Quick Take

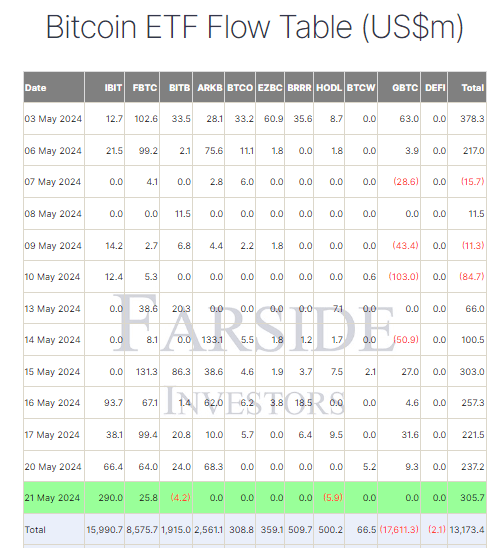

Farside data shows that on May 21, the Bitcoin (BTC) exchange-traded funds (ETFs) collectively accumulated $305.7 million, marking the largest single-day inflow since May 3.

Despite the impressive overall figure, the breadth of inflows from ETF issuers remained relatively narrow, with only two issuers contributing to the surge. BlackRock’s IBIT ETF accounted for the lion’s share, attracting a massive $290 million inflow – the largest since April 5. This substantial influx brought IBIT’s total net inflow to an impressive $16 billion.

Fidelity’s FBTC ETF also saw a significant inflow of $25.8 million, bringing its total net inflow to $8.6 billion. On the other hand, Bitwise’s BITB ETF experienced its first outflow since May 1, with $4.2 million leaving the fund. VanEck’s HODL ETF also reported an outflow of $5.9 million, resulting in total net inflows of $1.9 billion and $500.2 million, respectively. Notably, Grayscale’s GBTC ETF did not register any inflows or outflows on May 21, maintaining a neutral position. Despite the mixed performance among individual ETFs, the total net inflow for all Bitcoin ETFs now stands at an impressive $13.2 billion, according to Farside data.

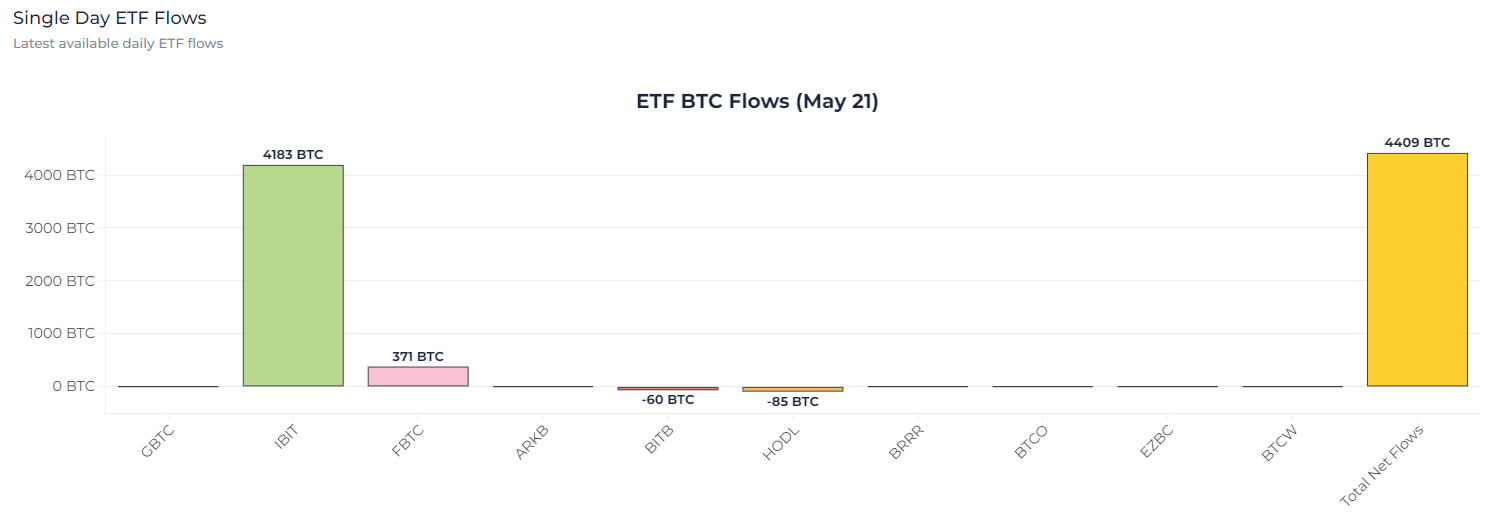

Data from HeyApollo indicates that IBIT now holds 281,899 BTC, placing it just behind GBTC, which has 289,512 BTC. On May 21, the total BTC accumulation was 4,409, with IBIT alone accumulating 4,183 BTC.

The post BlackRock’s IBIT ETF rakes in $290 million in one day, lifting total net inflows to $16 billion appeared first on CryptoSlate.