In Bloomberg Intelligence’s latest report, bitcoin is separating itself from risk assets with increasing HODL behavior and historical patterns suggest a mild down-turn.

- Bloomberg Intelligence discussed bitcoin and other cryptocurrencies as it relates to adoption, markets and defining asset classes.

- The report explains how bitcoin is separating itself from standard risk-assets and becoming a risk-off asset.

- Bloomberg Intelligence also discusses historical patterns of Federal Reserve policy as it relates to bitcoin and bear-markets, offering possible outlooks.

The latest Bloomberg Intelligence report for May discusses the adoption of bitcoin and other cryptocurrencies, markets, and the unprecedented advances of monetary technology.

The report stated that Bloomberg Intelligence’s key takeaway from the Bitcoin 2022 conference in Miami was that “what’s happening to advance money and finance into the 21st century is unstoppable.”

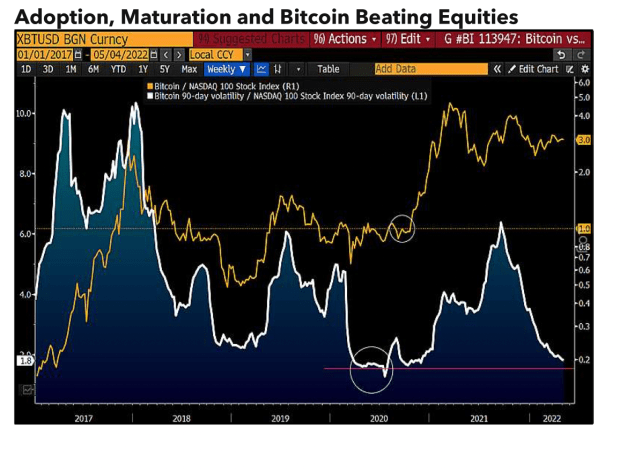

Early in the report, Bloomberg Intelligence notes institutional involvement and declining volatility in bitcoin versus traditional risk assets seems to show a clear divergence in favor of bitcoin, allowing investors to separate from the common pitfalls of traditional assets. Bloomberg Intelligence states “our view is not to buck ‘the trend is your friend’ mantra”, explaining that investors who choose not to at least partially-allocate may suffer the worst.

The report further illustrates bitcoin’s divergence as a standard risk-asset by comparing it to the year-to-date (YTD) numbers to May 3 for the Nasdaq 100 Stock Index. To that point. The Nasdaq 100 suffered a -20% downturn, while bitcoin only dipped -15%. Bloomberg Intelligence contends this to represent bitcoin becoming a risk-off asset.

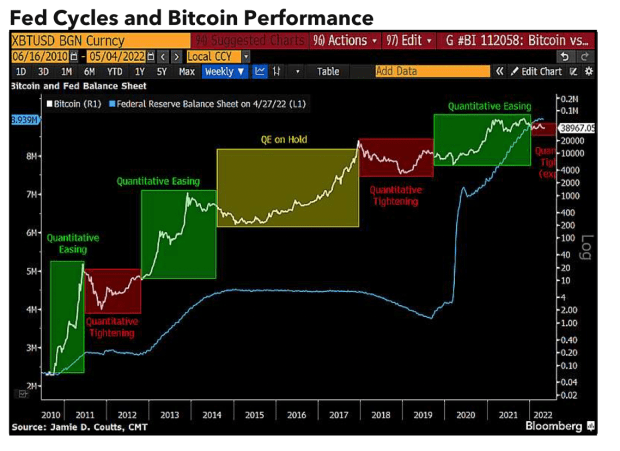

The separation from traditional assets becomes ever more important as today the world awaits the latest Federal Open Market Committee (FOMC) meeting. As the Federal Reserve continues with quantitative tightening, Bloomberg Intelligence notes that bitcoin is well-positioned to overtake a broader market cap against “potentially overextended equity prices.”

However, bitcoin seems to be deviating from the central banks policy decisions indicating a mild bear-market when compared to historical bear-markets. As can be seen below, during past tightening phases, bitcoin rises. With holding, the asset stays level. For loose easing practices, bitcoin historically rises.

While the report does state another expected leg-down as the Federal Reserve has only just begun the tightening process, Bloomberg Intelligence points to “HODL behavior,” which shows more addresses and new addresses alike are holding their bitcoin. This HODL mentality gives rise to the expectation of a much milder down-turn than has previously been observed in the face of negative economic impacts from the Federal Reserve.

“We see great potential for bitcoin to continue doing what it has been doing for most of its existence – outperforming most traditional asset classes,” the report said.