Amidst rising discussions within the general crypto community about Bitcoin’s next cycle top, a market expert has offered insights on the pressing subject and a potential timeline for the largest digital asset to experience a price peak in the ongoing cycle.

The Next Cycle Top For Bitcoin Set To Occur In 2025

In a bold prediction on the X (formerly Twitter) platform, Rekt Capital, a crypto expert and trader, has pinpointed a specific timeline for Bitcoin’s next cycle top, suggesting that the digital asset could begin a major rally in the short term.

Rekt Capital argues that the next cycle top for BTC could take place next year by citing historical trends and key market cycles, particularly before and after the Bitcoin Halving event, which proves consistent manner with previous bull runs.

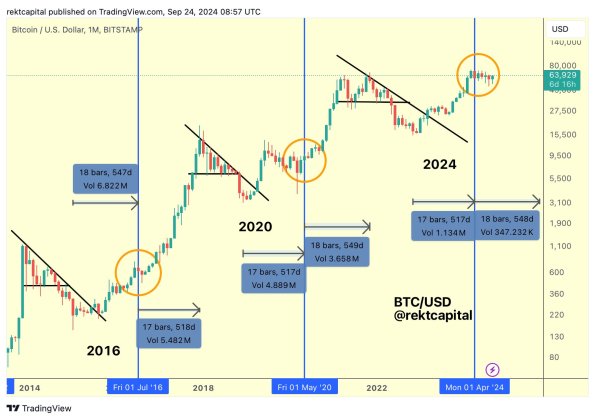

According to the market expert, prior to the Halving event in 2016, Bitcoin had reached its lowest point 547 days earlier and then reached its peak in its bull market about 518 days later. Also, the price of BTC peaked in its bull market 549 days after the Halving event in 2020, having bottomed out roughly 517 days before.

Meanwhile, prior to the 2024 Halving held in April, Bitcoin also saw its price bottoming out 517 days. As a result, Rekt Capital is confident that the crypto asset might experience a peak in the same 549 days in its bull market following the Halving, which brings the cycle top taking place in approximately October 2025. Considering these aligning patterns, the analyst has pointed out two key takeaways for investors and traders as they anticipate significant price movements in the run-up to the cycle’s peak.

The first takeaway highlighted by Rekt Capital is that the Bitcoin Halving acts like a mirror. This is because BTC Bear Market Bottoms happen about the same number of days before the Halving as it takes for the crypto asset to form Bull Market Tops following the Halving. The second takeaway is that the best of the Bitcoin bull market is yet to come.

BTC Is About To Enter The Parabolic Upside Phase

It is worth noting that BTC’s path to a cycle peak could be starting soon as the analyst predicts an impending shift in market sentiment. After analyzing the current price action of BTC, Rekt Capital noted that history suggests that the asset will move from its Reaccumulation phase into its Parabolic Upside phase within the next week or so.

In the past, between 154 and 161 days following the Halving, BTC has broken above its Reaccumulation phase. Given that in the ongoing cycle, the asset has remained in this phase for about 157 days after the event, the expert anticipates a breakout in the upcoming days.