Quick Take

As we approach the Bitcoin halving and bid farewell to the current epoch, it is crucial to reflect on the events that have transpired since the previous halving in May 2020. The world has witnessed a series of significant events that have shaped the economic landscape and influenced the adoption of Bitcoin.

The COVID-19 pandemic, which began in March 2020, had a detrimental effect on the global economy throughout the entire cycle. The aftermath of the pandemic has led to severe inflation and currency debasement, the effects of which are still felt today.

In August 2020, Michael Saylor, then CEO of MicroStrategy, made a bold move by adopting Bitcoin, resulting in the company accumulating more than 1% of the total Bitcoin supply as of April 2024. The FASB introduced rules that will positively influence corporate adoption by establishing fair value accounting for Bitcoin in corporate treasuries.

El Salvador made history by making Bitcoin legal tender and implementing a dollar-cost averaging (DCA) approach to acquiring the digital asset.

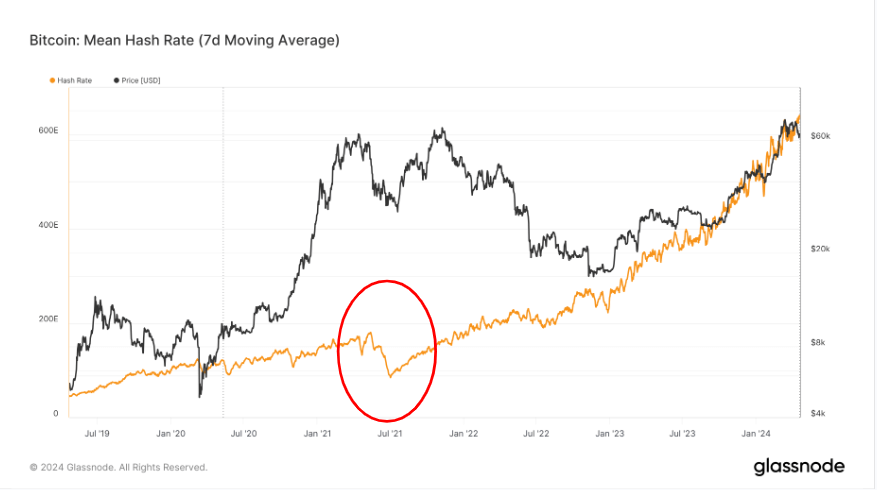

China’s ban on Bitcoin in the summer of 2021 caused a significant drop in the hash rate, which plummeted by approximately 50%.

Geopolitical tensions escalated, with multiple wars and invasions occurring, most notably Russia’s invasion of Ukraine in February 2022 and the recent conflict in the Middle East.

The introduction of Bitcoin ordinals paved the way for the launch of Runes at block 840,000.

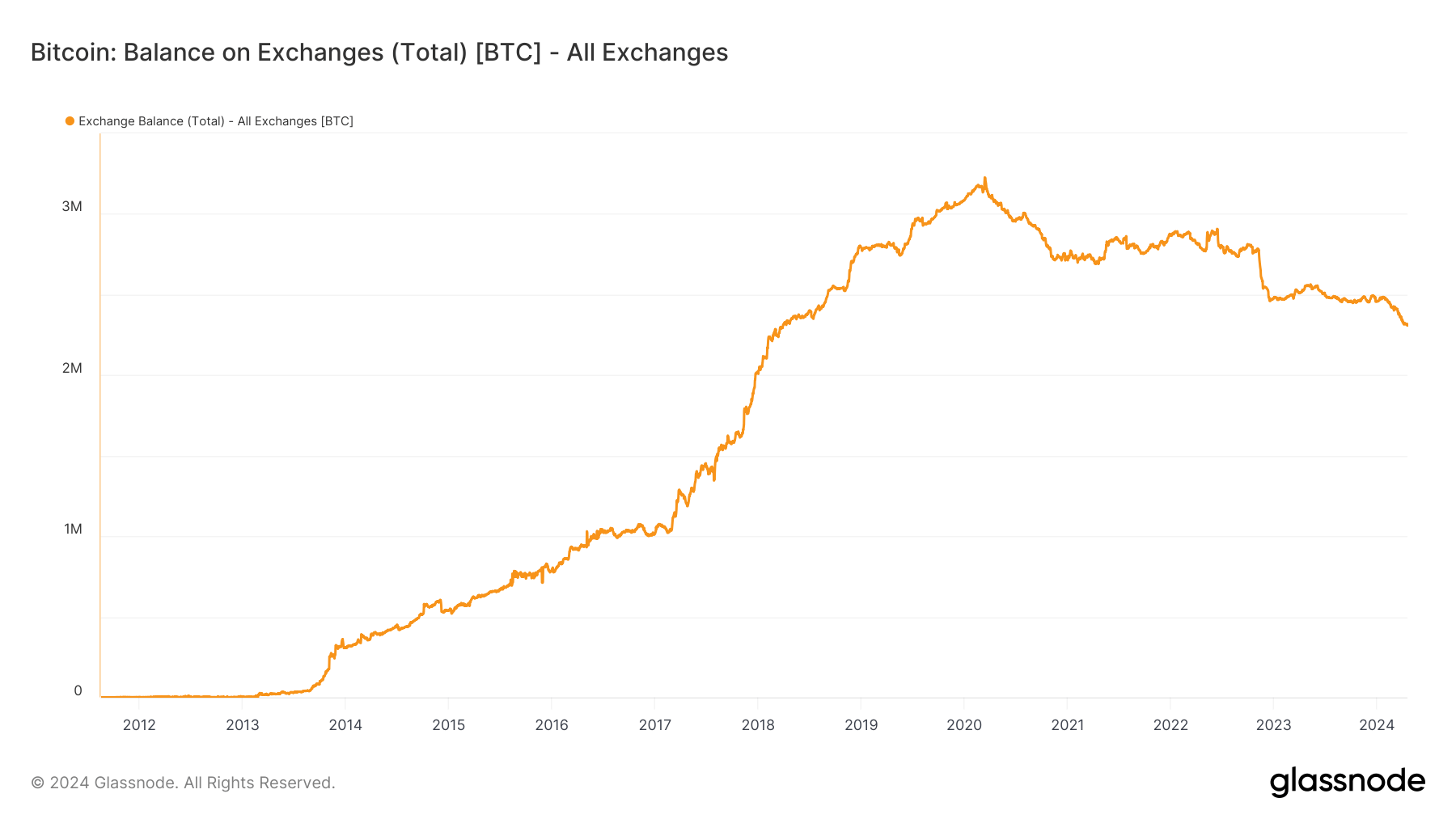

This cycle also marked the first time that the balance of Bitcoin on exchanges decreased, indicating a shift in investor behavior.

In this cycle, the digital asset exchange FTX collapsed alongside several crypto lending platforms like Celsius and BlockFi.

In January 2024, the launch of Bitcoin ETFs became an instant success, further solidifying Bitcoin’s position in the financial world.

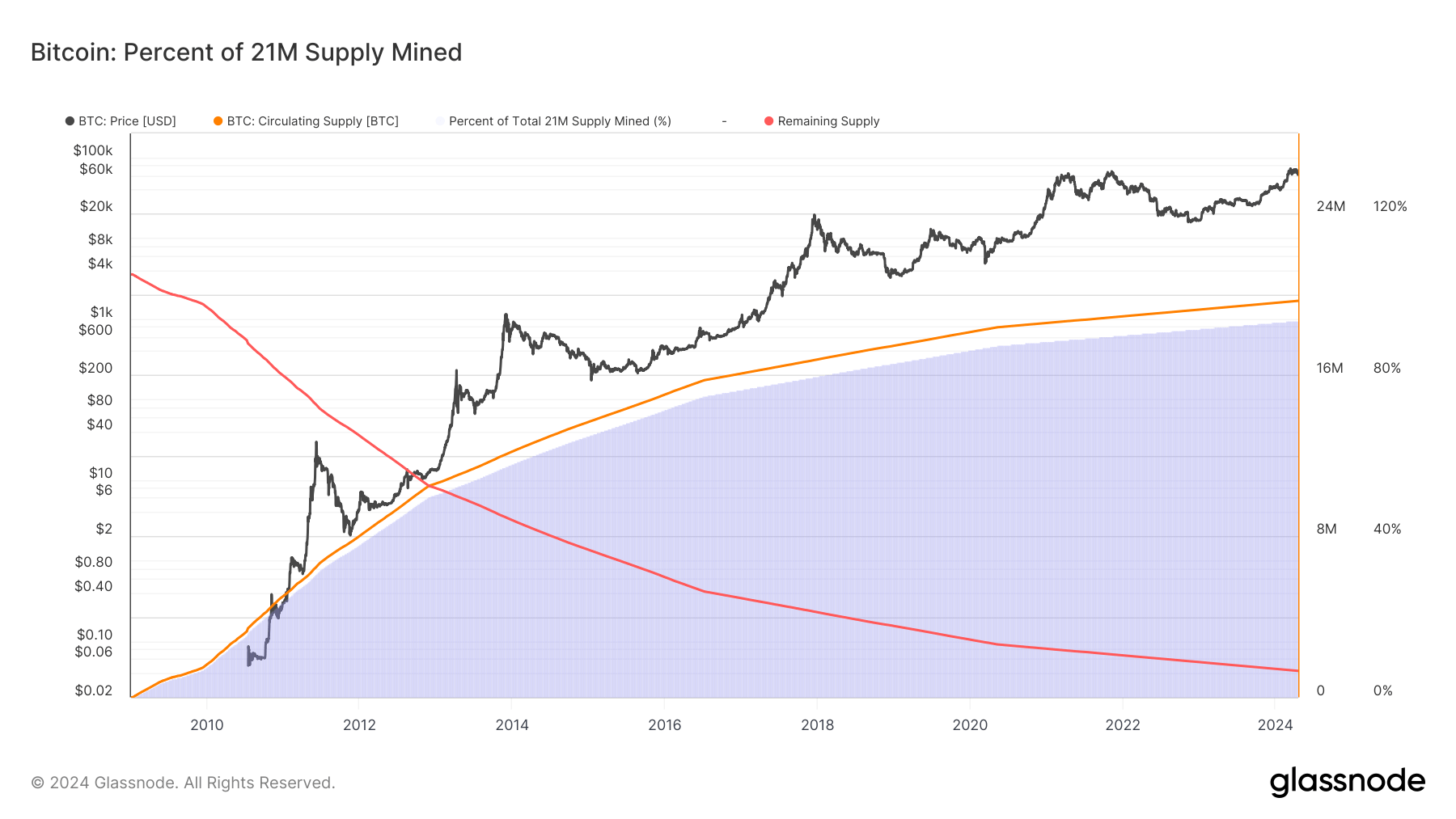

Other notable events included the highest inflation and interest rates in recent history, reminding us that while the future remains unpredictable, the limited supply of 21 million Bitcoin remains a constant.

Despite the challenges and events that have unfolded, Bitcoin has surged an impressive 577% since the last halving.

The post Bitcoin’s resilience tested: Price up 577% amid pandemics, war and corporate embrace appeared first on CryptoSlate.