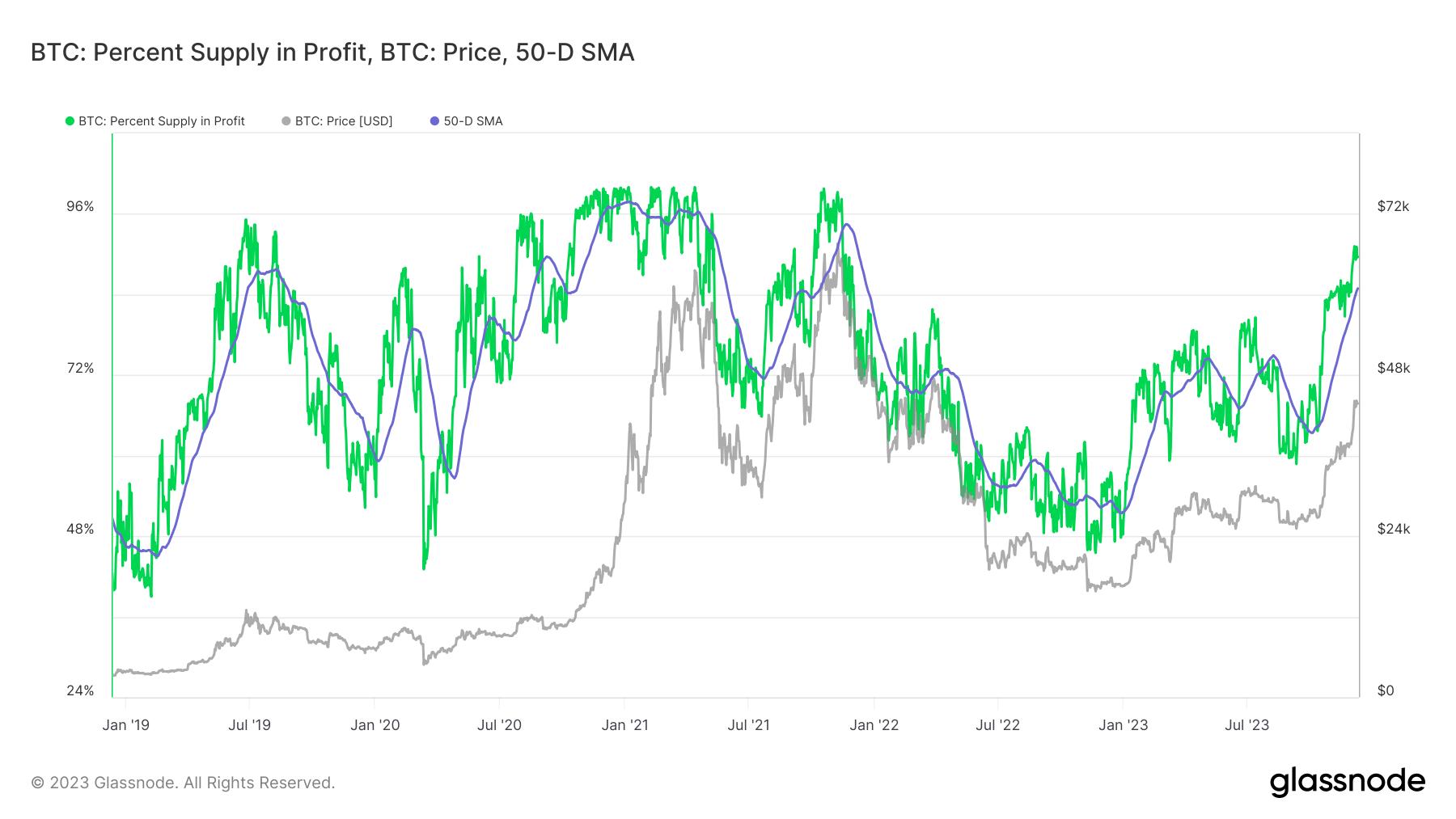

Monitoring the percentage of Bitcoin’s supply in profit offers crucial insights into market trends and potential movements. This metric calculates the proportion of existing Bitcoins currently held at a value higher than their purchase price. Its significance lies in providing a snapshot of overall market profitability, revealing whether most holders are in a state of gain or loss. Spikes in this metric often correlate with market optimism, while drops can indicate increasing pressure to sell, often preceding market downturns.

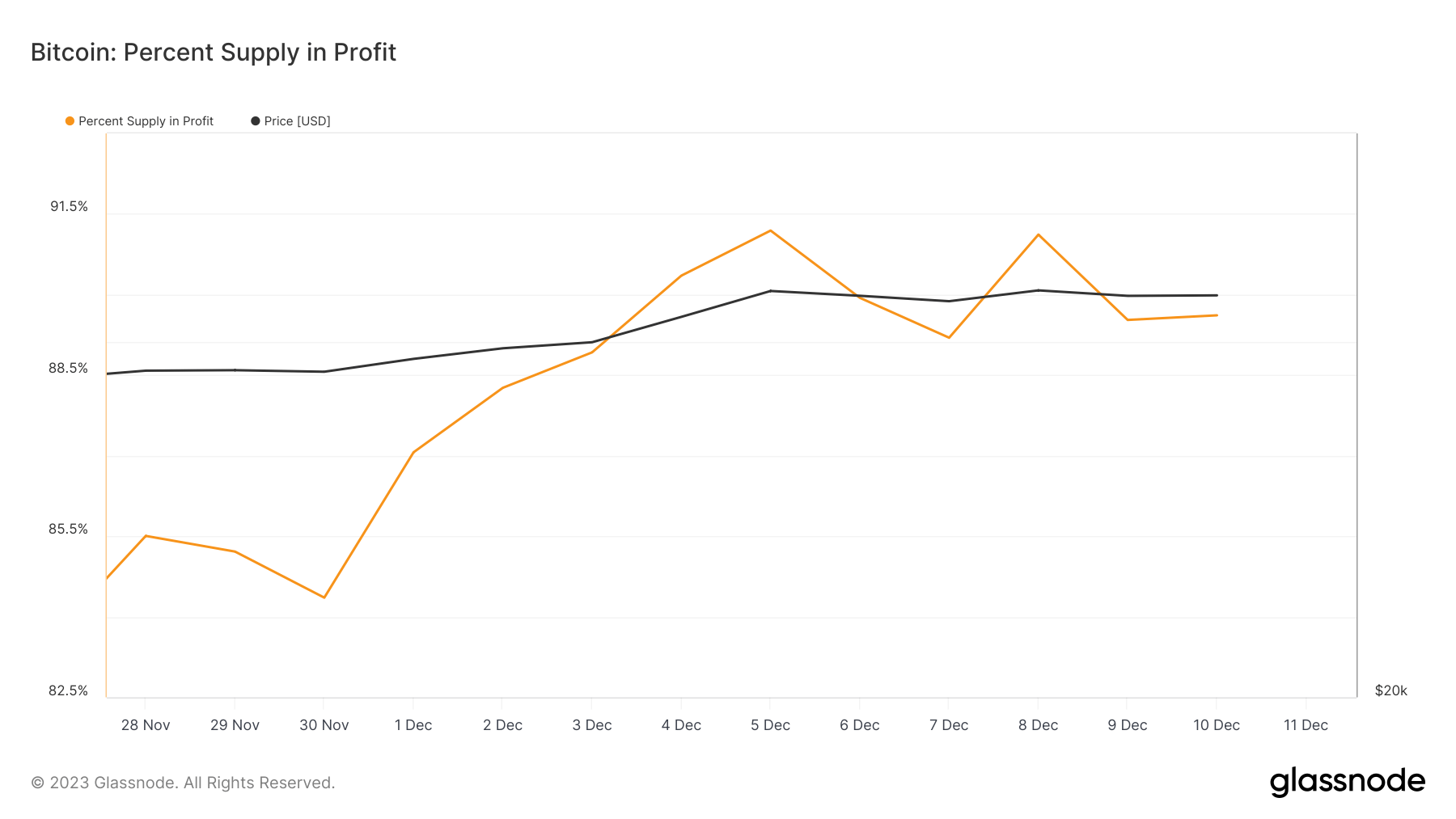

On Dec. 8, 2023, a crucial market milestone was achieved as Bitcoin’s supply in profit exceeded 91.1%, with its price surging over $44,000. This marked a momentous phase of market prosperity unseen since early November 2021. Such a high percentage of Bitcoin in profit typically signals a widespread bullish sentiment, as most investors hold assets at a value exceeding their initial investment.

However, this peak was followed by a swift correction over the weekend, with Bitcoin’s price retreating below $42,000. This shift resulted in the supply in profit dwindling to 89.6%, illustrating a substantial profit-taking event in the market. This reduction suggests that traders, possibly anticipating a more dramatic decline, were keen to secure their gains. Such behavior often indicates a market poised at a critical juncture, with investors wary of a potential fall below pivotal psychological levels like $40,000.

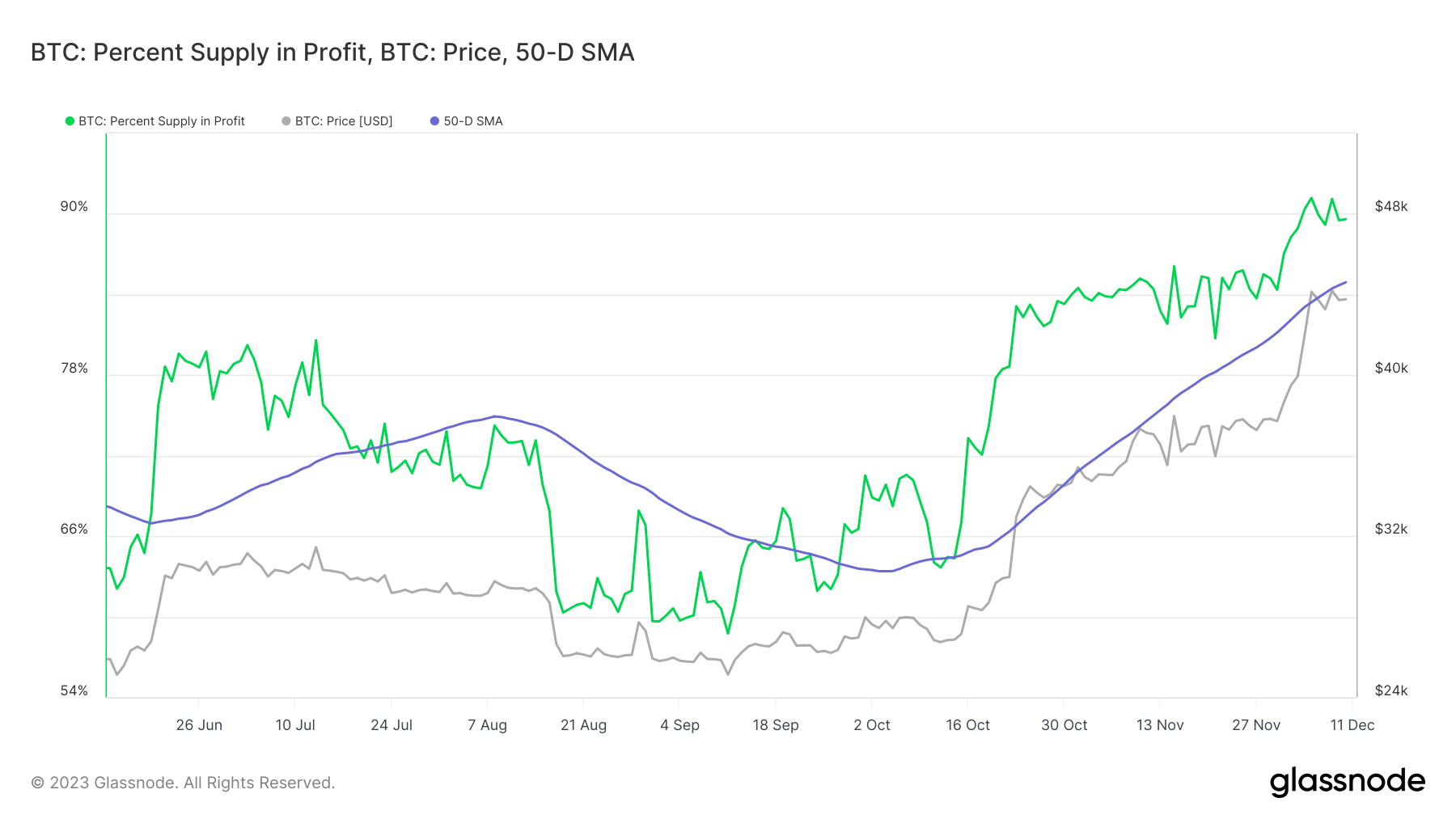

While raw data on Bitcoin’s supply in profit provides immediate insights, it can often be misleading due to its susceptibility to daily market fluctuations. To garner a more accurate and long-term perspective, analyzing the 50-day moving average (MA) of this metric is more instructive. The 50-day MA smooths out short-term volatility, offering a clearer picture of underlying market trends. When the percentage of Bitcoin’s supply in profit consistently hovers above this average, it generally reflects a bullish market sentiment. Conversely, persistently low figures below the MA can hint at bearish trends.

Since early October, the 50-day MA for Bitcoin’s supply in profit has witnessed a marked increase. It rebounded from a low of 63.3% in early October to 84.91% by Dec. 11, after a decline from 74.9% in early August. Notably, the supply in profit has remained above its 50-day MA since Oct. 14, underscoring a sustained bullish outlook among investors.

This persistent elevation above the 50-day MA is a strong indicator of market confidence. It suggests that the overarching sentiment remains positive despite short-term corrections and volatility. Investors are seemingly unfazed by temporary downturns, maintaining their holdings in anticipation of future gains.

The post Bitcoin’s supply in profit shows bullish sentiment despite volatility appeared first on CryptoSlate.