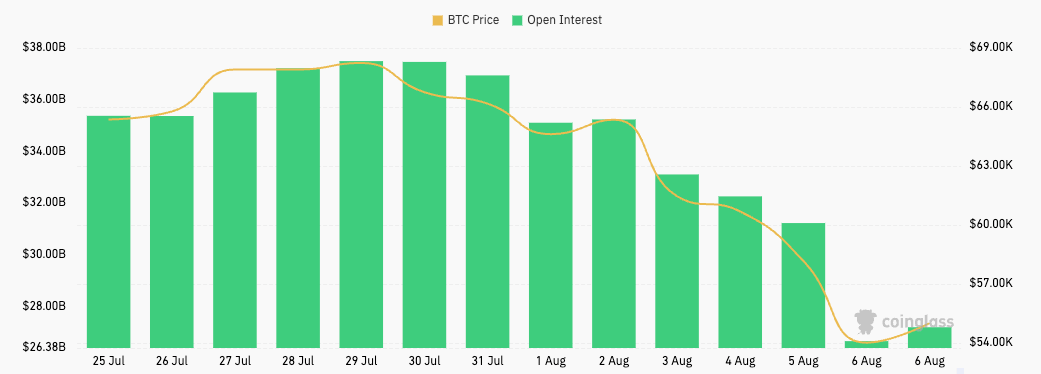

This week’s crash has led to some of the highest losses we’ve seen since the collapse of FTX, wiping out billions from the crypto market. Bitcoin’s drop to below $50,000 dramatically affected the futures market, with futures open interest plunging from $31.22 billion on Aug. 5 to $26.65 billion on Aug. 6.

Such a sharp drop in just 24 hours was most likely caused by forced liquidations of futures positions due to margin calls. When Bitcoin’s price drops below critical levels needed to maintain collateral, it usually triggers a cascade of liquidations, and over-leveraged traders have their positions forcibly closed.

The wipeout in futures open interest we’ve seen this week shows that a significant number of traders were betting on Bitcoin’s continued rise and were caught off guard by the sudden downturn, leading to a massive reduction in leveraged positions.

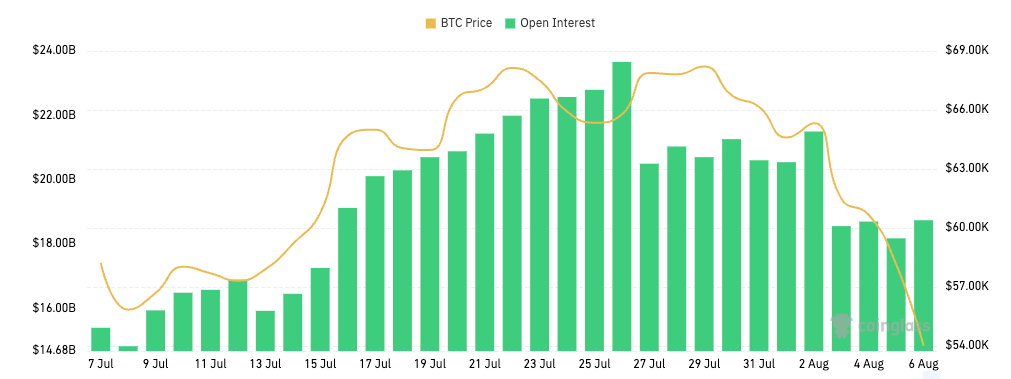

On the other hand, the options market remained relatively stable during the price downturn. Options open interest remained almost flat, fluctuating slightly around $18 billion during the weekend.

Unlike futures, options don’t involve margin calls that can force positions to close immediately. Instead, they give traders the right, but not the obligation, to buy or sell BTC at a predetermined price. This inherent characteristic enables options traders to hold onto their positions without the immediate risk of liquidation, even during periods of extreme price volatility.

However, it’s highly unlikely that the stability in options OI we’ve seen over the past few days was due to traders holding onto their positions.

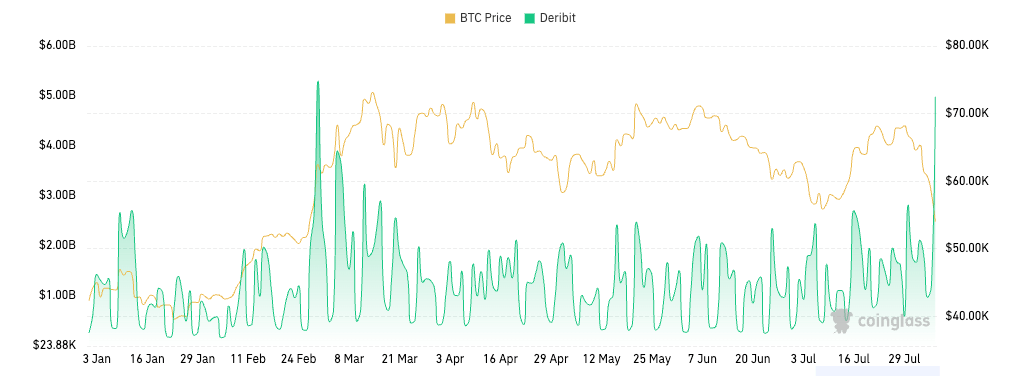

Options trading volume on Deribit surged from $1.22 billion on Aug. 5 to $4.98 billion on Aug. 6. This is the second-highest options volume ever recorded, topped only by the $5.30 billion in volume the market saw on Feb. 29 this year.

Such a high spike in volume indicates heightened trading activity, where traders are actively engaging in the market. Several factors could have contributed to this phenomenon where open interest remains stable while trading volume increases.

Firstly, during periods of high volatility, traders enter and exit positions more frequently, which means opening new contracts and closing existing ones at a rapid pace. If the number of new contracts opened roughly equals the number of contracts closed, the OI will remain relatively unchanged while the volume spikes. A high turnover of contracts could result from short-term speculation, hedging, or rolling over positions.

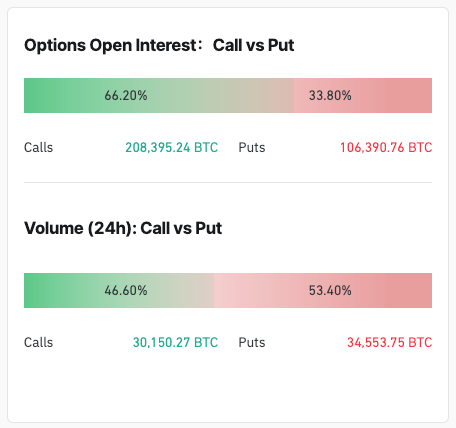

An interesting aspect of the options market during this period is the skew towards calls over puts. With over 66% of the options open interest being calls, it shows a bullish sentiment still prevails among traders.

However, while open interest shows a strong bias toward calls, trading volume is skewed toward puts. The 24-hour options trading volume between Aug. 5 and Aug. 6 came from puts. This can be explained by the immediate reactions traders had to the price drop. When Bitcoin experienced a sharp decline, traders likely rushed to buy puts to hedge their existing positions or to speculate on further price declines in the short term.

In contrast, open interest reflects more of traders’ longer-term positioning. Most open interest being calls indicates that traders have built up these positions over time, maintaining a bullish outlook on Bitcoin’s longer-term prospects. These positions are not as quickly adjusted or closed as short-term trades, which is why the open interest remains heavily skewed toward calls.

The post Bitcoin’s crash wipes out $5 billion in futures OI but options remain stable appeared first on CryptoSlate.