Quick Take

Bitcoin experienced a continuous drop from roughly $70,000 to $60,000 within a 17-day span in June 2024. Throughout 2024, CryptoSlate has closely monitored the activities of Bitfinex whales, whose movements often serve as valuable indicators for market pricing.

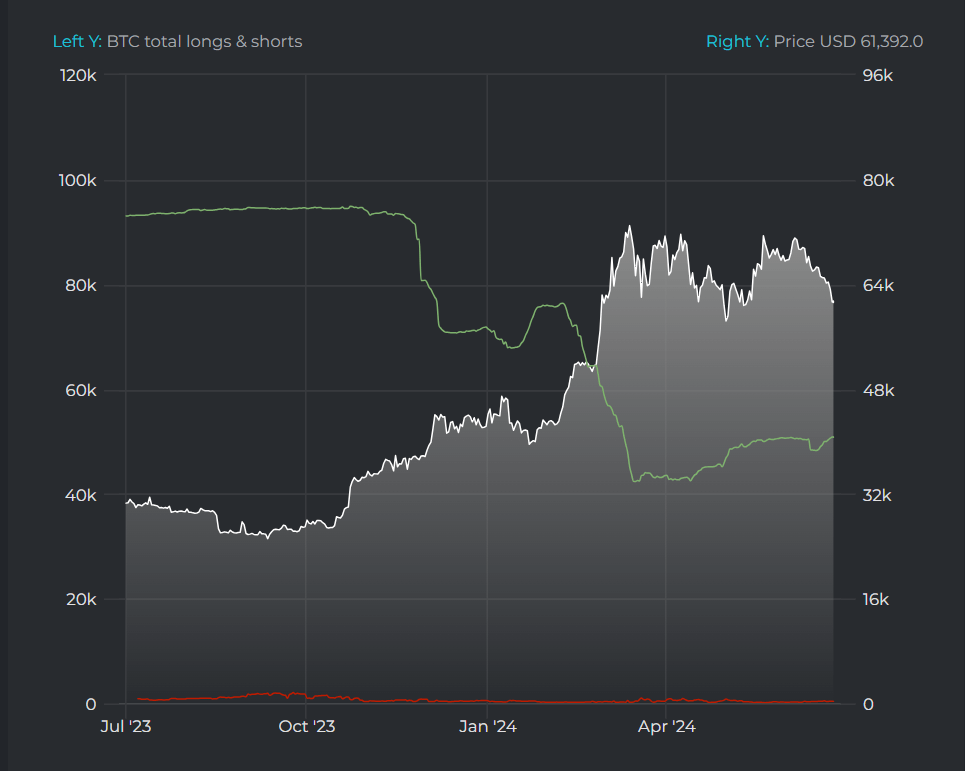

Since June 15, over 2,500 BTC has been added on margin to Bitfinex longs, raising the total to 50,880 BTC from a low of just above 48,000 BTC, according to Datamish.

The data further shows that these whales have a keen ability to gauge market trends. Previously, they held 77,000 BTC long on margin and began reducing their exposure as Bitcoin approached its all-time high in March. This high nearly coincided with the long positions bottoming out at around 42,000 BTC.

Since March, Bitcoin has been consolidating within the $60,000 to $70,000 range. During this consolidation phase, whales have been incrementally increasing their margin-long exposure.

After a brief reduction in June, they are now once again adding to their long positions. This behavior is encouraging, particularly as Bitcoin hovers around key support levels. The $60,000 mark serves as a critical psychological support, suggesting potential stability and resilience in the market at this level.

The post Bitfinex whales boost long positions by 2,500 BTC appeared first on CryptoSlate.