On-chain data shows Bitcoin whales may have quietly been accumulating at the recent price lows as exchanges have registered large withdrawals.

Bitcoin Exchange Reserve Has Observed A Decline Recently

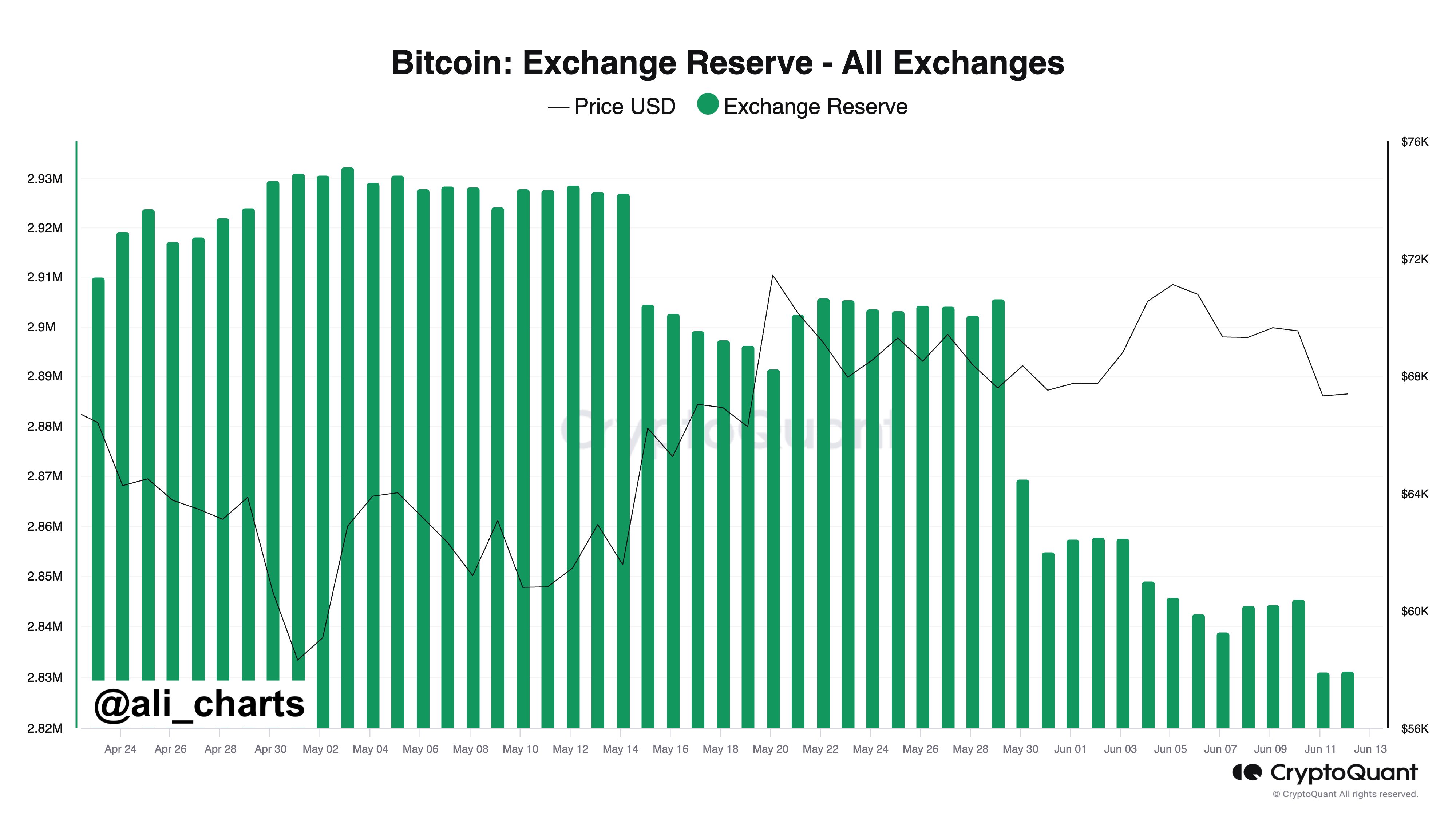

As pointed out by analyst Ali Martinez in a post on X, exchanges have seen significant withdrawals over the last couple of days. The on-chain metric of interest here is the “Exchange Reserve,” which keeps track of the total amount of Bitcoin currently sitting in the wallets of all centralized exchanges.

When the value of this metric goes up, it means that these platforms are receiving a net amount of deposits right now. As one of the main reasons why investors would transfer their coins to exchanges is for selling-related purposes, this kind of trend can potentially be bearish for the asset’s price.

On the other hand, the indicator observing a decline implies the users are taking out a net number of tokens from these central entities currently. Holders may take coins to self-custody when they wish to hold into the long-term, so such a trend could prove to be bullish for the cryptocurrency.

Now, here is a chart that shows the trend in the Bitcoin Exchange Reserve over the past few months:

As displayed in the above graph, the Bitcoin Exchange Reserve has gone down recently. More specifically, a net amount of 14,140 BTC, which is worth around $954 million at the current exchange rate, has left these platforms during the last 48 hours or so.

In this period, Bitcoin has been trading at lows following its plunge, so it’s possible that these withdrawals could indicate some fresh accumulation has occurred at these potentially profitable prices.

Given the massive scale, of course, the whale entities would have to have been involved here. These humongous investors participating in possible buying at these levels and taking the coins to self-custody can naturally be a positive sign for the asset.

It would seem that the cryptocurrency may already be seeing the bullish benefit of this accumulation, as its price has now experienced a rebound back above the $69,000 level.

From the chart, it’s also visible that these recent exchange outflows aren’t something that’s exactly new in the market, as the Exchange Reserve has in fact been steadily going down over the past month.

As such, it would appear that there has been significant appetite for taking coins off these platforms in the Bitcoin sector recently.

BTC Price

While Bitcoin may have enjoyed a rebound from its recent lows following the whale exchange outflows, the asset’s price at $69,300 is still very much within the range that the coin been stuck moving inside for so long now.