Quick Take

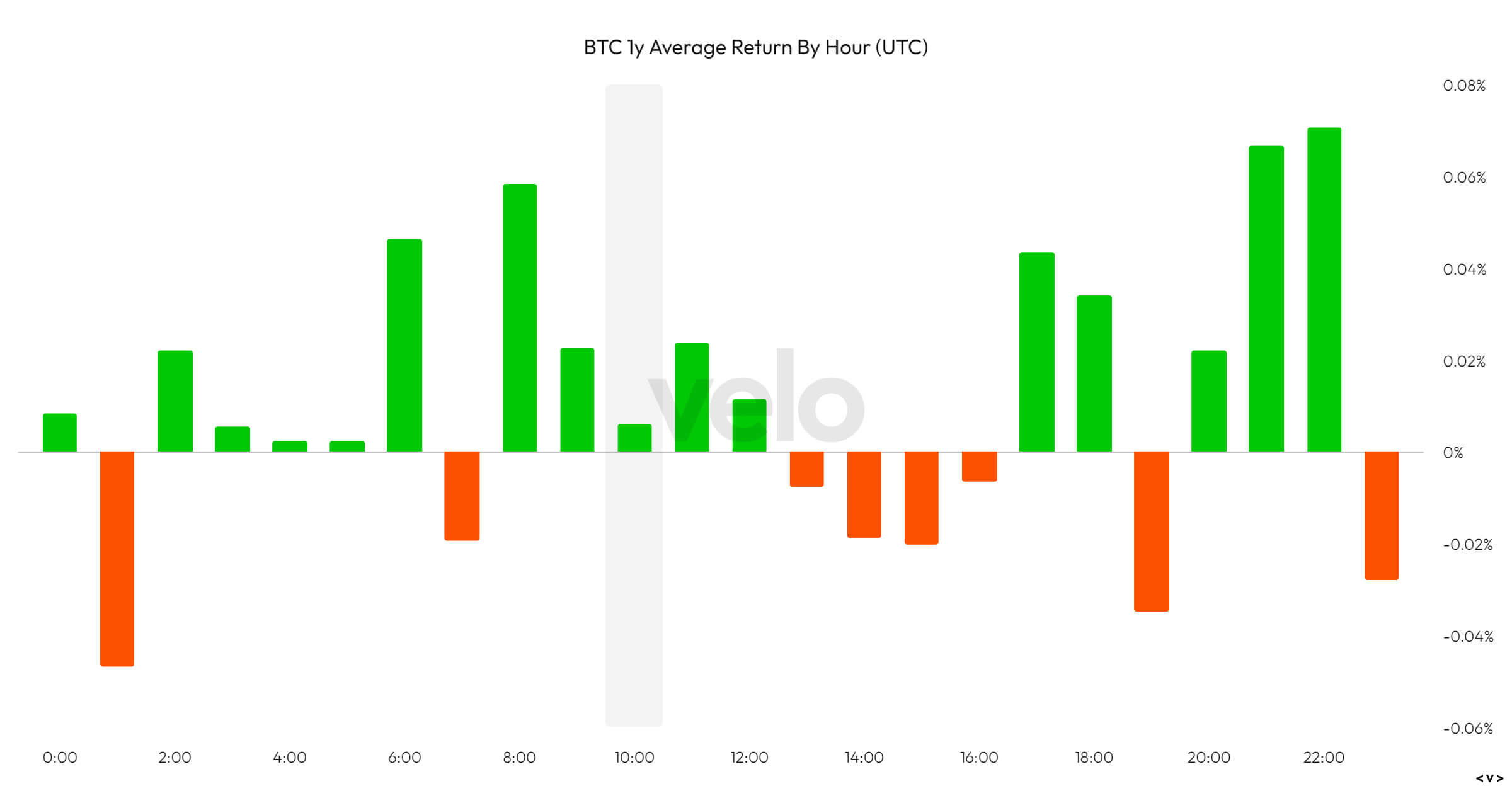

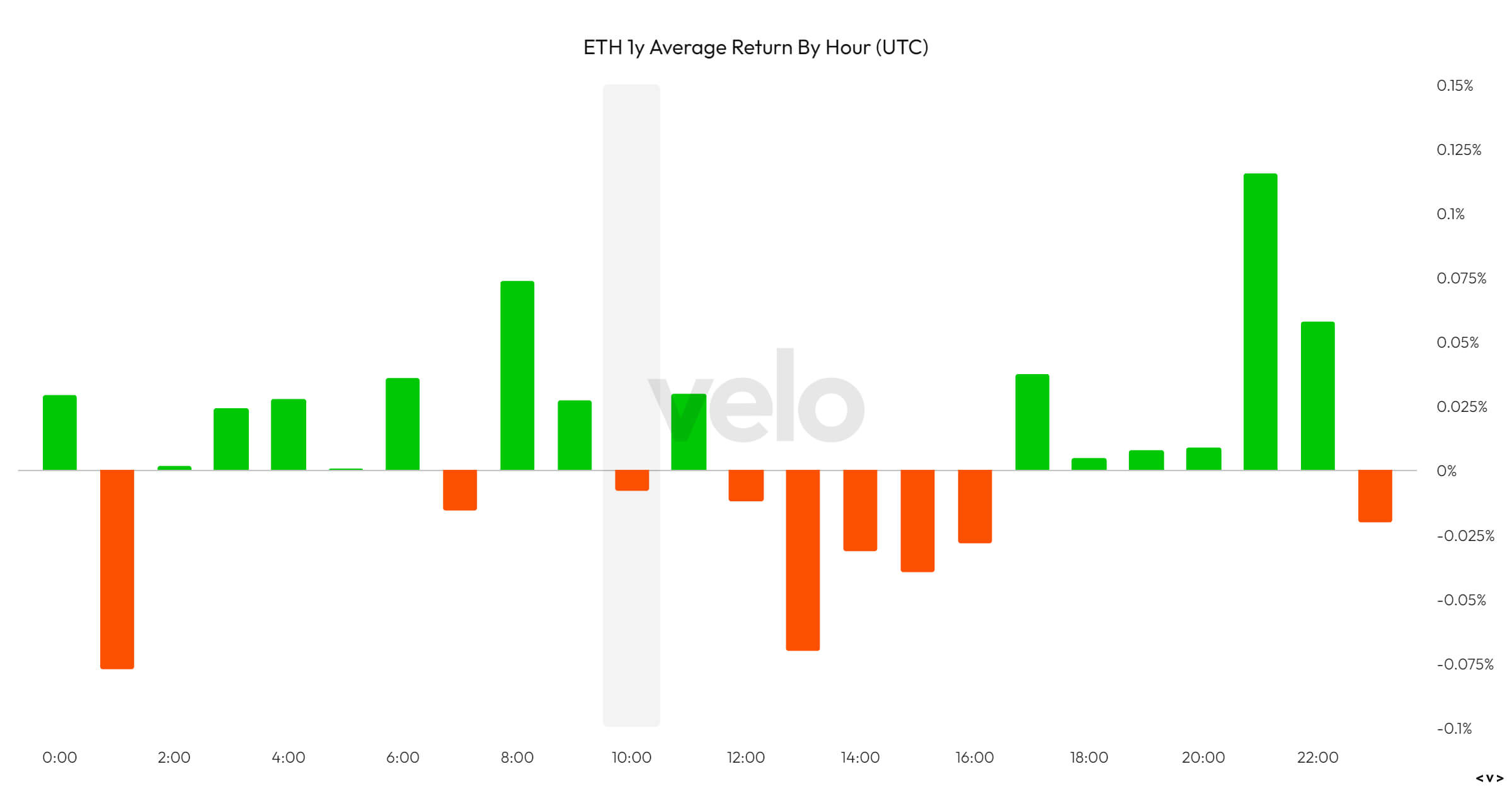

A recent analysis of BTC and Ethereum returns, based on Velo data, reveals distinct hourly patterns in price behavior, particularly around US market hours (data is UTC zone). One key observation is that in early EU hours at 6:00 A.M. UTC, BTC tends to show strong performance, with Ethereum slightly trailing. However, once the US markets officially open, both BTC and Ethereum typically experience a bearish period after a strong performance during EU hours.

Throughout the early US trading session, BTC continued to perform better than Ethereum, while Ethereum tended to decline more quickly. Interestingly, the hours following the US market close at 9 P.M. UTC appear to be the most bullish for both digital assets, with BTC showing particularly strong gains.

These trends are consistent over shorter periods of three and six months, emphasizing the influence of US market forces on digital assets behavior.

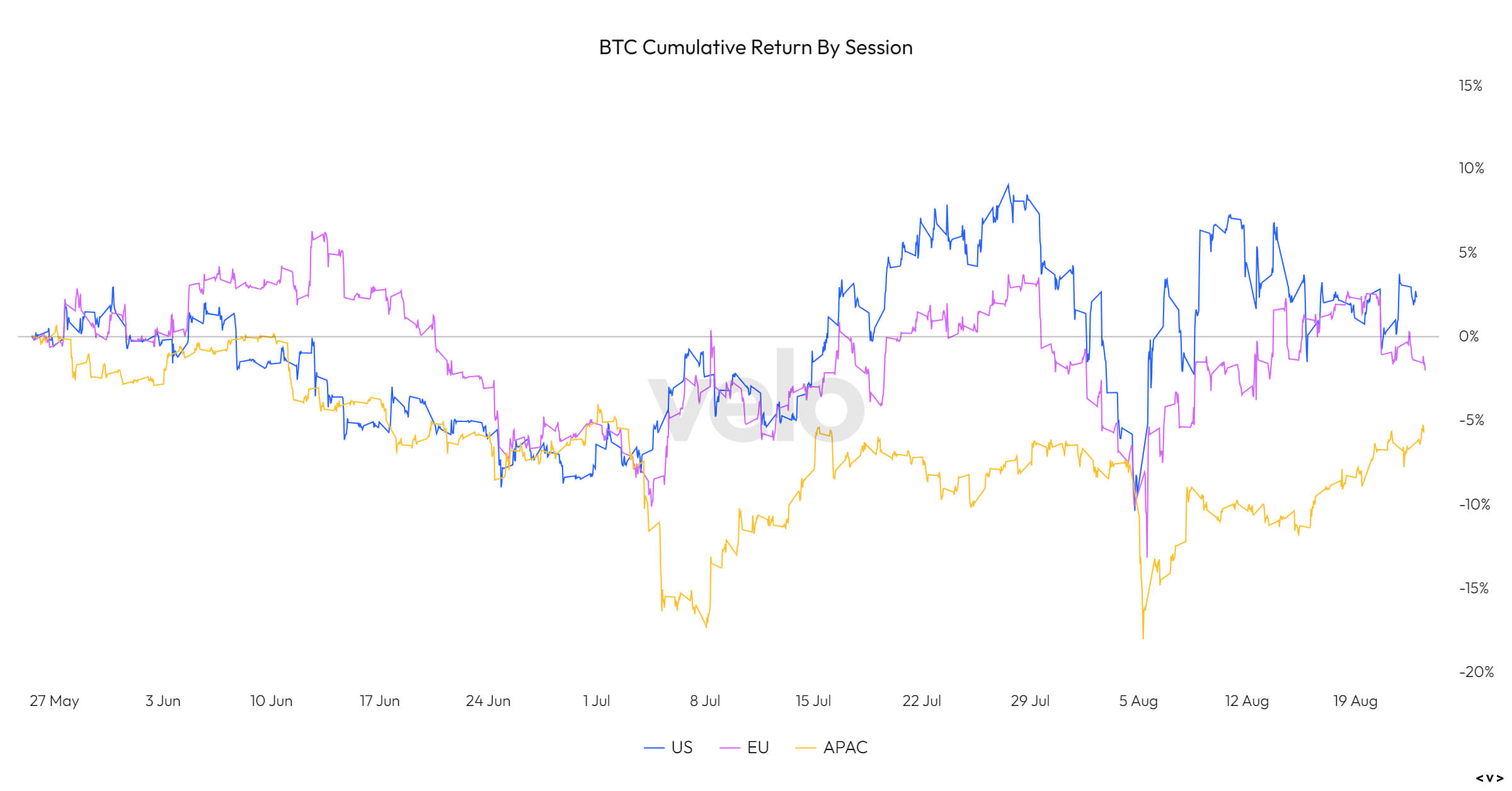

When examining BTC cumulative returns by session in the past three months using Velo data, the EU and US sessions show relatively flat performance around a 10-point swing, excluding Aug. 5. However, the APAC sessions were entirely negative. This pattern illustrates the stagnation in BTC prices over the past few months, with no single session showing dominance.

The post BTC and Ethereum demonstrate distinct hourly trends around US market hours appeared first on CryptoSlate.