Onchain Highlights

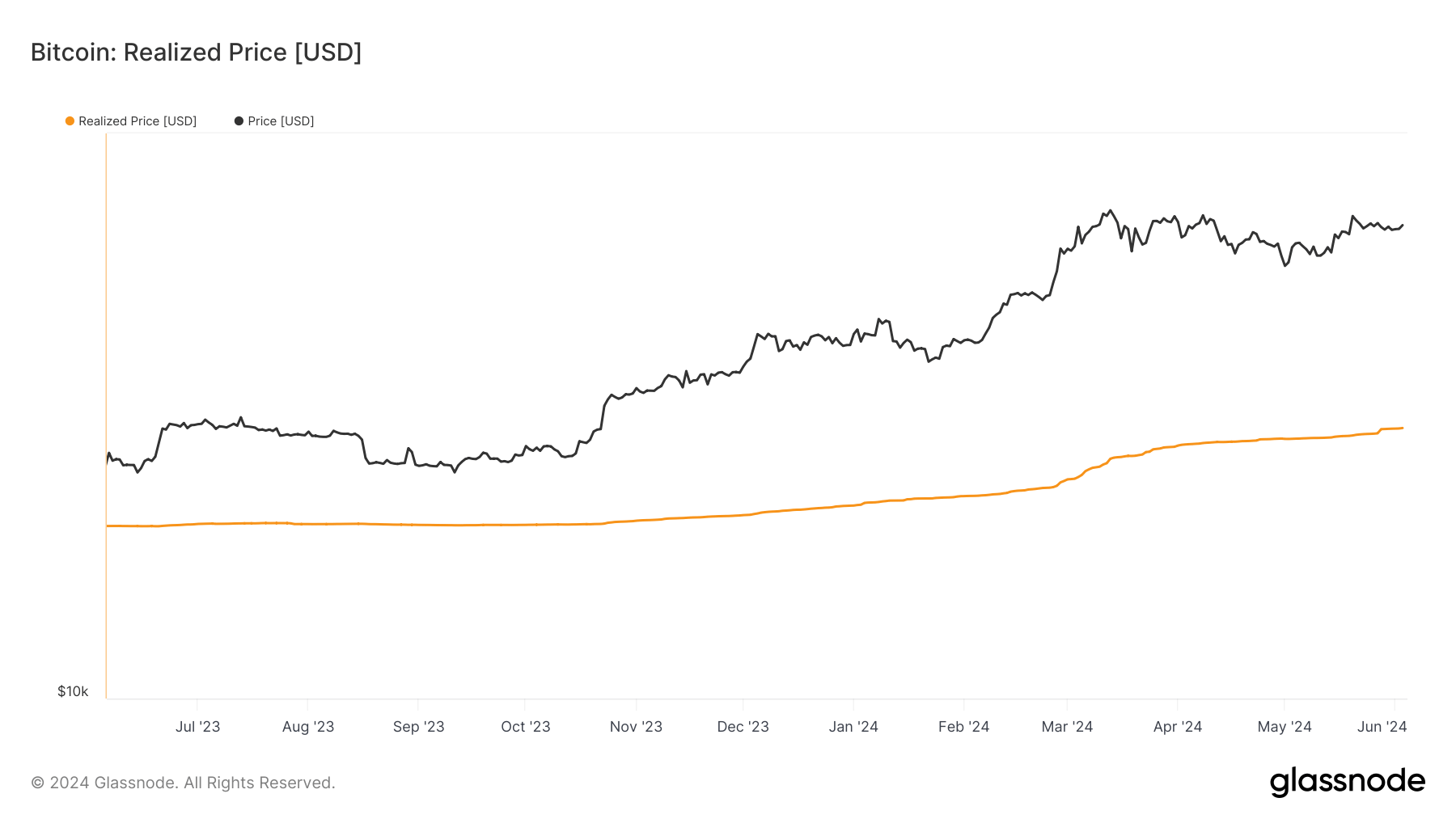

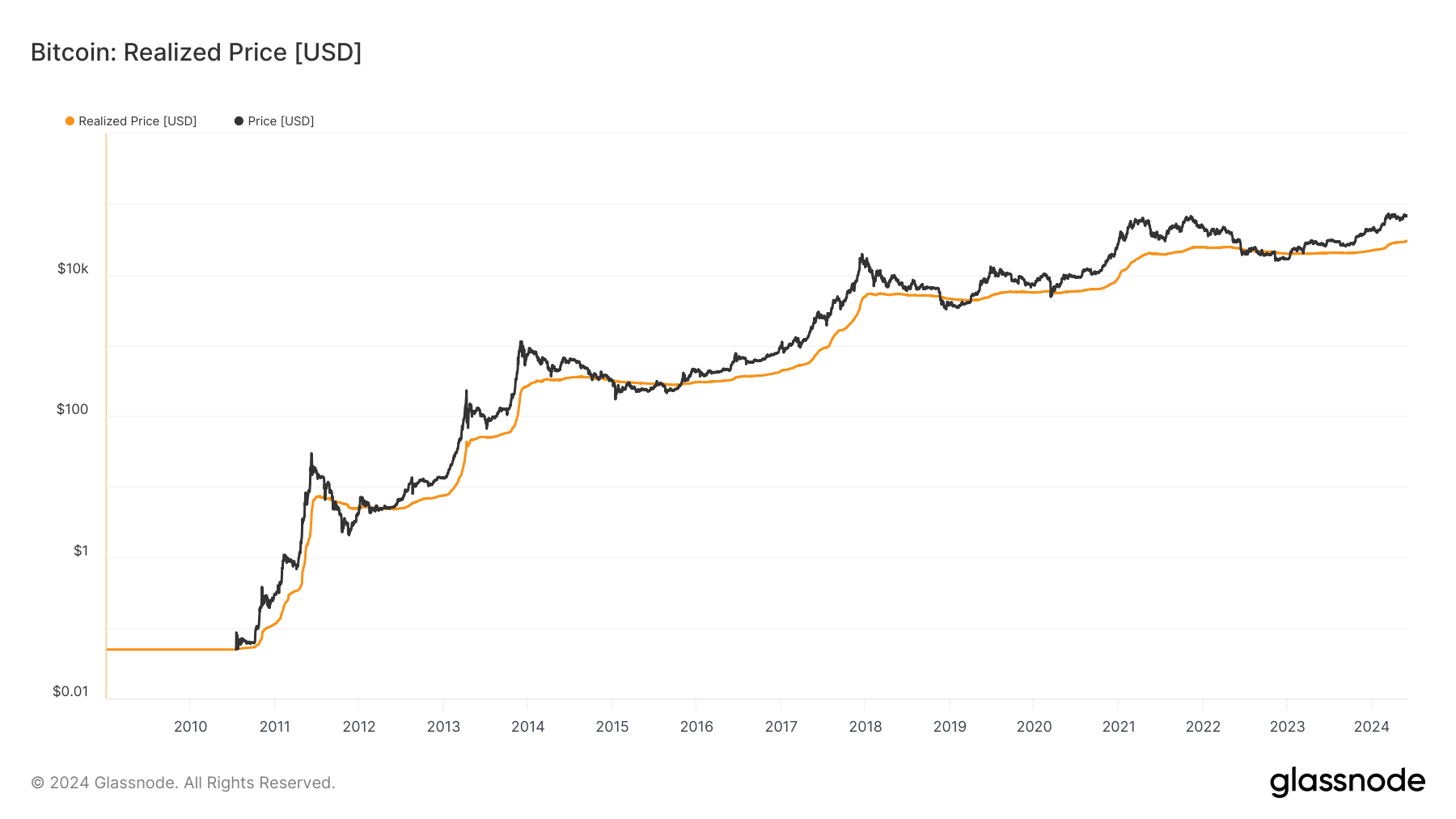

DEFINITION: Realized Price is the Realized Cap divided by the current supply.

Bitcoin’s realized price has reached new heights, breaking $30,000, driven by significant market activity and investor confidence. Bitcoin’s realized price indicates the average price at which all Bitcoin currently in circulation was last moved.

In April, the realized price for short-term holders (STH) surged to over $57,547, marking a significant rise and reflecting the bullish sentiment among recent investors. This metric is crucial as it represents the ‘on-chain cost basis’ for coins moved within the last 155 days, showcasing how short-term holders are influencing the market by actively accumulating Bitcoin.

The divergence between short-term and long-term holder realized prices is also notable, with long-term holders (LTH) maintaining a lower average acquisition cost. This trend highlights the distinct strategies and market impacts of different investor cohorts.

Overall, the upward momentum in Bitcoin’s realized price illustrates a robust market environment post-halving, with short-term holders playing a pivotal role in sustaining higher support levels for Bitcoin.

The post Bitcoin’s realized price surpasses $30,000 appeared first on CryptoSlate.