On-chain data shows the Bitcoin investors have participated in a massive amount of loss taking as the asset’s price has gone through a crash.

Bitcoin Entity-Adjusted Realized Loss Observed A Sharp Spike Recently

In a new post on X, the on-chain analytics firm Glassnode has talked about the latest trend in the Realized Loss for Bitcoin. The “Realized Loss” here refers to an indicator that measures the total amount of loss that the investors are ‘realizing’ through their transactions on the network every day.

The metric works by going through the transfer history of each coin being sold on the blockchain to see what price it was moved at prior to this. If the last selling price was more than the current price for any token, then that particular coin’s sale can be assumed to be resulting in loss realization.

The Realized Loss considers that this loss is equal to the difference between the two prices. In this manner, the metric calculates the loss involved in each transaction and then finds the total sum for the network. A counterpart metric known as the Realized Profit keeps track of the transfers of the opposite type.

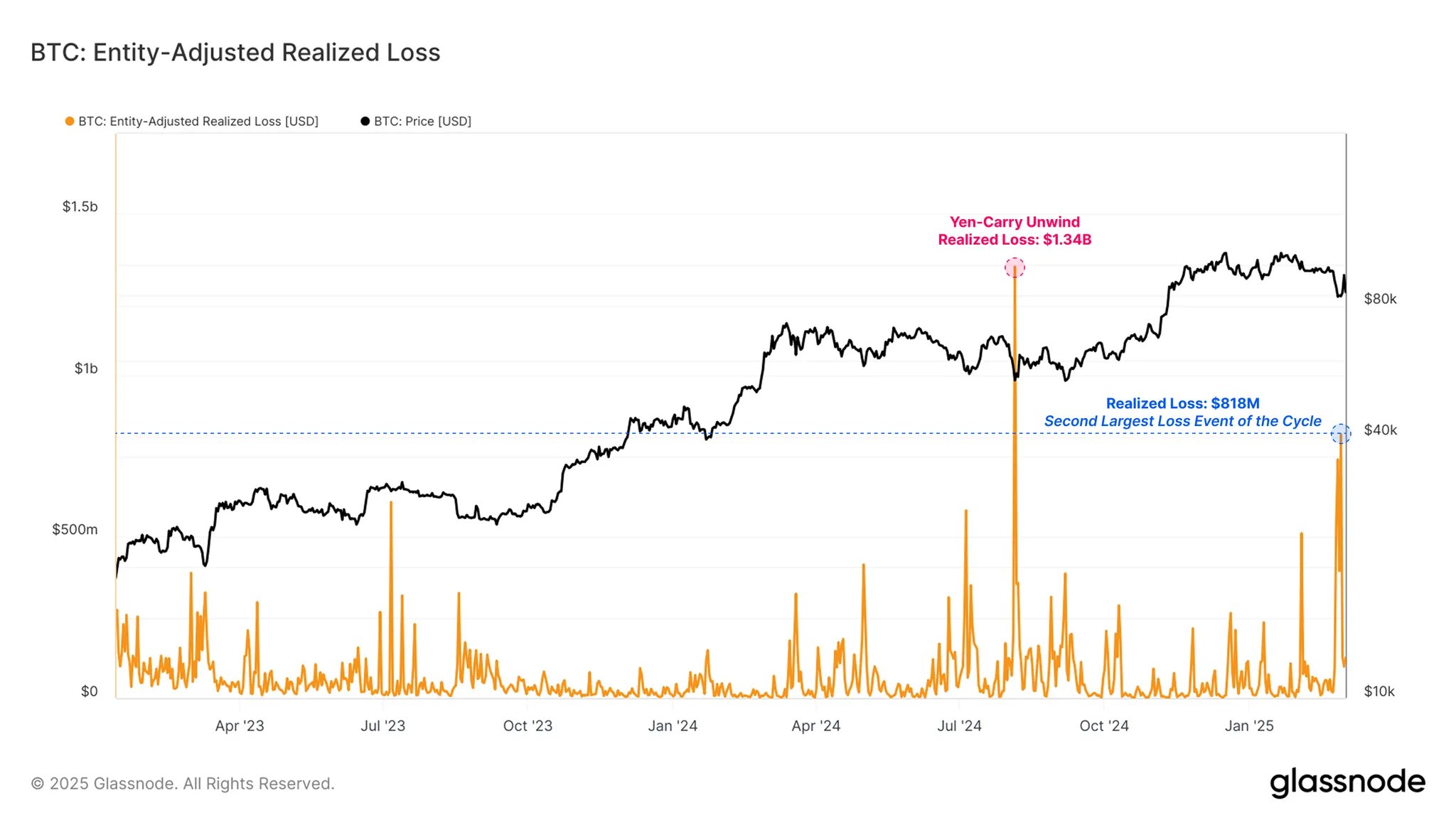

Now, here is the chart shared by Glassnode that shows the trend in the Bitcoin Realized Loss over the last couple of years:

In the graph, the version of the Realized Loss is the “Entity-Adjusted” one, meaning that the metric only accounts for sales happening between two separate entities, not just addresses. An entity is a collection of wallets that the analytics firm has determined to belong to the same investor.

Transactions between the addresses of the same investor don’t really lead to any loss or profit realization, so it makes sense to exclude such moves from the data of the indicator.

As displayed in the chart, the Bitcoin Entity-Adjusted Realized Loss has observed a sharp spike recently, implying the investors have made a large number of underwater transactions.

This capitulation event is naturally a result of the bearish volatility that BTC has witnessed recently. During the initial crash, the metric’s value hit a whopping $818 million, which is the second largest loss-taking event for the cycle thus far.

The only capitulation event where the indicator observed a larger peak was during the yen-carry trade unwind of last year, where investors realized a total of $1.34 billion in losses.

Historically, mass selloffs where investors capitulate have generally led to bottoms for Bitcoin, as tokens tend to transfer from weak hands to strong ones in these periods. It now remains to be seen whether the spike in Realized Loss would have a similar effect on the cryptocurrency this time or not.

BTC Price

At the time of writing, Bitcoin is floating around $90,300, up almost 7% in the last seven days.