Quick Take

Since bottoming out around $15,500 in November 2022, Bitcoin’s performance has been on a consistently upward trajectory. This growth culminated in new all-time highs in March 2024, marking a staggering 280% surge from its cycle low. However, the market has experienced several healthy corrections during this bullish trend.

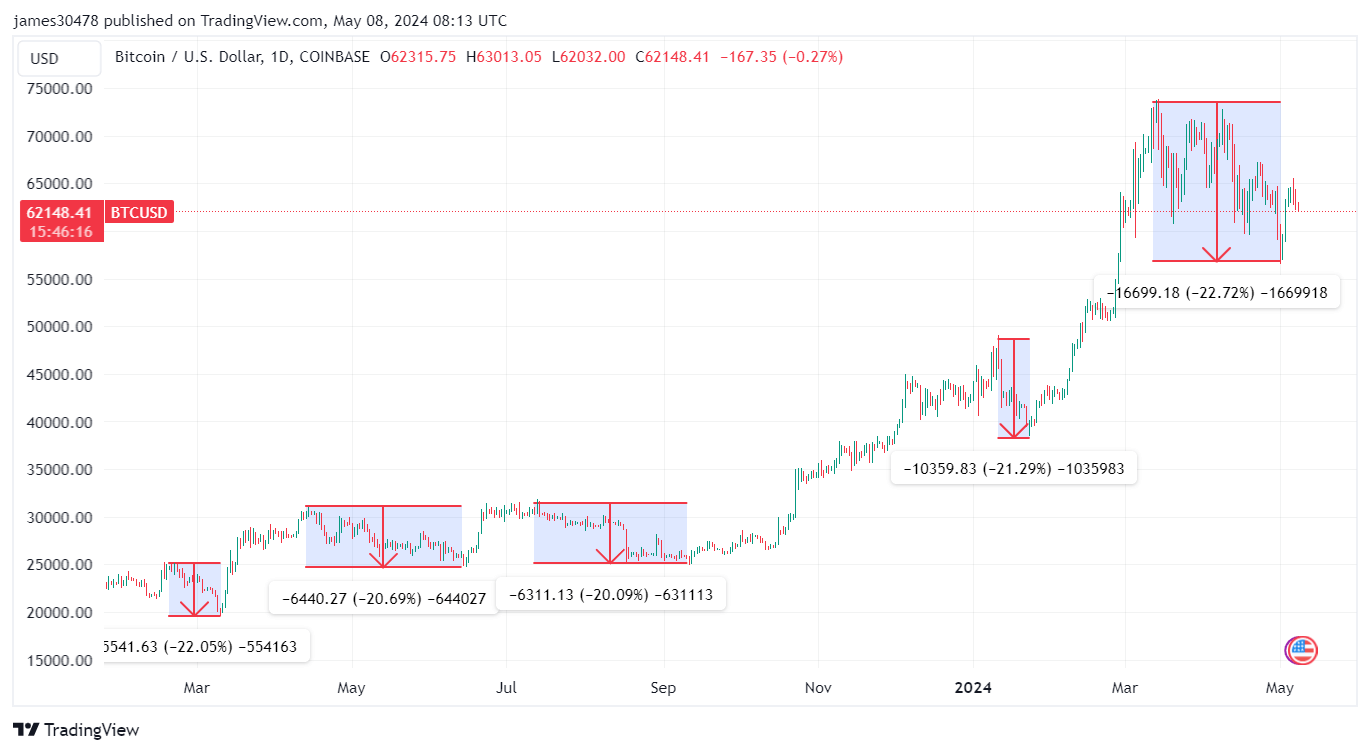

In March 2023, Bitcoin saw a 22% drawdown, followed by a 20% correction that lasted from April to June 2023. Another 20% pullback occurred between July and September 2023. Following the debut of a Bitcoin ETF in January 2024, the market saw a correction of just over 20%. Most recently, Bitcoin retraced 23% from its March 2024 peak of approximately $73,000, reaching lows around $56,500 at the beginning of May.

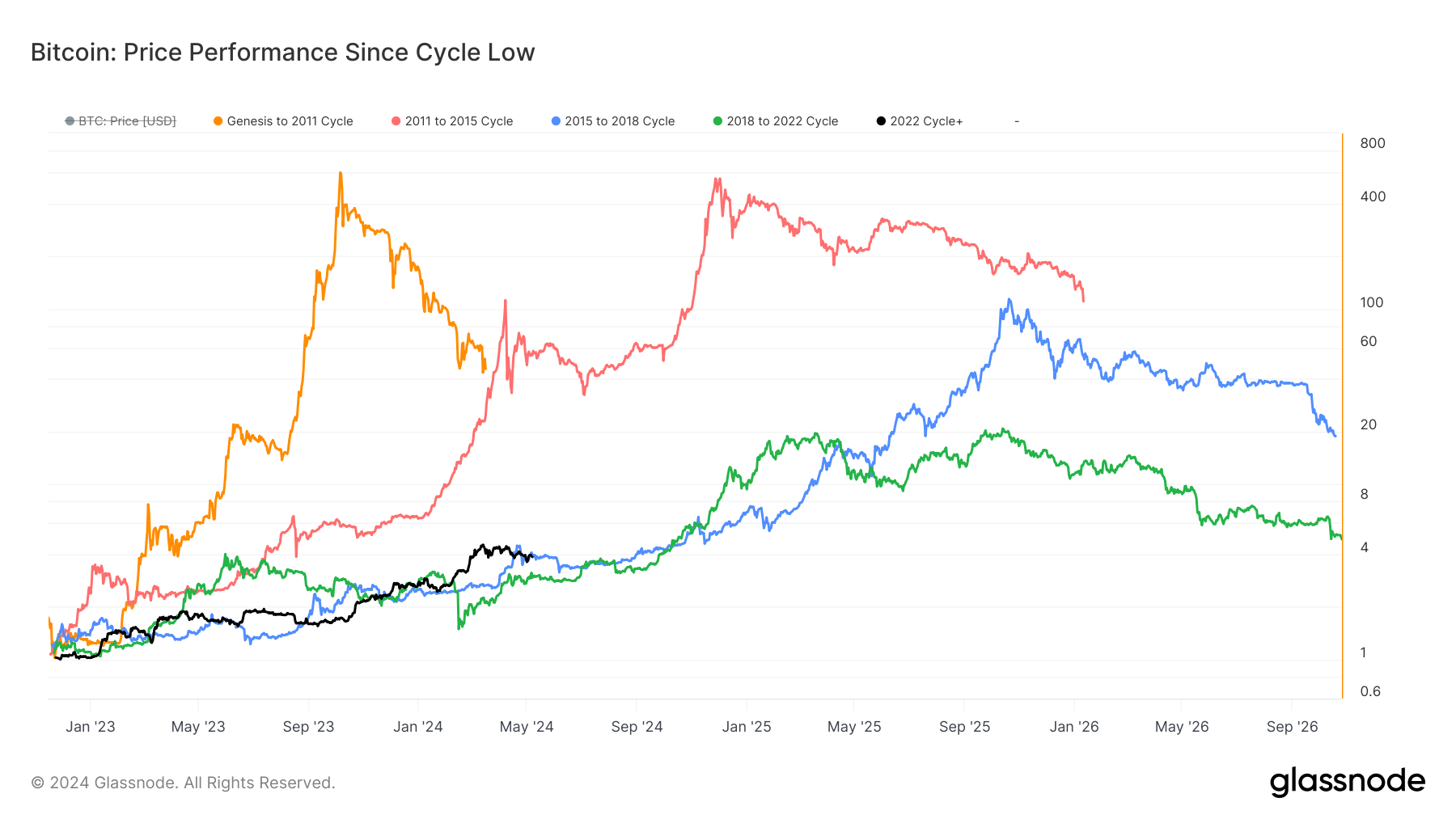

The current cycle low mirrors the recovery trajectory seen in the 2015/2018 cycle, with both achieving approximately 280% growth at this stage. Subsequently, that cycle surged to over 11,000% from its lowest point. Compared to the low of the 2018/2022 cycle, that cycle has rebounded approximately 190% by this stage. Looking ahead, the 2018/2022 cycle reached a peak that was roughly 2000% higher than its low. These indicators bode well for the current Bitcoin cycle.

The post Bitcoin’s 280% surge from cycle lows mirrors previous bull cycles appeared first on CryptoSlate.