It’s a major win for Ripple ($XRP) as Brazil’s securities regulator Comissão de Valores Mobiliários (CVM) approved the world’s first $XRP spot exchange-traded fund (ETF).

The news is yet another big step in the company’s expansion, which already includes partnerships with central banks.

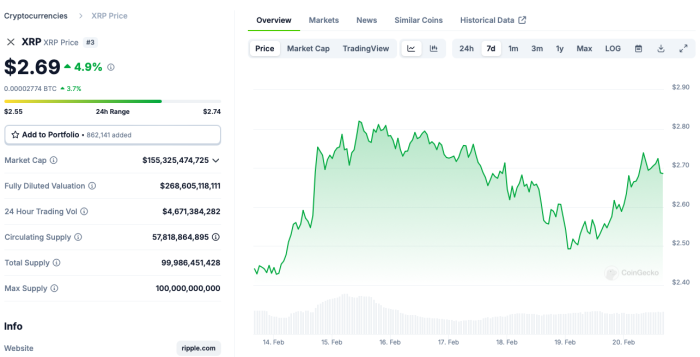

The crypto market has reacted positively to this development, which raised $XRP’s price in the past 48 hours. The development is also sure to increase the exposure of other ETFs in Brazil. This includes Solana ($SOL)—which has two ETFs in the country—as well as related projects like Solaxy ($SOLX).

Let’s dive into the details below.

$XRP Gains Added Exposure with ETF Approval

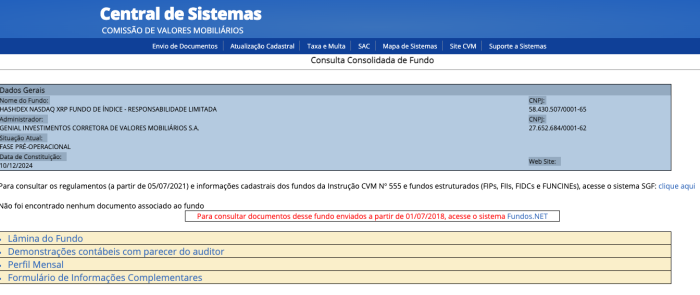

Brazil’s CVM announced the approval of the $XRP spot ETF on February 18, the first of its kind worldwide. Formally known as the ‘Hashdex NASDAQ XRP Index Fund,’ the fund was established on December 10, 2024, and will be traded in B3, the country’s main stock exchange.

With brokerage firm Genial Investimentos as its administrator, the $XRP ETF will allow investors to gain direct exposure to $XRP.

This means they will be able to speculate on the digital currency’s price in the stock market without actually owning $XRP tokens. This will also facilitate investing in the token, as they can do this without using crypto wallets.

There’s no information yet, however, regarding the ETF’s launch date. We’ll keep you posted as soon as it happens.

A Major Win for $XRP and Other Cryptocurrencies

The approval of the first $XRP spot ETF will certainly help with Ripple’s rapid expansion worldwide, as explained above.

But on top of the ETF, the company has also partnered with 10 central banks—including Colombia, Georgia, and Montenegro—to help develop their respective Central Bank Digital Currencies.

The CVM’s approval could also accelerate the confirmation of other $XRP ETFs currently under review in the US, such as Rex-Osprey $XRP ETF, Canary $XRP ETF, and 21Shares Core $XRP Trust. A more crypto-friendly US government will also increase the possibility of this approval.

$XRP’s entry into the Brazilian stock exchange also reflected positively on the token’s price. As of writing, XRP is at $2.69 after bottoming out at $2.12 on February 3.

$XRP Approval Bodes Well for Solana and Solaxy

The $XRP spot ETF is only one of several crypto ETFs in Brazil. Solana has two such funds, one offered by Brazilian asset manager QR Asset, and the other under Hashdex, which also manages the $XRP, as well as $BTC and $ETH funds.

Both $SOL ETFs were approved in August 2024. QR Asset’s spot ETF raised $2.75M during its initial public offering in the same month.

The second $SOL ETF, meanwhile, is currently in its pre-operational phase. Once both Solana-based funds start trading, we can expect $SOL’s visibility and value to increase further.

$SOL’s wider availability would also benefit meme coins at large, particularly Solaxy ($SOLX). It’s a Solana Layer 2 blockchain that aims to solve common issues with Solana, including failed transactions, network congestion, and high fees.

How does it aim to achieve all that? Through Roll-Up Technology, which bundles transactions together and processes them off-chain, making the entire process more efficient.

And if you were wondering about a lapse in security because of this, don’t. Solaxy will finalize the transactions on Solana, which means the transactions will inherit the blockchain’s awesome security.

The $SOLX token is currently on presale, which will allow you to invest in the project and hedge on Solana’s success without waiting for $SOL to trade in Brazil’s stock exchange. To date, the project has already raised $22.4M, which makes it one of the best crypto presales of 2025.

To get started, you’ll need to get a crypto wallet like Best Wallet and connect it to the presale widget on Solaxy’s website. After that, you can buy $SOLX with crypto or fiat currency. You’ll receive the tokens once the presale ends.

Alternatively, you can stake them. This means locking $SOLX in a staking wallet for a set amount of time, giving you the opportunity to earn passive income (the APY is currently 181%).

$SOLX is still affordable at only $0.00164 each. Another price increase will happen in less than 10 hours, though, so it’s best to buy tokens as soon as you can.

Research Before You Invest

Crypto trading can be highly volatile. This means there’s a huge potential for you to either lose or gain from your investment. Because of this, always do your own research before you buy crypto, and never invest money you’re not ready to lose.

Also, speak with a financial advisor if you’re considering buying crypto. The information in this article is for educational purposes only and does not constitute investment advice.