Bitcoin price rebounded to $80,000 after a sharp decline triggered by fears over US President Donald Trump’s tariff policies. The cryptocurrency market saw panic selling in the past 12 hours as economic concerns spread across various sectors.

Market Cap Holds At $1.5 Trillion As Bitcoin Dominance Grows

According to market data, Bitcoin’s market capitalization currently stands at $1.5 trillion despite recent price fluctuations. While the leading cryptocurrency has bounced back slightly, altcoins continue to struggle with deeper losses.

Bitcoin’s dominance in the overall crypto market has jumped to 60%, showing investors may be seeking refuge in the largest digital asset during uncertain times.

The market is responding directly to broader economic fears rather than crypto-specific issues, market analysts said.

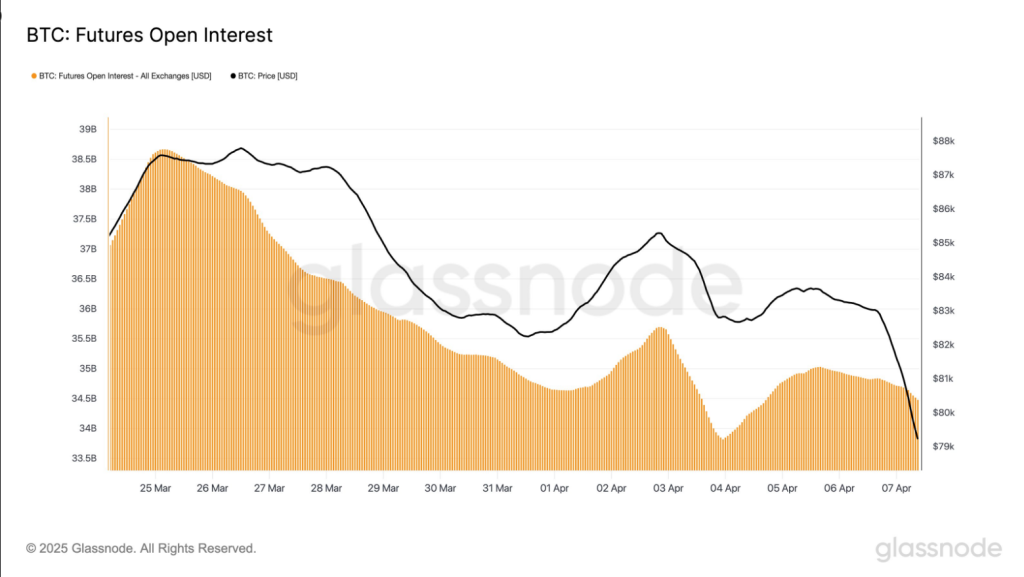

$BTC futures open interest sits at $34.5B. While there was a brief recovery from the $33.8B low on April 3, the broader downtrend remains intact. Futures exposure continues to unwind as traders reduce risk in response to declining price momentum. pic.twitter.com/ZX06yOCtsA

— glassnode (@glassnode) April 7, 2025

Futures Market Shows Surprising Resilience

Based on reports from Glassnode, Bitcoin futures open interest has fallen to $34.5 billion, showing a brief recovery from its April 3 low of $33.8 billion but maintaining an overall downward trend. Traders have been reducing their futures exposure as Bitcoin’s price momentum slowed.

Since March 25, cash-margined open interest declined from $30 billion to $27 billion. Crypto-margined open interest fell during the same time from $7.5 billion to $6.9 billion. More recent figures indicate crypto-margined open interest has started to rise again, indicating that some traders are moving back into riskier positions.

The share of crypto-collateralized futures contracts has reached 21% of open interest from 19% on April 5. This change may render the market more responsive to shift in price and, thus, lead to increased volatility in the next few days.

Limited Liquidations Suggest Controlled Selling

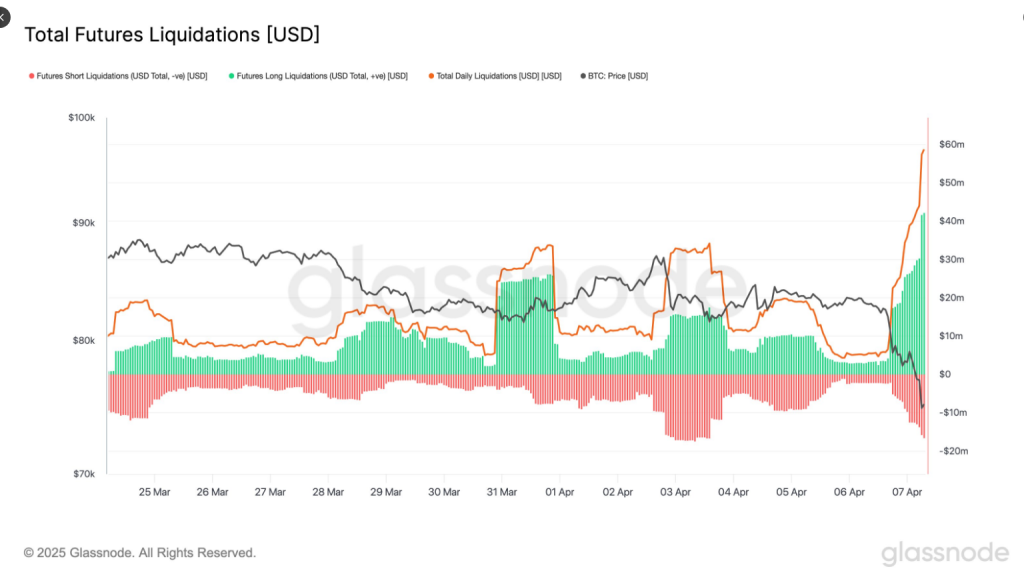

The last 24 hours witnessed $58 million worth of Bitcoin futures liquidations, with longs taking $42 million versus shorts taking $16.6 million. Market watchers point out this liquidation figure is remarkably low considering the 10% price decline in Bitcoin.

Total $BTC futures liquidations hit $58.8M over the past 24h. Longs took the heavier hit with $42.1M wiped out vs. $16.6M in shorts. Despite the price dropping 10%, this liquidation size is relatively modest, suggesting limited leverage chasing upside. pic.twitter.com/104kM2XQoF

— glassnode (@glassnode) April 7, 2025

The relatively small liquidation numbers indicate the market was not highly leveraged prior to the selloff. Long liquidations accounted for approximately 73% of total futures liquidations, which indicates a mildly bullish sentiment prior to the correction.

These numbers pale in comparison to previous market events in February and March, when daily liquidations topped $140 million. The present trend indicates a structured price fall fueled primarily by spot selling and not a wave of forced liquidations due to over-leveraged positions.

Institutional Investors Continue To Enter The Market

There are reports of increased institutional demand despite recent market volatility. Statistics reveal 76 new institutions with over 1,000 BTC have entered the network in the last two months, which is a 4.5% rise in large Bitcoin holders.

Featured image from Gemini Imagen, chart from TradingView