Dogecoin (DOGE) is currently at a pivotal juncture, confronting substantial resistance levels that could significantly impact its future price trajectory. Crypto analyst Ali highlights a critical resistance zone on DOGE’s chart.

Despite the asset’ currently facing a price decline, Ali noted that should the Dogecoin price break above this key resistance, we could see a massive rally for the memecoin.

DOGE’s Decisive Battle: Overcoming Critical Resistance for Potential Price Surge

In a post published on May 28, Ali highlighted a critical resistance zone between $0.166 and $0.171, notably bolstered by the collective holdings of approximately 10 billion DOGE held by 75,500 addresses.

This significant aggregation of Dogecoin at these specific price points forms a strong barrier, complicating the asset’s ability to surge in value.

Ali posits that if Dogecoin can effectively surpass this resistance, it may trigger a substantial price surge. Breaking through this level could lead to doubling its current price, setting the stage for an assault on the next major resistance mark at $0.322.

#Dogecoin is encountering significant resistance between $0.166 and $0.171, where 75,500 addresses have acquired nearly 10 billion $DOGE. However, once this barrier is overcome, #DOGE has the potential to double, with the next key resistance around $0.322 pic.twitter.com/p02Cks63EI

— Ali (@ali_charts) May 28, 2024

This scenario presents a potentially lucrative opportunity for investors but also requires navigating a densely packed zone of accumulated holdings that could stall or propel Dogecoin’s ascent in the market.

The importance of this resistance zone is further magnified by current market conditions, where Dogecoin has experienced a correction, decreasing by 4.9% in the past 24 hours and settling at a trading price of $1.633.

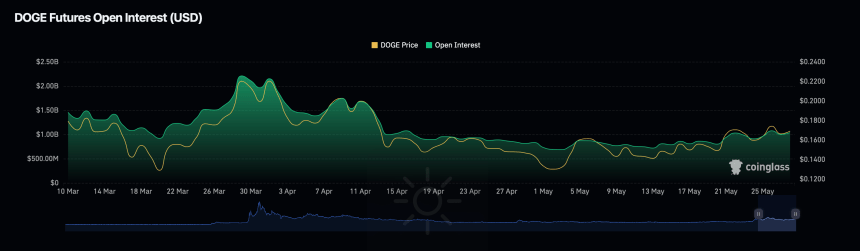

This downturn is part of a broader altcoin retreat. Dogecoin’s open interest declined by 8.26% over the past day, although its open interest volume surged nearly 20% in the same period.

Other Predictions And Market Sentiment Around Dogecoin

Despite the immediate challenges, some analysts remain optimistic about Dogecoin. Mags, a noted crypto analyst, has recently predicted a potential 700% increase in Dogecoin’s price, propelling it above the $1 mark.

This bullish forecast is supported by recent improvements in Dogecoin’s on-chain metrics, suggesting a robust recovery and promising prospects for the meme coin.

Mags shared his enthusiasm on X, indicating his investment in DOGE over the past few months in anticipation of significant gains.

$DOGE about to go parabolic..

Last cycle, I shared Dogecoin before it went up by 170x.

I’ve been accumulating Dogecoin for the past few months and my bags are loaded.

I’m expecting a 7x return this cycle. See you at $1+

pic.twitter.com/OeXdDMpJDZ

— Mags (@thescalpingpro) May 25, 2024

Featured image from DALL·E, Chart from TradingView