Quick Take

Analyzing average prices at which Bitcoin was withdrawn from major digital asset exchanges using Glassnode data offers valuable insights into the market’s cost basis.

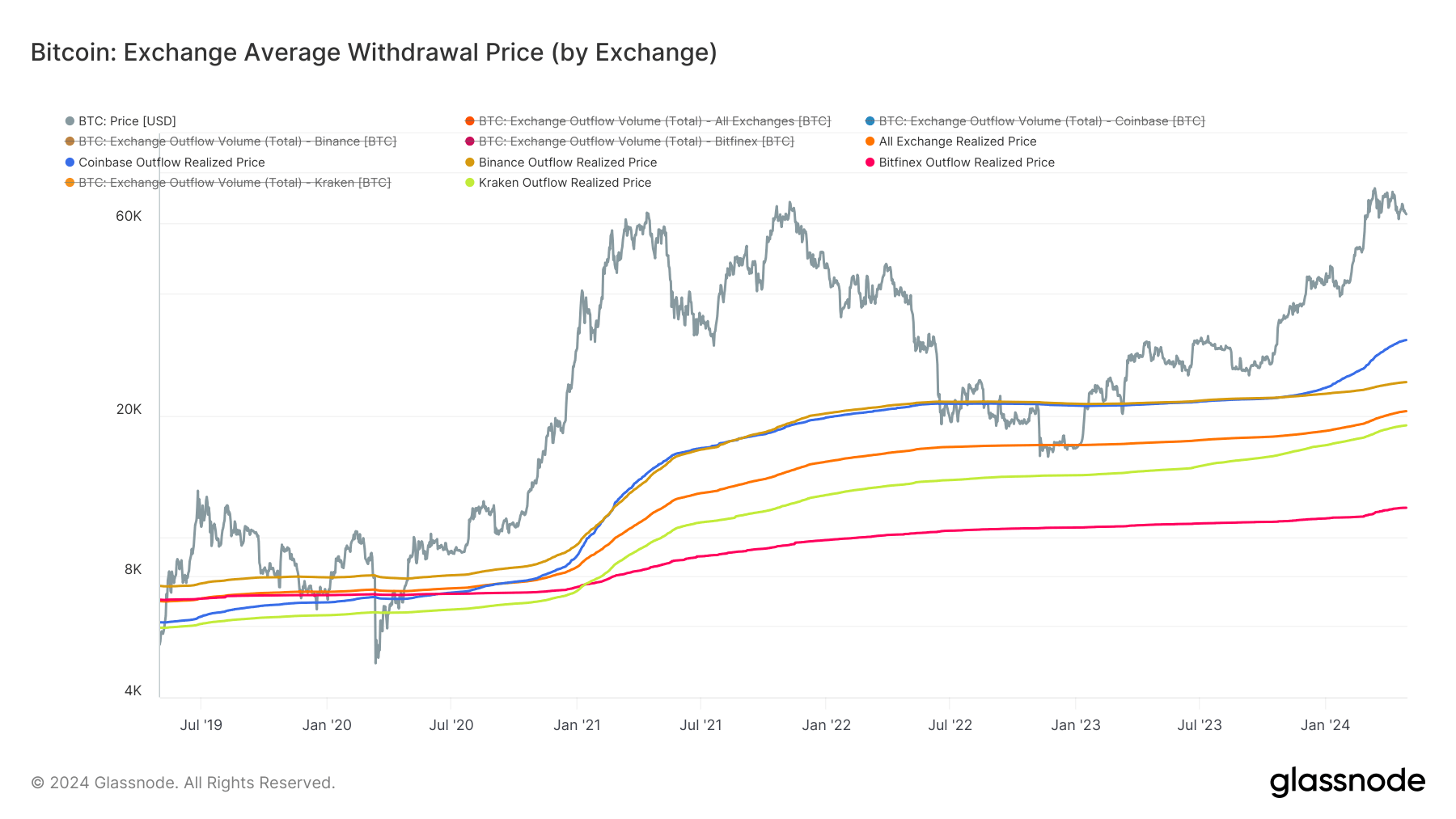

According to Glassnode data, the analysis indicates that Coinbase and Binance exhibited parallel movement from the start of 2021 to the conclusion of 2023, maintaining average withdrawal prices around $22,500 by November 2023. However, a significant discrepancy arose in November 2023 amidst speculation regarding a Bitcoin ETF approval. Binance’s outflow price stabilized at $24,180, while Coinbase maintained a higher level at $30,740 as of April 2024. This suggests that speculation and demand during the Bitcoin price surge were predominantly fueled by activity on Coinbase.

Although Bitfinex and Kraken exhibit the lowest outflow cost-basis total at $11,800 and $18,900, respectively, the overall average across all exchanges stands at $20,500, suggesting that the Bitcoin rally primarily came from Coinbase.

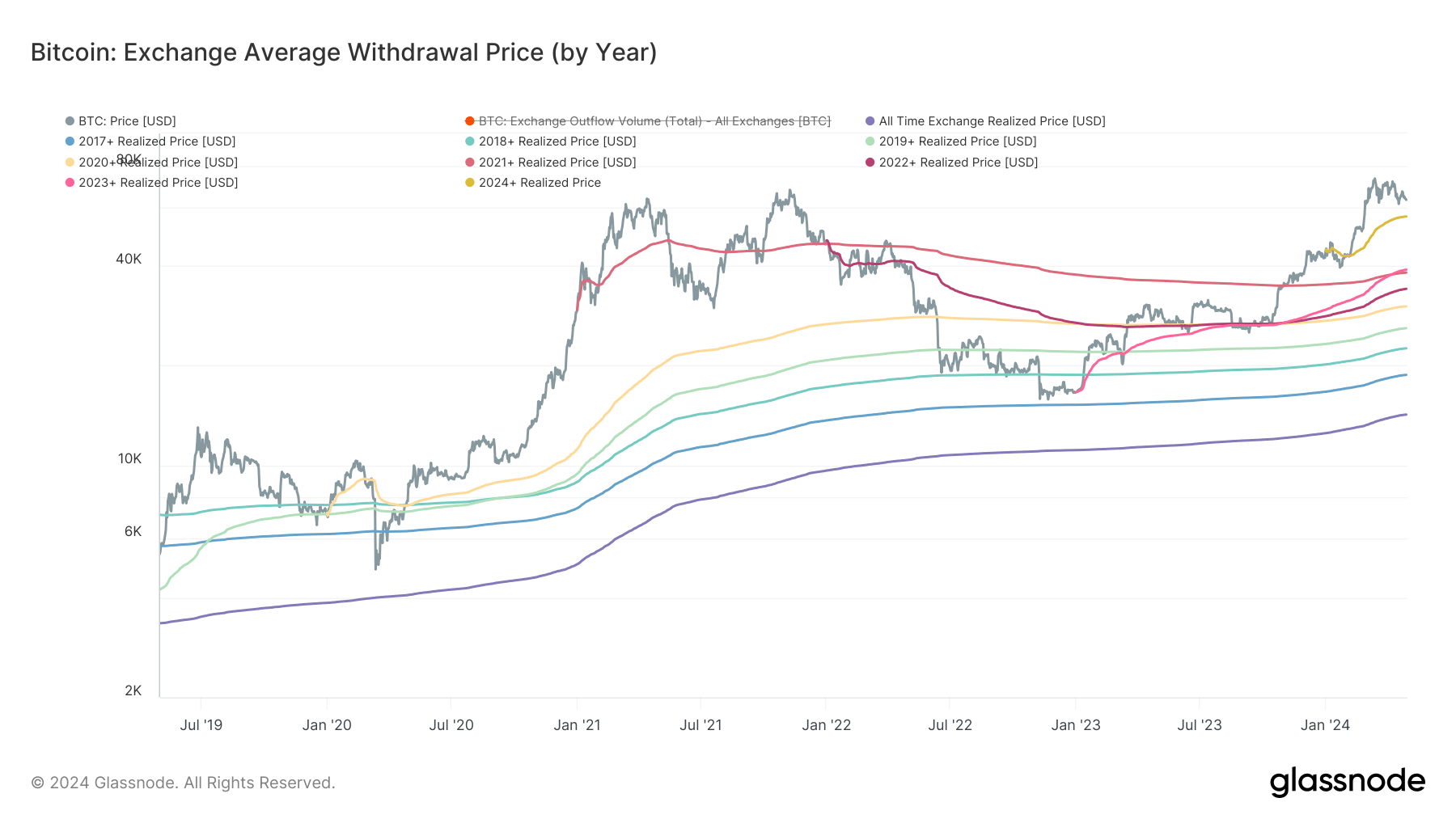

It’s noteworthy that all realized price cohorts by year are currently showing profits. The 2024 cohort holds an average cost basis of $56,200, reflecting a gain of over 10% from current price levels. This could signify a significant support level if Bitcoin were to drop below the psychological $60,000 price level. Additionally, the 2023 cohort has surpassed buyers from the previous bull run in 2021, boasting a cost basis of $38,855 compared to $38,000, respectively.

The post Bitcoin’s 2024 cohort sees over 10% profit, indicating a strong market support level appeared first on CryptoSlate.