Andrew Parish, the founder of x3 and a frequent source of high-level information on X, has stirred the crypto community with his latest claim that the world’s largest asset manager, BlackRock, “will eventually capitulate and offer both XRP and SOL ETF’s.”

Parish conveyed that sources close to the matter have told him “crypto floodgates have opened, 2025 filings expected,” while also suggesting that BlackRock leadership has indicated “we may not be first, but we will give clients choices,” and that “if nothing else, both will be included in crypto asset class products” because “crypto assets are an unprecedented growth opportunity.”

This is not the first time Parish has shared alleged insider knowledge that turned out to be accurate. On March 17, he posted an update in which he cited “two SEC sources” who believed that the Ripple case was “very close to ending,” adding that these sources expected “XRP to get serious commodity consideration” and a “greatly reduced fine; GREATLY reduced.” He also emphasized that “new leadership knows this case and how they handle it is a big deal; precedent.”

Just two days after Parish released that information, Ripple CEO Brad Garlinghouse took to X to announce that the US Securities and Exchange Commission would drop its appeal, lending credence to Parish’s track record. It is also worth noting that the US Securities and Exchange Commission actually reduced its penalty significantly from $125 million to $50 million, as revealed by Parish.

Will BlackRock Launch A Spot XRP ETF?

While Parish’s assertion regarding a future spot XRP ETF offering may seem bold, he is not alone in his assessment. Nate Geraci, President of The ETF Store, Host of ETF Prime, and Co-Founder of The ETF Institute, has similarly predicted that BlackRock will seek to expand its crypto footprint beyond Bitcoin and Ethereum.

Geraci noted three weeks ago, “I’m ready to log formal prediction… BlackRock will file for both Solana & XRP ETFs,” pointing out that in his view “Solana could be any day. Think XRP once SEC lawsuit concluded.” According to Geraci, BlackRock’s motivation lies in its current dominance by assets in Bitcoin and Ether ETFs.

He believes the firm will be reluctant to allow competitors to break ground with major altcoin ETFs, stating that “I simply don’t see them allowing competitors to come in & launch ETFs on 2 of the top 5 non-stablecoin crypto assets w/out any sort of fight. I also believe BlackRock will file for crypto index ETFs btw.”

Geraci’s reasoning underscores a notable shift from BlackRock’s previously cautious stance on additional cryptocurrency ETFs. In July of last year, the firm’s Chief Information Officer, Samara Cohen, told Bloomberg that BlackRock had no imminent plans to roll out altcoin products beyond Bitcoin and Ethereum. Jay Jacobs, BlackRock’s US Head of Thematic and Active ETFs, reinforced that perspective in December, saying the company was predominantly focused on its existing crypto investment offerings.

Additional remarks from Parish reveal that he has been hearing similar timelines and predictions from unnamed “ETF execs in the know.” In one update posted two weeks ago, Parish mentioned anticipating a variety of spot crypto ETF approvals beginning in Q2, including an expected timeframe of “XRP early Q2,” “LTC early Q2,” “SOL late Q2,” and “HBAR early Q3,” while also pointing to the possibility of “basket” crypto ETF products and leveraged long or short funds. His sources, he said, predict that “2025 is the year of crypto ETF’s.”

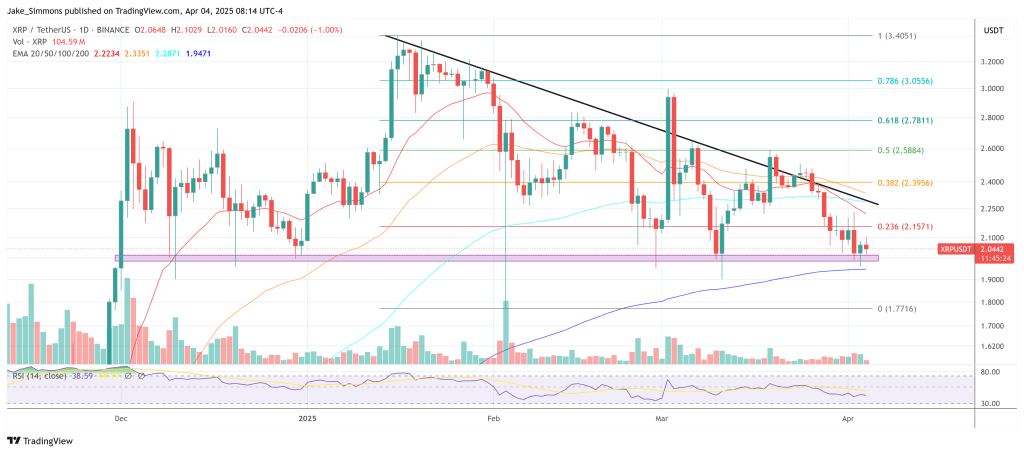

At press time; XRP traded at $2.04