The Bitcoin (BTC) market took a positive turn in the past week rising by 1.10% according to data from CoinMarketCap. While there are still expectations of a further price correction, the effects of macroeconomic developments as seen with recent statements from US President Donald Trump cast more uncertainty over the premier cryptocurrency’s future trajectory.

Bitcoin Bulls Face A Showdown At $98K Resistance – Can They Break Through?

Following an extended market correction, Bitcoin recorded spontaneous market gains in the last week reaching a local peak of round $95,000. Currently, the crypto asset trades around $86,000 with little indication of its future movement.

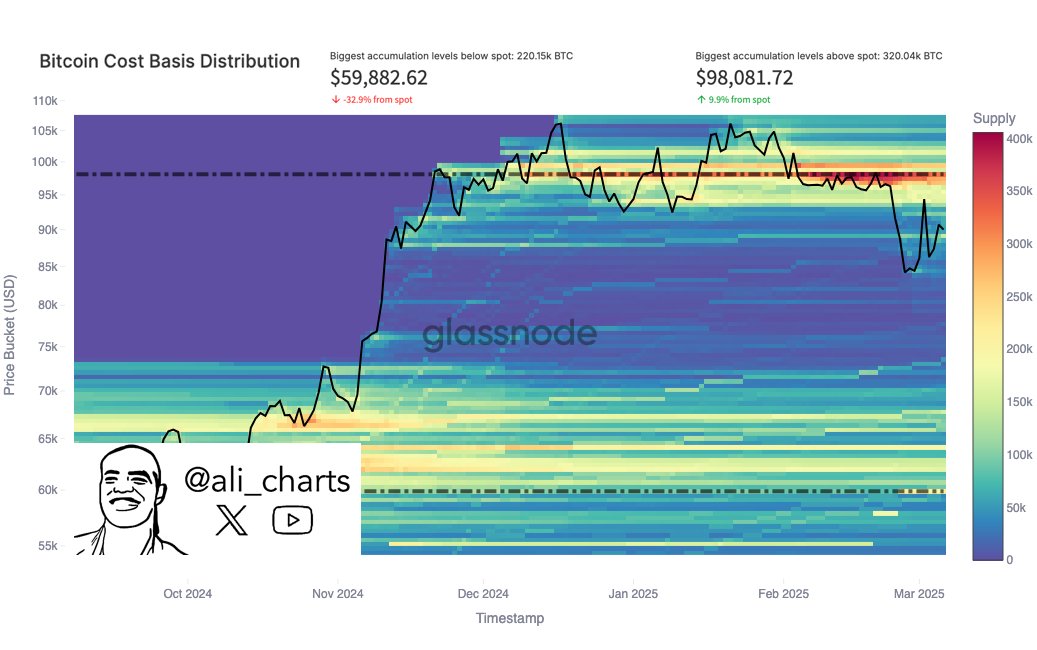

According to top market analyst Ali Martinez, Bitcoin’s price action is currently stuck between two key accumulation levels based on its cost basis distribution (CBD) — the allocation of Bitcoin holdings according to the price at which different investors acquired their BTC. The CBD helps to identify major support and resistance levels by showing where significant amounts of Bitcoin were bought or sold.

Based on the CBD data, Ali Martinez explains in making any further gains, Bitcoin will face a key resistance at $98,081. This prediction stems from investors previously acquiring 320,040 BTC at this price region and are likely to sell following a price rebound to exit the market with little or zero losses. However, if Bitcoin bulls can mount sufficient buying pressure to break past this resistance level, it paves the way for a return above $100,000 and perhaps a new all-time high.

On the other hand, should BTC resume its correction trend, Martinez highlights that the next significant support level based on accumulation data is at $59,882 at which 220,150 BTC have been previously accumulated.

If Bitcoin declines toward these support levels, it is likely to experience a strong bounce as long-term holders are likely to acquire more BTC to defend their positions. Interestingly, this analysis aligns with other market insights that suggest BTC is likely to undergo further correction. However, it’s worth noting that any decisive break below $59,882 would trigger a massive amount of panic selling.

BTC Price Outlook

At the time of writing, BTC trades at $85,995 following a minor 1.98% decline in the past day. Meanwhile, its daily trading volume is down by 6.38%, indicating a decrease in market interest. Amidst positive events like the establishment of a US Strategic Bitcoin Reserve, the BTC market remains in a rather volatile state as indicated by the larger market reaction to events of the past week.