Onchain Highlights

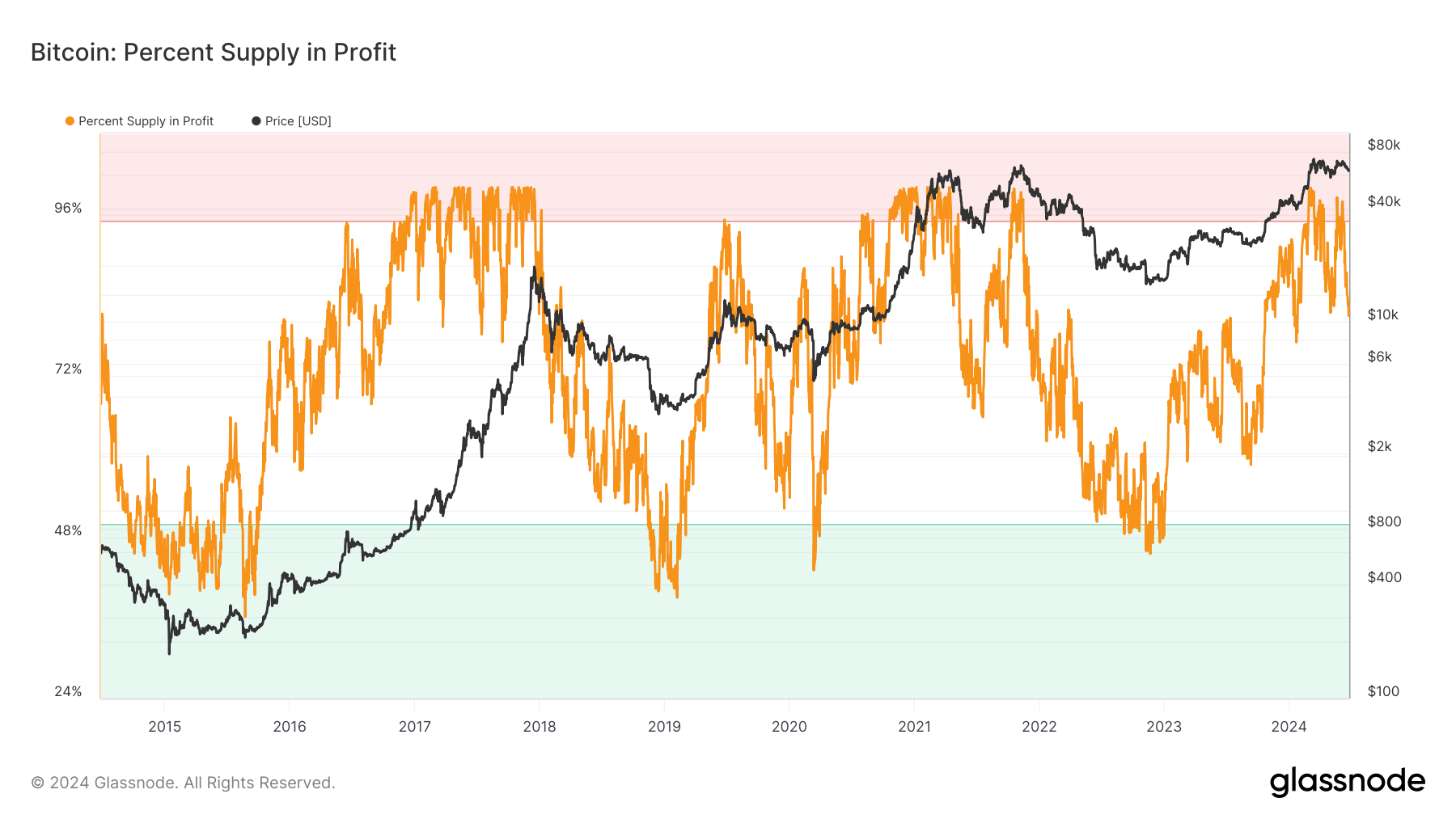

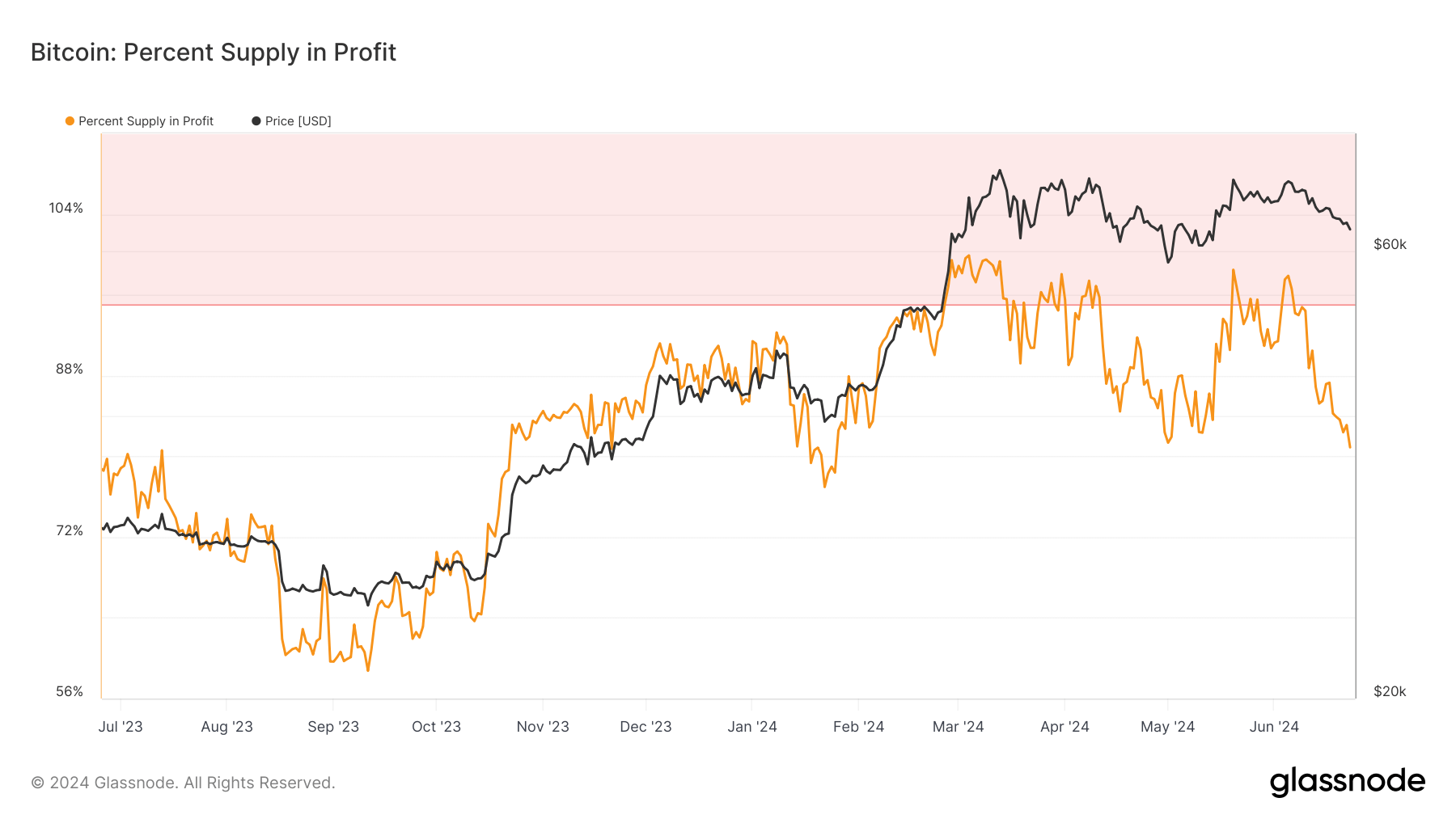

DEFINITION: The percentage of circulating supply in profit, i.e. the percentage of existing coins whose price at the time they last moved was lower than the current price.

Bitcoin’s percentage supply in profit reflects dynamic market conditions. The first chart illustrates historical data from 2013 to 2024, showing periods where over 90% of the supply was in profit, particularly during 2017 and late 2020 to early 2021. This period correlated with significant price rallies, highlighting the cyclical nature of Bitcoin’s market.

In contrast, the second chart focuses on the past 12 months, from mid-2023 to mid-2024, showing a significant decline in the percentage of supply in profit. After reaching a peak of approximately 100% in March 2024, just before the Bitcoin halving event, the metric has since dropped to 80% by June 2024. This decline mirrors the price drop from nearly $73,000 to roughly $60,000 within the same period.

These trends highlight the market’s volatility and the influence of key events like the halving on Bitcoin’s profitability metrics. Monitoring the percentage supply in profit can provide insights into market sentiment and potential price movements, as significant shifts often precede or follow major price changes.

The post Bitcoin’s supply in profit drops to 80% as post-halving effects take hold appeared first on CryptoSlate.