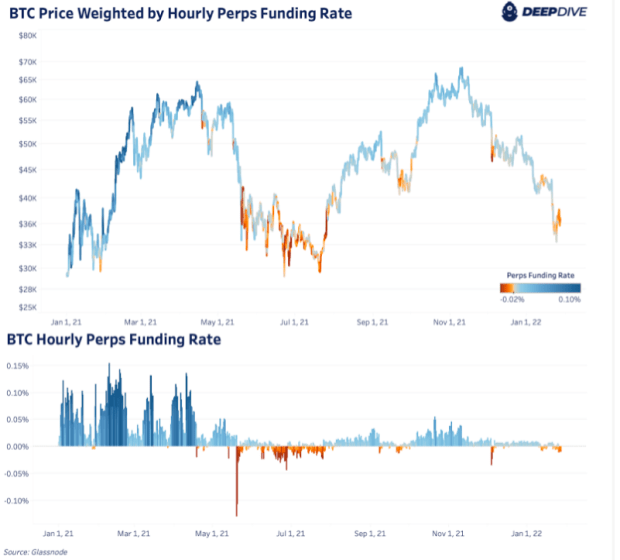

Recently, funding for bitcoin futures contracts has flipped negative and perpetual futures are trading below spot.

The bitcoin perpetual swap, the most liquid and traded futures instrument, is a contract that allows traders to speculate on the bitcoin price with leverage. While there is always an equal amount of long and shorts, the positioning of those contracts relative to the spot bitcoin price shows the bullish/bearish bias in the derivatives market.

When the contract price of a perpetual futures contract (a futures contract that never expires) is above the spot market bitcoin price, the perpetual futures funding rate will be positive, meaning longs pay shorts a percentage of their notional position size. The opposite is also true.

Typically, a bullish bias is present in futures markets. Throughout much of 2021, perpetual futures contracts were persistently leading spot markets by a wide margin, indicating a strong bullish bias from speculators. Recently, funding has flipped negative, showing that perpetual futures are trading below spot, and this isn’t a result of cascading liquidations driving price, but rather a flip in sentiment and market expectation.

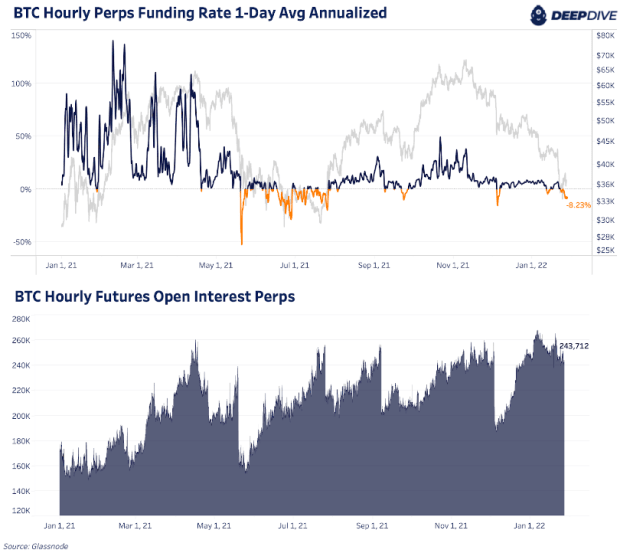

Over the last 24 hours, perpetual futures funding has been negative 8.23% on an annualized basis, meaning that shorts are paying longs 8.23% annualized on their notional position size. While it is certainly possible that increasing downside is to come due to an increasingly uncertain macroeconomic outlook and Fed hawkishness, it is a good sign for bitcoin bulls to see negative funding persist.

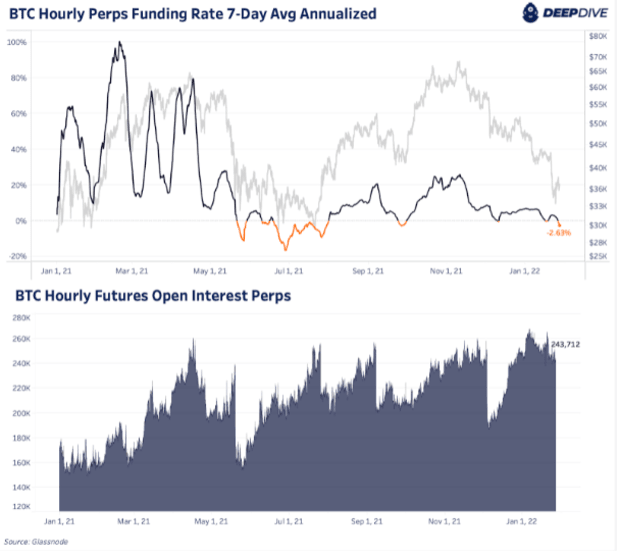

Below is the same chart but averaged over a seven-day period to adjust for variance:

What to watch out for over the coming weeks is increasing negative funding rates coupled with rising open interest, similar to what was witnessed over the summer of 2021.