and the market will have topped before the red tick runs out.

Severino also highlighted the TD Sequential as another indicator that suggests the Bitcoin peak could occur as soon as the first or second quarter of this year. He noted that BTCUSD’s quarterly candlesticks are on an 8-count. The analyst further revealed that a perfected TD9 count ended the 2017 bull run.

Therefore, if history repeats itself, the Bitcoin price could top by July. However, the analyst still believes that the top could happen as early as Q1, noting that it isn’t uncommon for this peak to happen on the 8th candlestick in the sequence. He also raised the possibility of the Bitcoin bull market extending beyond Q2, stating that the TD8/9 setups could fail.

However, Severino added that it seems unlikely that Bitcoin will continue trending higher for multiple quarters without a more significant correction. The crypto analyst also previously predicted that the Bitcoin price could top below $150,000 as early as January 20. He explained that Donald Trump’s inauguration could be the new paradigm leading to this cyclical peak. He made this prediction based on the fact that the market could have already priced into Trump’s pro-crypto moves.

Bitcoin Price Correction Nearing Its End

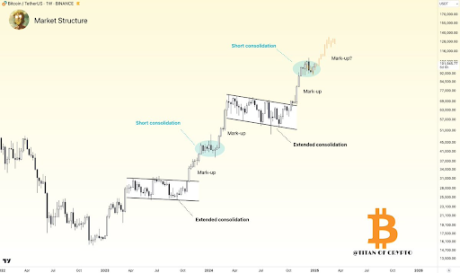

In the meantime, crypto analysts have suggested that the Bitcoin downtrend may be nearing its end, especially with the flagship crypto back above $100,000. In an X post, crypto analyst Titan of Crypto mentioned that a Bitcoin mark-up is imminent. This came as he remarked that the 7-week consolidation for BTC might be nearing its end.

Crypto analyst Mikybull Crypto also suggested that Bitcoin has flipped bullish once again. He remarked that the bears were no longer in control following Bitcoin’s rise above $100,000, invalidating the bearish setup. With the flagship crypto back above this price level, the crypto analyst predicted it may be ready for a sustainable rally to a cycle top.

At the time of writing, the Bitcoin price is trading at around $101,677, up over 2% in the last 24 hours, according to data from CoinMarketCap.