The price of Bitcoin made a strong start to the month of April, reaching as high as $87,000 on Wednesday, April 2. The flagship cryptocurrency couldn’t sustain this blistering momentum, dropping below $84,000 in the late hours of Friday, April 4.

However, the BTC price has been relatively stable compared to the altcoin market and the US equities market following the announcement of new trade tariffs by United States President Donald Trump. This show of resilience has reinforced the idea that the bull cycle might not be over just yet.

Why Bitcoin Price Must Remain Above $69,000

In a Quicktake post on the CryptoQuant platform, crypto analyst Burak Kesmeci analyzed the Bitcoin market relative to the downturn affecting the broader financial markets. The analyst offered insight on the most critical support level should the premier cryptocurrency witness a similar decline.

Kesmeci pinpointed the “Bitcoin Spot ETF Realized Price” as a crucial metric to watch if the price of BTC succumbs to bearish pressure. As its name suggests, the Bitcoin Spot ETF Realized Price indicator measures the average price at which each Bitcoin exchange-traded fund was acquired.

According to Kesmeci, the average purchase price of the BTC ETFs has acted as a formidable support area since the exchange-traded funds launched in early 2024. As observed in the chart below, the flagship cryptocurrency has tested the Bitcoin ETF’s realized price multiple times in the past 15 months.

Kesmeci highlighted that the ETF realized price and Bitcoin’s most critical support level currently stand at around $69,000. The community analyst noted that the premier cryptocurrency is less likely to witness any severe correction so long as it does not slip beneath this price level.

When Will BTC Resume Bull Run?

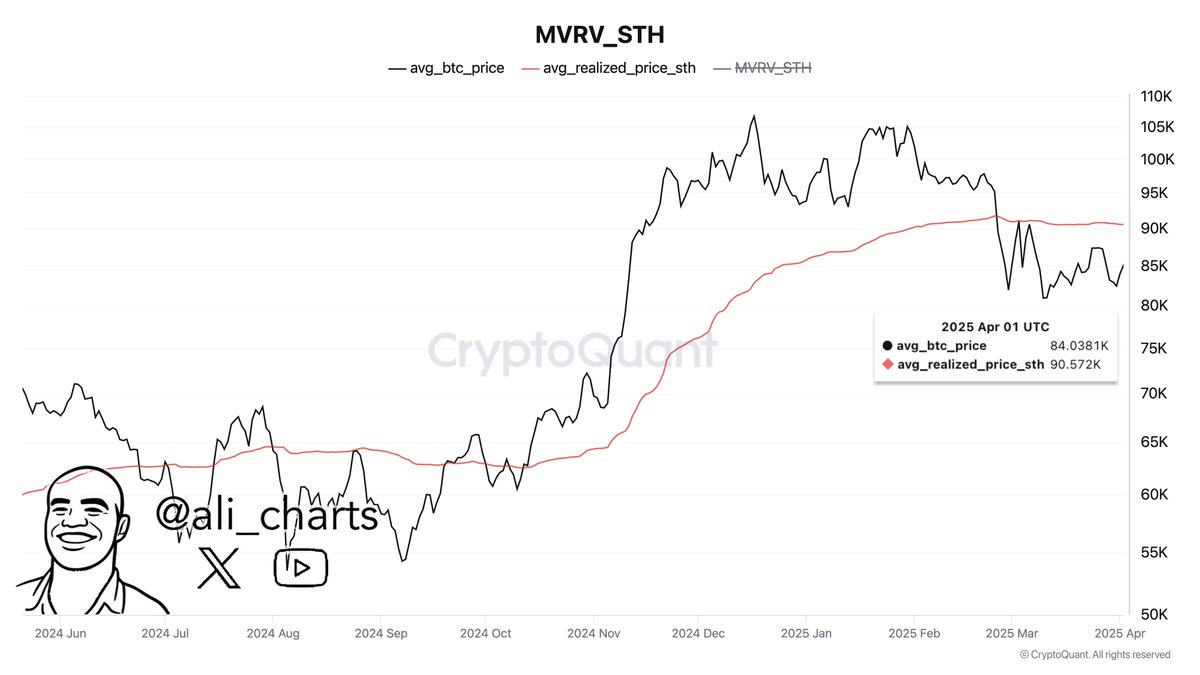

While the Bitcoin ETF’s realized price is a crucial support level that could prevent a deep correction, the short-term holder (STH) realized price could prove pivotal to the resumption of the bull run. Ali Martinez said in a post on X that the first signal that BTC is ready to resume its bull run is reclaiming the short-term holder realized price at $90,570.

As seen in the chart above, the STH realized price is acting as a major resistance to the premier cryptocurrency. The Bitcoin price has tested the on-chain indicator twice since falling beneath it in late February.

As of this writing, the market leader is valued at around $83,900, reflecting an over 1% price leap in the past 24 hours. According to data from CoinGecko, the price of BTC is down by nearly 1% in the last seven days.