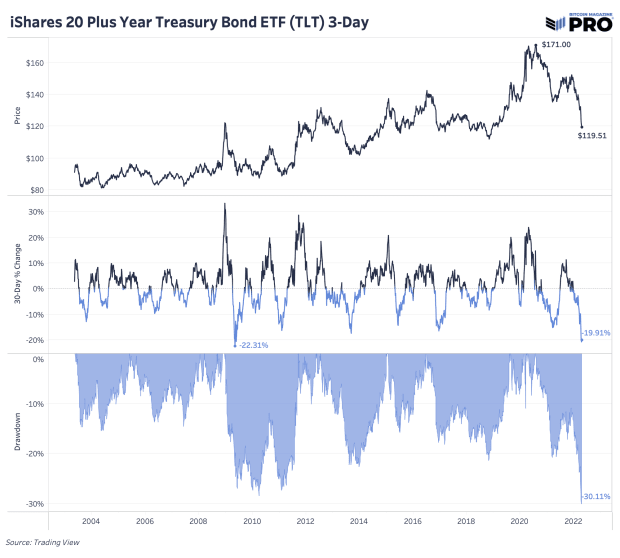

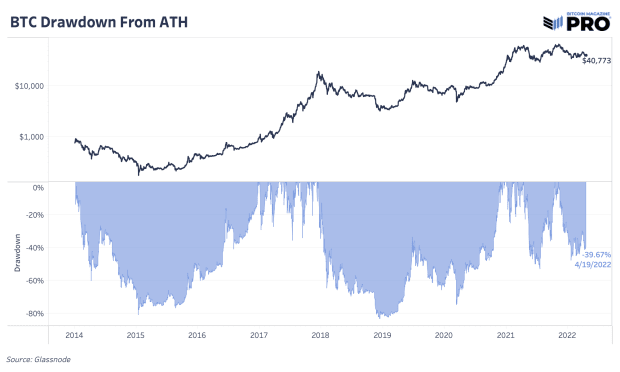

The drawdown in bonds is not much less than bitcoin’s drawdown from its all-time high. Legacy finance is demonstrating to be just as volatile as bitcoin.

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

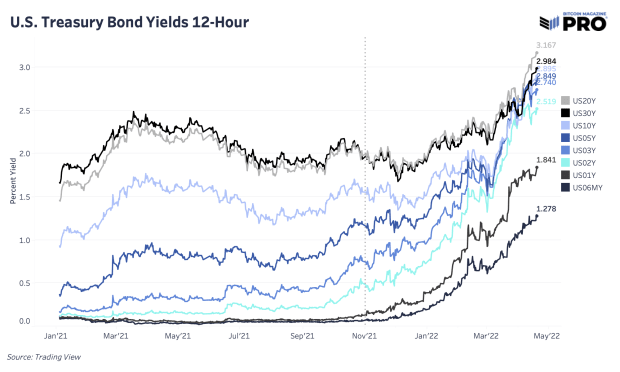

U.S. 30-Year Treasury Yield Hits 3%

Recently, the U.S. 30-year Treasury bond yield hit over 3% as the Treasury bond market across durations and broader credit markets continue selling off.

The rise in yields has resulted in much higher bond market volatility and significant drawdowns for investors. The iShares 20-year Treasury Bond ETF, TLT, which tracks an index of long duration maturities, is now down over 30% from the all-time high back in July 2020. The latest drawdown is the fastest deceleration across a 30-day percentage change since May 2009.

For context, bitcoin is only down roughly 39% from the all-time high. So much for long-dated U.S. Treasuries providing low volatility, portfolio hedging performance and “risk-free” rates.

It’s important to keep in mind the long-term outlook of the global economic system when evaluating the performance of bitcoin and debt securities.

Because of the realities of a historic debt burden that worsened post COVID-19 economic lockdowns, followed by the historic stimulus that followed, debt as an asset class was a promise of return-free risk. Debt is not merely an agreement between borrower and lender, but in the global economy it underpins the entire financial system as a liquid asset class (the largest one at that).

Because of the reality of roughly $100 trillion worth of credit promising return-free risk (nevermind the assets that are priced off of the historically negative real rates: equities, real estate, etc.), our case has repeatedly been that the perfect asset in theory to hold at this stage of a long-term debt cycle is one with no counterparty risk and zero dilution risk.

Theory met reality with the advent of the Bitcoin network in 2009.

Now, as the entire investing world is working to figure out how to outpace the historic inflation regime we are faced with today, there stands bitcoin, which continues to look remarkably cheap against the market valuation of every other asset on the planet.