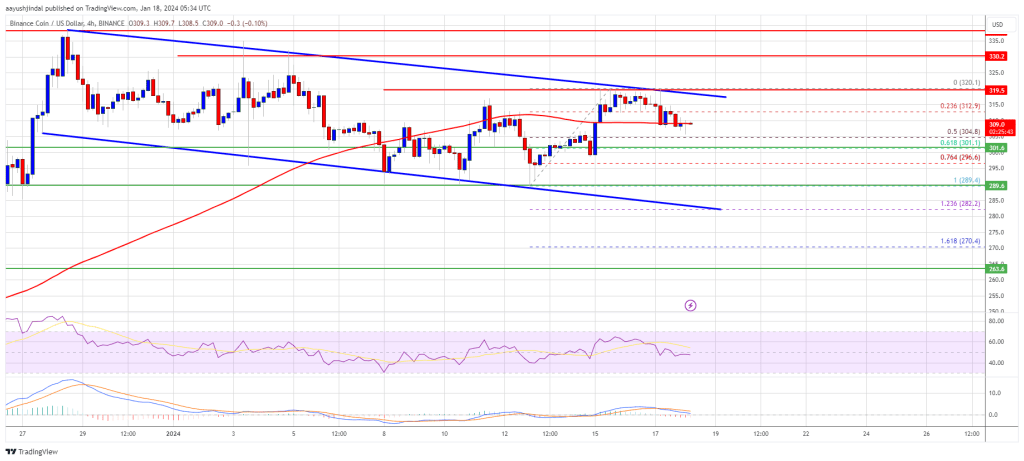

BNB price is struggling to clear the $320 resistance zone. It might decline toward the $288 support zone before the bulls aim for another increase.

- BNB price is struggling to gain traction above the $320 resistance.

- The price is now trading near $310 and the 100 simple moving average (4 hours).

- There is a major declining channel or a bullish flag pattern forming with resistance near $316 on the 4-hour chart of the BNB/USD pair (data source from Binance).

- The pair might continue to move up if it stays above the $288 and $282 support levels.

BNB Price Holds Support

After forming a base above the $280 level, BNB price started a decent increase. There was a move above the $305 and $315 resistance levels. However, the bears seem to be active near the $320 zone.

A high was formed near $320 and the price is now correcting gains. However, the downsides are limited compared to Bitcoin and Ethereum. There was a move below the $312 level. The price is now approaching the 50% Fib retracement level of the upward move from the $289.4 swing low to the $320.1 high.

BNB price is now trading near $310 and the 100 simple moving average (4 hours). There is also a major declining channel or a bullish flag pattern forming with resistance near $316 on the 4-hour chart of the BNB/USD pair.

Source: BNBUSD on TradingView.com

Immediate resistance is near the $315 level or the channel region. The next resistance sits near the $320 level. A clear move above the $320 zone could send the price further higher. In the stated case, BNB price could test $340. A close above the $340 resistance might set the pace for a larger increase toward the $350 resistance. Any more gains might call for a test of the $375 level.

More Downsides?

If BNB fails to clear the $315 resistance, it could continue to move down. Initial support on the downside is near the $300 level or the 61.8% Fib retracement level of the upward move from the $289.4 swing low to the $320.1 high.

The next major support is near the $292 level. The main support sits at $288. If there is a downside break below the $288 support, the price could drop toward the $282 support. Any more losses could initiate a larger decline toward the $262 level.

Technical Indicators

4-Hours MACD – The MACD for BNB/USD is losing pace in the bullish zone.

4-Hours RSI (Relative Strength Index) – The RSI for BNB/USD is currently below the 50 level.

Major Support Levels – $300, $292, and $288.

Major Resistance Levels – $315, $320, and $325.