In recent times, the increasing appeal of Bitcoin (BTC) among asset managers and traditional finance (TradFi) institutions has gained significant attention, particularly with the notable success of Bitcoin ETF products offered by industry leaders like BlackRock, Grayscale, and Fidelity.

This success has prompted more Wall Street banking institutions to eagerly enter the newly approved ETF market as authorized participants (AP).

Major Institutions Join BlackRock

As per recently disclosed notes, BlackRock has expanded the list of authorized participants for its iShares Bitcoin Trust (IBIT) ETF.

BlackRock’s addition of five new participants, including Goldman Sachs, Citadel, Citigroup, UBS, and clearing house ABN AMRO, brings the total number of authorized participants to nine. This move comes as the fund attracts substantial investments from individuals and institutions.

It is worth noting that Jane Street Capital, JPMorgan, Macquarie, and Virtu Americas were already on the authorized participant list.

According to BlackRock’s filing, the authorized participants will exclusively transact in cash to create and redeem ETF shares. They will not directly or indirectly handle Bitcoin as part of the creation or redemption process.

Authorized Participants play a critical role in the ETF ecosystem. They have agreements with ETF issuers that give them the right to create and redeem ETF shares in response to market demand. These participants may act on their behalf or that of other market participants and are not compensated by ETF issuers.

By dynamically adjusting the number of ETF shares outstanding, authorized participants aim to increase efficiency and reduce costs for ETF investors.

Wall Street Giants Embrace Bitcoin ETF Market

Adding high-profile Wall Street institutions such as Goldman Sachs, Citigroup, UBS, and Citadel to the Authorized Participants underscores the growing interest and acceptance of Bitcoin-related financial products.

Bloomberg ETF expert Eric Balchunas suggests that these banking giants either have a newfound interest in the sector or are now comfortable publicly associating with it.

According to Balchunas, their participation was not previously explicitly mentioned in ETF filings. However, these ETFs’ remarkable growth and success have likely influenced their decision to participate openly.

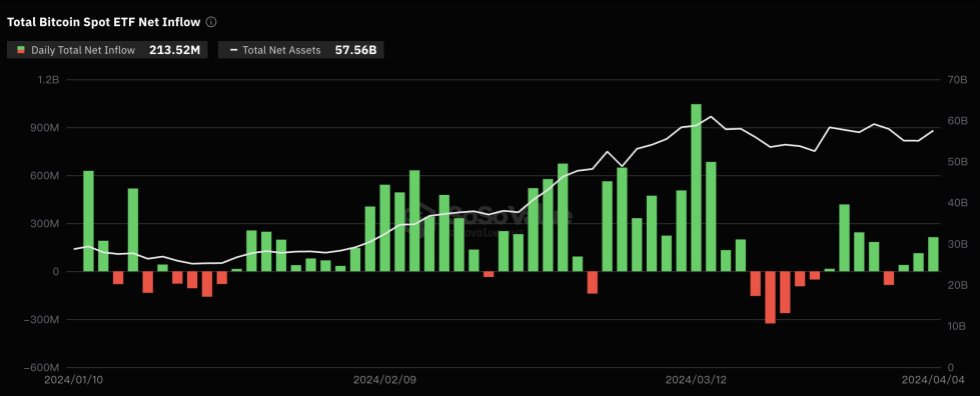

Regarding market flows, the ten Spot ETFs recently approved by the US Securities and Exchange Commission (SEC) have shown steady investor interest. On April 4, these ETFs recorded a notable net inflow of $213 million, marking the third consecutive day of positive flows.

However, Grayscale’s GBTC experienced a substantial net outflow of $79.3 million within a single day. The historical net outflow for GBTC has now reached $15.31 billion.

On the other hand, BlackRock’s IBIT ETF emerged as the top performer, witnessing a significant net inflow of approximately $144 million on the same day. This brings IBIT’s total historical net inflow to $14.4 billion.

BTC trades at $67,700, experiencing sideways price action over the past 24 hours and a 2% price decline over the past seven days despite the Bitcoin ETF market’s success.

Featured image from Shutterstock, chart from TradingView.com