Charles Hoskinson, who co-founded Ethereum and now leads the Cardano blockchain, has projected that Bitcoin could reach a price of $250,000 by the end of this year or next year. His prediction, made during a CNBC interview, comes despite the recent slump in the wider financial markets including crypto.

Why Bitcoin Will Hit $250,000 Within Less Than 2 Years

Hoskinson emphasized that rising geopolitical tensions and evolving trade dynamics are creating supportive conditions for decentralized networks like Bitcoin. Speaking on a world that appears to be “moving from a rules-based international order to a great powers conflict,” he suggested this shift would highlight the limitations of traditional banking and trade systems, steering more transactions toward cryptocurrencies.

“If Russia wants to invade Ukraine, it invades Ukraine. If China wants to invade Taiwan, it’s going to do that. So treaties don’t really work so well, and global business doesn’t really work so well there. So your only option for globalization is crypto,” Hoskinson told CNBC.

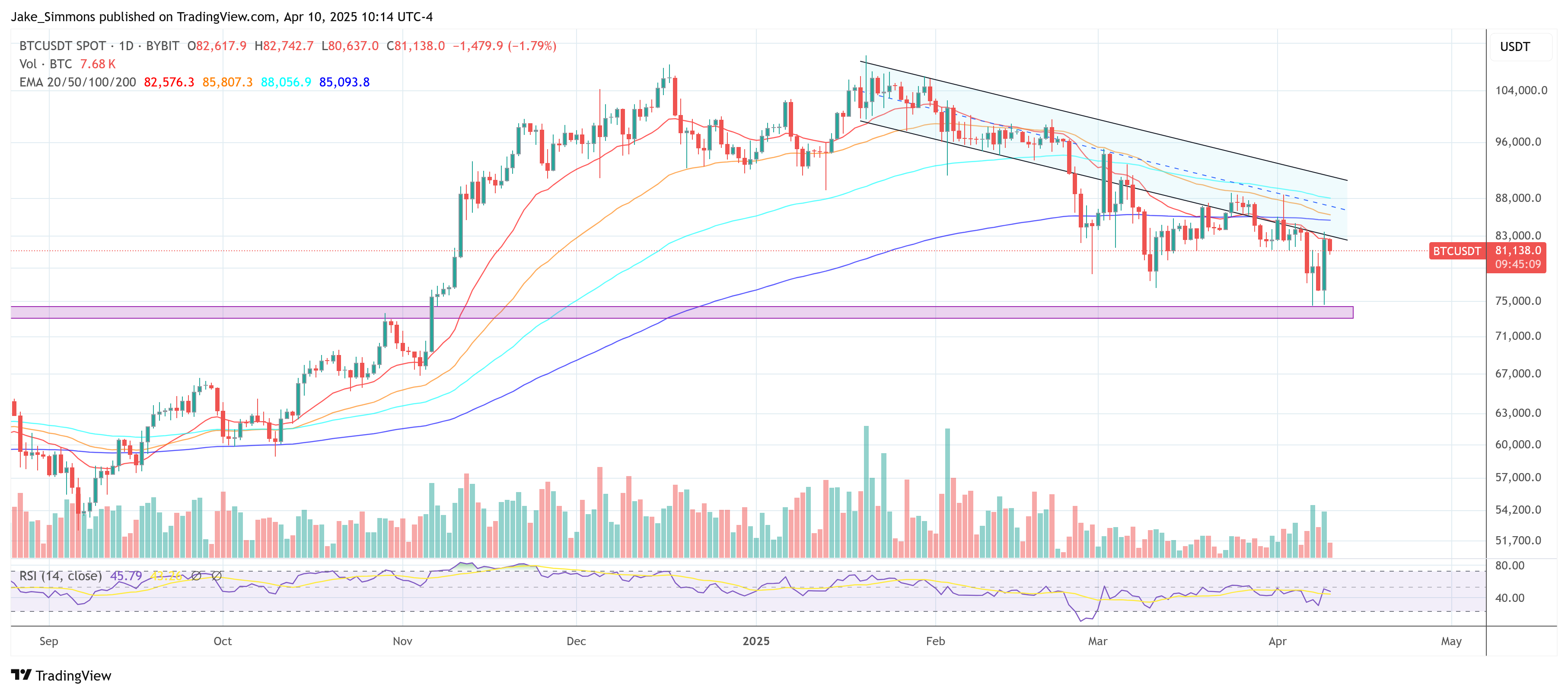

He also noted the significant sell-off in crypto and other risk assets, a trend that has partially stemmed from US President Donald Trump’s reciprocal tariffs on countries worldwide. Bitcoin dipped below $77,000 over the last week before briefly surpassing $83,000 on Wednesday, and remains considerably lower than its record high above $100,000 set in January. Still, Hoskinson’s confidence stands: “No, I think Bitcoin will be over $250,000 by the end of this year or next year.”

Among the factors that might drive such a dramatic price surge, Hoskinson pointed to the Federal Reserve possibly lowering interest rates in response to market pressures. “Then you’ll have a lot of fast, cheap money, and then it’ll pour into crypto,” he said, explaining how additional liquidity could lead to renewed interest in digital assets. The potential for big tech companies such as Microsoft and Apple to enter the crypto space also figures into his bullish outlook.

Another component of Hoskinson’s optimism lies in the prospect of new legislation. He singled out anticipated stablecoin legislation as well as the Digital Asset Market Structure and Investor Protection Act, both of which are currently making their way through Congress. He believes these regulatory moves could streamline the crypto market and pave the way for institutional adoption.

Stablecoins, which are pegged to fiat currency and backed by real-world assets, may prove especially attractive to major technology companies looking to facilitate rapid, cost-effective global transactions. “The stablecoin bill in particular could lead the ‘Magnificent 7’ companies to begin adopting the assets,” he added, referring to Apple, Microsoft, Amazon, and other mega-cap tech giants.

Hoskinson further argued that once these regulatory frameworks become clearer, the market will likely “stall for probably the next three to five months,” before “a huge wave of speculative interest” re-enters the space around late summer or fall. That renewed enthusiasm, combined with a more settled geopolitical landscape and a stable regulatory environment, could, in his view, push Bitcoin’s price as high as $250,000.

At press time, BTC traded at $81,138.