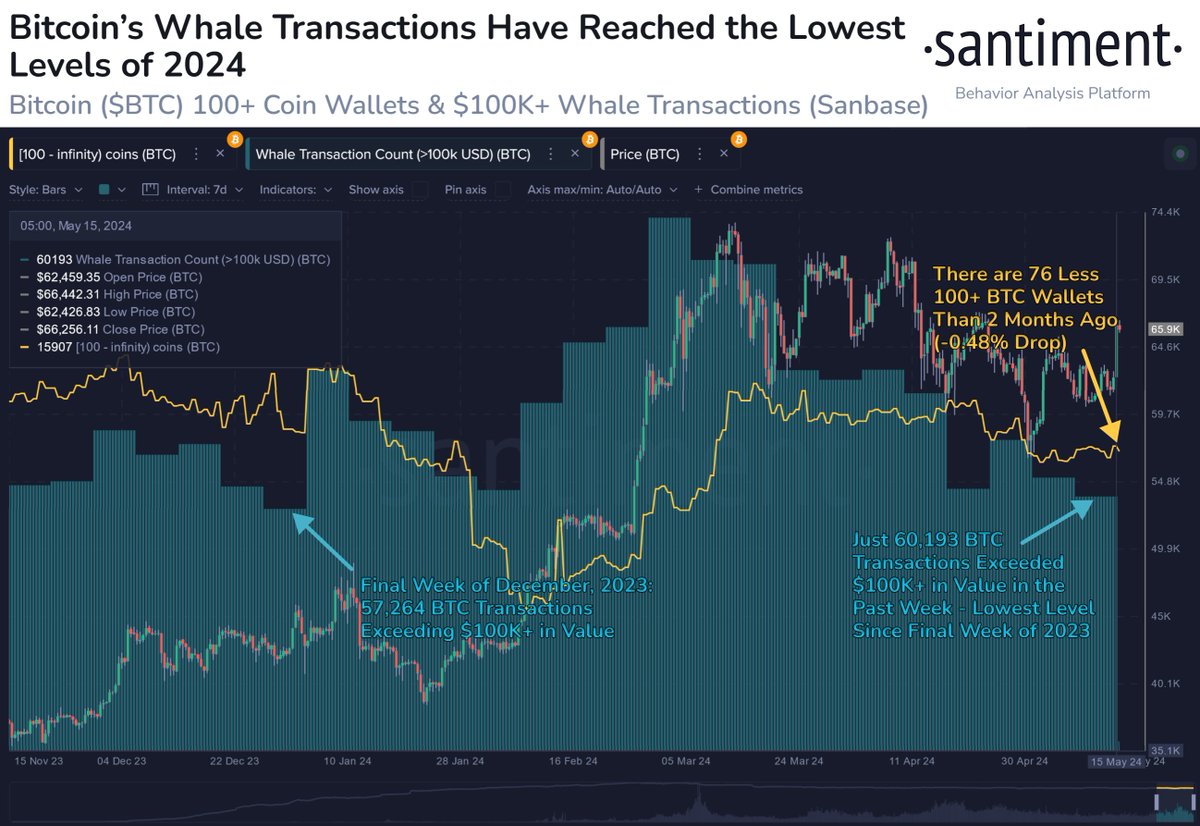

Recent data from Santiment indicates a noticeable decrease in Bitcoin whale activity, reaching the lowest levels seen in 2024. This trend shows that holders of large amounts of Bitcoin, known as whales, are drifting away from active trading.

While this could signal a negative trend, the situation presents a complex picture of the cryptocurrency’s market dynamics.

Despite the fall in whale activity, the total number of Bitcoin wallets with at least 100 BTC remains high, at 11.79 million BTC across 15,907 wallets.

Historically, increased activity from these large holders has often preceded significant price movements in Bitcoin, suggesting that their current quiet could lead to various market outcomes. The question remains: What does this reduced activity mean for the market’s future?

Analyzing Whale Activity: What This Means For Bitcoin

A decline in whale activity could initially be interpreted as an indicator of lower market volatility. Significant moves by these large holders can profoundly affect Bitcoin’s price, often resulting in abrupt and unforeseen fluctuations.

While #Bitcoin‘s 100+ $BTC whale wallets continue to hold a high level of coins (11.79M), whale activity has dropped to its lowest level of 2024. There are currently 15,907 wallets holding at least 100 coins. It would be a #bullish sign if this rises. https://t.co/nldtOms3aT pic.twitter.com/Lyj4Epfp9a

— Santiment (@santimentfeed) May 16, 2024

Consequently, a diminished presence of whales might lead to much market stability and predictability in the near term. However, this stability might contradict the typical trading behavior associated with crypto, where volatility often presents trading opportunities.

Moreover, if these whales hold onto their Bitcoin rather than sell, this behavior could be interpreted as a long-term bullish signal. It suggests that these influential market players see the potential for future price increases and are choosing to hold their positions.

This perspective is reinforced by the current trading price of Bitcoin, which is above $66,000, marking a nearly 5% increase over the past week.

Indicator Shows Further Surge Ahead

Adding to the analysis, Willy Woo, a prominent crypto analyst, discussed the latest trends in the BTC volume-weighted average price (VWAP) Oscillator. The VWAP is a trading benchmark that measures an asset’s average price based on price and volume over a specific period.

This metric prioritizes price levels with higher trading volumes, offering a more comprehensive view of market trends.

Woo’s analysis revealed that the Bitcoin VWAP Oscillator has been in negative territory for several months but has recently started to rise. The oscillator could soon reach a neutral point if this upward trend continues.

This shift often signals that a bullish phase is on the horizon, based on historical patterns where the oscillator’s rise from negative to neutral has coincided with substantial price gains for Bitcoin.

Still a lot of room to run before reversal or consolidation.

Hate to be a trapped #Bitcoin bear right now. https://t.co/LGet9XVoQY pic.twitter.com/EgJ47mzNLG

— Willy Woo (@woonomic) May 16, 2024

Featured image created with DALL·E, Chart from TradingView