Bitcoin’s recent price struggles presented investors with “buying opportunities,” resulting in the inflow of $441 million into crypto-related investment products, according to CoinShares‘ latest report.

James Butterfill, the head of research at CoinShares, explained that digital assets experienced heavy volatility last week due to selling pressures from the German government and news of defunct Mt. Gox’s repayments.

These factors caused Bitcoin’s price to drop significantly, hitting a five-month low below $55,000. It also recorded one of the most significant market liquidations since the FTX collapse in 2022.

Butterfill pointed out that the “price weakness” presented a “buying opportunity” for investors looking to gain exposure to the emerging industry.

This inflow marks a turnaround after three consecutive weeks of outflows. However, Exchange-Traded Product (ETP) volumes remained low at $7.9 billion.

Butterfill added:

“Volumes in Exchange Traded Products (ETPs) remained relatively low at $7.9 billion for the week, reflecting the typical seasonal pattern of lower volumes in the summer months. This represents a 17% lower participation rate compared to the total market for trusted exchanges.”

Investors spread tentacles

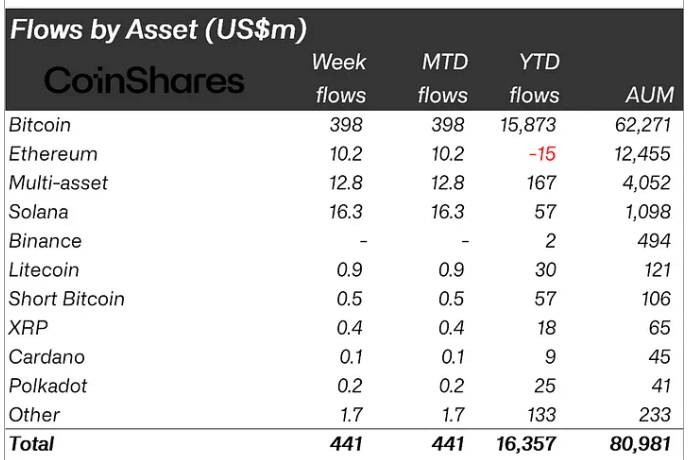

CoinShares noted that investors were willing to spread their funds across different digital assets, which reduced Bitcoin’s usual dominance to 90% of the total inflows. According to the firm, the flagship digital asset saw inflows totaling $398 million, bringing its year-to-date flow to $15.8 billion.

Meanwhile, top altcoins like Solana also saw significant inflows, reflecting investors’ diversification strategies. Last week, investment products related to Solana received $16 million in inflows, bringing their year-to-date flows to $57 million.

Similarly, Ethereum saw a positive shift with $10 million in inflows. However, it remains the only ETP with a net outflow of $15 million year-to-date.

Other altcoins, such as Polkadot, XRP, Litecoin, and Cardano, saw cumulative inflows of more than $1 million.

The post Bitcoin’s price drop created $441 million buying frenzy for crypto investment products appeared first on CryptoSlate.