The post Bullish Sign for Crypto? BlackRock’s Multi-Million Investment in BTC and ETH appeared first on Coinpedia Fintech News

Due to recent investments, BlackRock, the world’s largest asset manager, is attracting significant attention from crypto enthusiasts amid ongoing market uncertainty. Today, February 12, 2024, blockchain-based security intelligence firm Arkham posted on X (formerly Twitter) that BlackRock has invested millions of dollars in Bitcoin (BTC) and Ethereum (ETH).

BlackRock’s Investment In Bitcoin and Ethereum

According to the post, the asset management giant has purchased 250 BTC worth $24 million and 4.845k ETH for $12.63 million, hinting at an ideal buying opportunity and exemplifying the “Buy the Dip” strategy.

With this recent purchase, BlackRock now holds $56.1 billion worth of BTC and $3.5 billion worth of ETH, highlighting the significant value of these two top crypto assets.

This notable BTC and ETH purchase comes as the overall crypto market sentiment seems to be shifting, with prices beginning to recover. At press time, BTC is trading near $96,780, having experienced a 2% upside momentum, while ETH is trading near $2,670, with a price surge of over 3% in the past 24 hours.

Traders Sentiment Shifts Towards Long Position

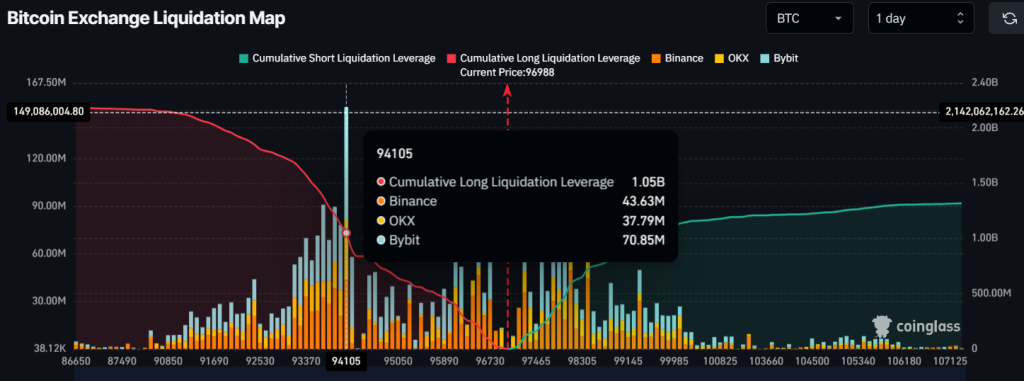

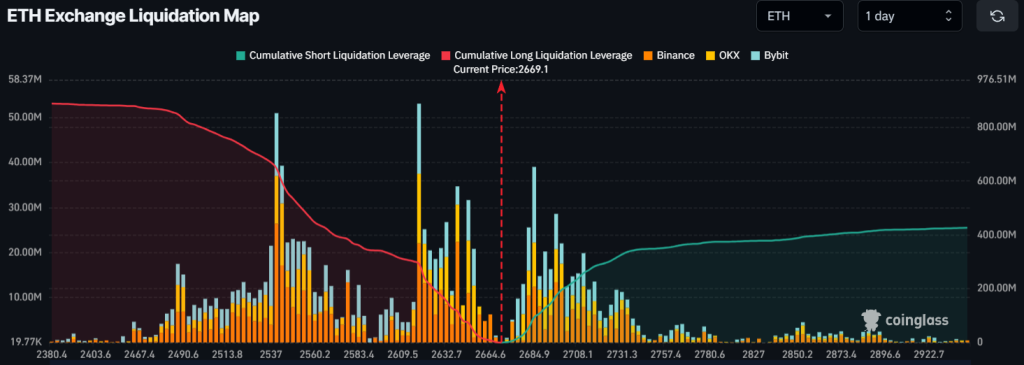

As prices begin to recover, traders are increasingly betting on the long side, as revealed by the on-chain analytics firm Coinglass.

At press time, traders holding long positions are over-leveraged at the $94,000 level, with $1.01 billion worth of long positions. Conversely, traders holding short positions are over-leveraged at the $98,000 level, with $700 million worth of short positions. This data clearly defines the current support and resistance levels for BTC.

These bullish bets are similarly observed in ETH as well. Data reveals that traders holding long positions are over-leveraged at the $2,620 level, with nearly $300 million worth of ETH long positions. Meanwhile, $2,685 is another over-leveraged level, where traders holding short positions have $93.5 million worth of positions, which also indicates the true intraday support and resistance levels.

This data not only indicates traders’ rising interest and confidence in the asset, but also highlights shifts in market sentiment.