On-chain data shows that large investors in the Bitcoin network have been buying while the market has been in a panic state about the latest crash.

Bitcoin Large Holders Netflow Has Been Positive Recently

According to data from the market intelligence platform IntoTheBlock, the largest wallets on the Bitcoin blockchain have been making some large net inflows recently.

The on-chain indicator of interest here is the “Large Holders Netflow,” which keeps track of the net amount of the cryptocurrency entering into or exiting the wallets associated with the “Large Holders.”

IntoTheBlock defines Large Holders as those investors who own at least 0.1% of the entire circulating supply of the asset. There are over 19.7 million BTC tokens in circulation, so this figure would be equivalent to around 19,700 BTC.

This stack is worth upwards of $1.2 billion at the current exchange rate of the cryptocurrency, so clearly, these Large Holders are quite large indeed and, thus, could be considered to carry some degree of influence in the market.

As such, their behavior can be worth keeping an eye on, as even if it may not directly end up reflecting on the asset’s price, it could still contain information about the sentiment among these humongous entities.

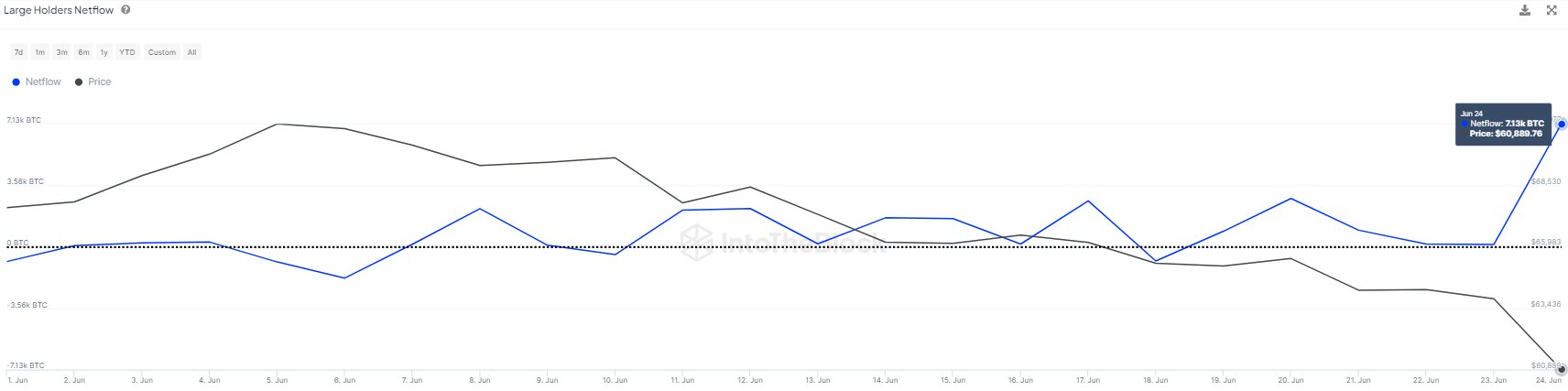

Now, here is a chart that shows the trend in the Bitcoin Large Holders Netflow over the past month:

As displayed in the above graph, the Bitcoin Large Holders Netflow has been mostly above zero during the last few weeks, suggesting that these investors have been receiving net deposits to their wallets.

This accumulation from the whales has come while the cryptocurrency has been going through a period of bearish momentum. This bearish trend culminated in a crash for the coin yesterday, in which its price went as low as under $60,000.

The Large Holders have latched onto this opportunity, having displayed their strongest net inflows since late May. These investors bought a net amount of 7,130 BTC during the dip yesterday, which is worth almost $439 million right now.

The strong buying would naturally imply that the whales believe these recent lows to provide a profitable window for further accumulation of the cryptocurrency, regardless of the amount of FUD going around in the wider market.

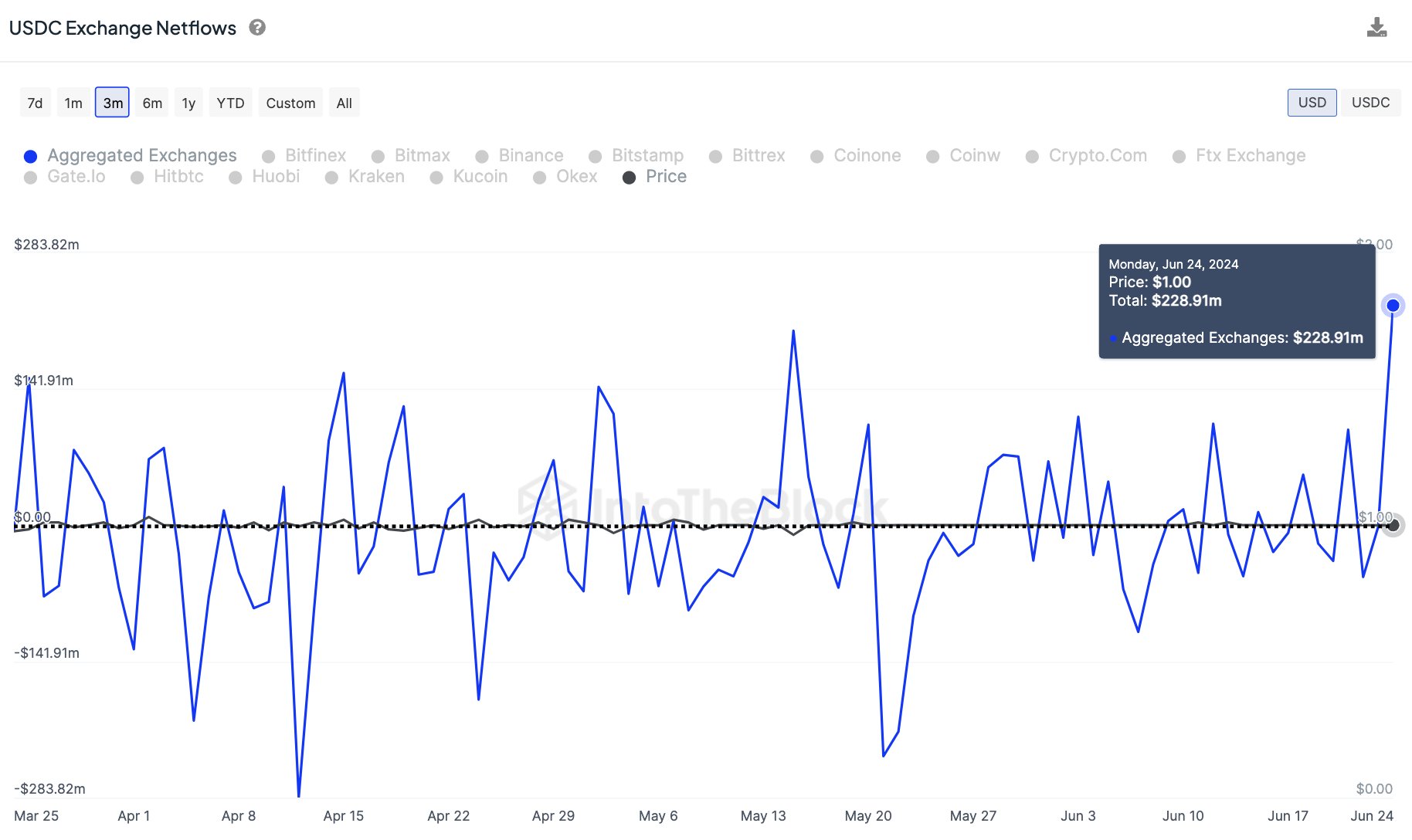

Another potential bullish development has also taken place for Bitcoin simultaneously, as IntoTheBlock Head of Research Lucas pointed out in an X post. It would appear that exchanges received large USD Coin (USDC) inflows yesterday.

Investors generally transfer their coins to these central entities whenever they want to trade them away, so these USDC net inflows would imply a huge amount to swap the stablecoin, possibly for other cryptocurrencies like Bitcoin.

Thus, these $228 million net USDC inflows into exchanges could add to the buying pressure for BTC.

BTC Price

At the time of writing, Bitcoin is floating around $61,500, down over 4% in the last seven days.