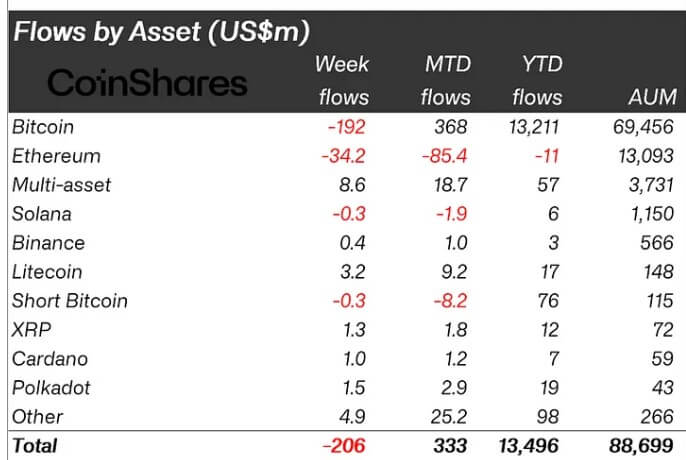

Crypto-related investment products saw their second consecutive week of outflows in April, with roughly $206 million leaving the market, per CoinShares‘ recent weekly report.

Despite Bitcoin’s recent halving, which typically generates excitement in the market, investor interest in the leading digital asset remained subdued, evidenced by outflows totaling $192 million.

Conversely, short-term investors seized the opportunity presented by the halving event to strengthen their positions, injecting $300,000 into the market.

What is fuelling the outflows?

During the past week, CryptoSlate reported that US-based Bitcoin (BTC) exchange-traded funds (ETFs) experienced five consecutive days of outflows. These outflows were primarily driven by Grayscale’s GBTC, ProShares BITO, and Ark 21 Shares’ ARKB.

James Butterfill, the Head of Research at CoinShares, elucidated that these outflows signify a dwindling interest among ETP/ETF investors. The trend stems from speculations that the Federal Reserve may choose to delay rate cuts further.

Additionally, Butterfill pointed out a parallel decline in trading volumes of ETPs, which clocked in at $18 billion last week. He emphasized that these volumes now represent a lesser share of total BTC volumes, marking a shift from 55% a month ago to 28%.

Altcoins draw interest

Investors are increasingly favoring lesser-known altcoins over major cryptocurrencies like Solana and Ethereum.

According to the report, altcoins such as Chainlink, Polkadot, Litecoin, Cardano, and XRP collectively attracted over $7 million in inflows last week.

Meanwhile, Ethereum has continued its downward trend, with last week marking the sixth consecutive week of outflows totaling $34 million. Its month-to-date flow remains negative at $85 million, with a year-to-date flow also in negative territory, amounting to $11 million.

Solana experienced more modest outflows of $300,000, while blockchain equities recorded their 11th consecutive week of outflows, reaching $9 million.

Butterfill attributed the outflows from blockchain equities to investor concerns regarding the impact of mining halving on mining companies.

The post Bitcoin’s halving fails to stem $206 million outflows as investors shift to altcoins like Polkadot appeared first on CryptoSlate.