Data suggests users on Binance responded to the Ethereum exchange-traded fund (ETF) news by aggressively longing the cryptocurrency.

Ethereum Net Taker Volume On Binance Has Just Seen Its Biggest Candle Ever

As explained by CryptoQuant community manager Maartunn in a post on X, the Ethereum Net Taker Volume has observed a sharp increase after rumors have surfaced that the ETH spot ETFs have a renewed chance of gaining approval.

The “Net Taker Volume” here refers to an indicator that keeps track of the difference between the ETH taker buy and taker sell volumes on any given centralized exchange.

When the value of this metric is positive, it means that the taker buy or long volume is outpacing the taker sell or short volume on the platform right now. Such a trend implies a bullish sentiment is dominant among the investors.

On the other hand, the indicator being negative suggests the presence of a majority bearish mentality among the users of the exchange as the shorts are outpacing the longs.

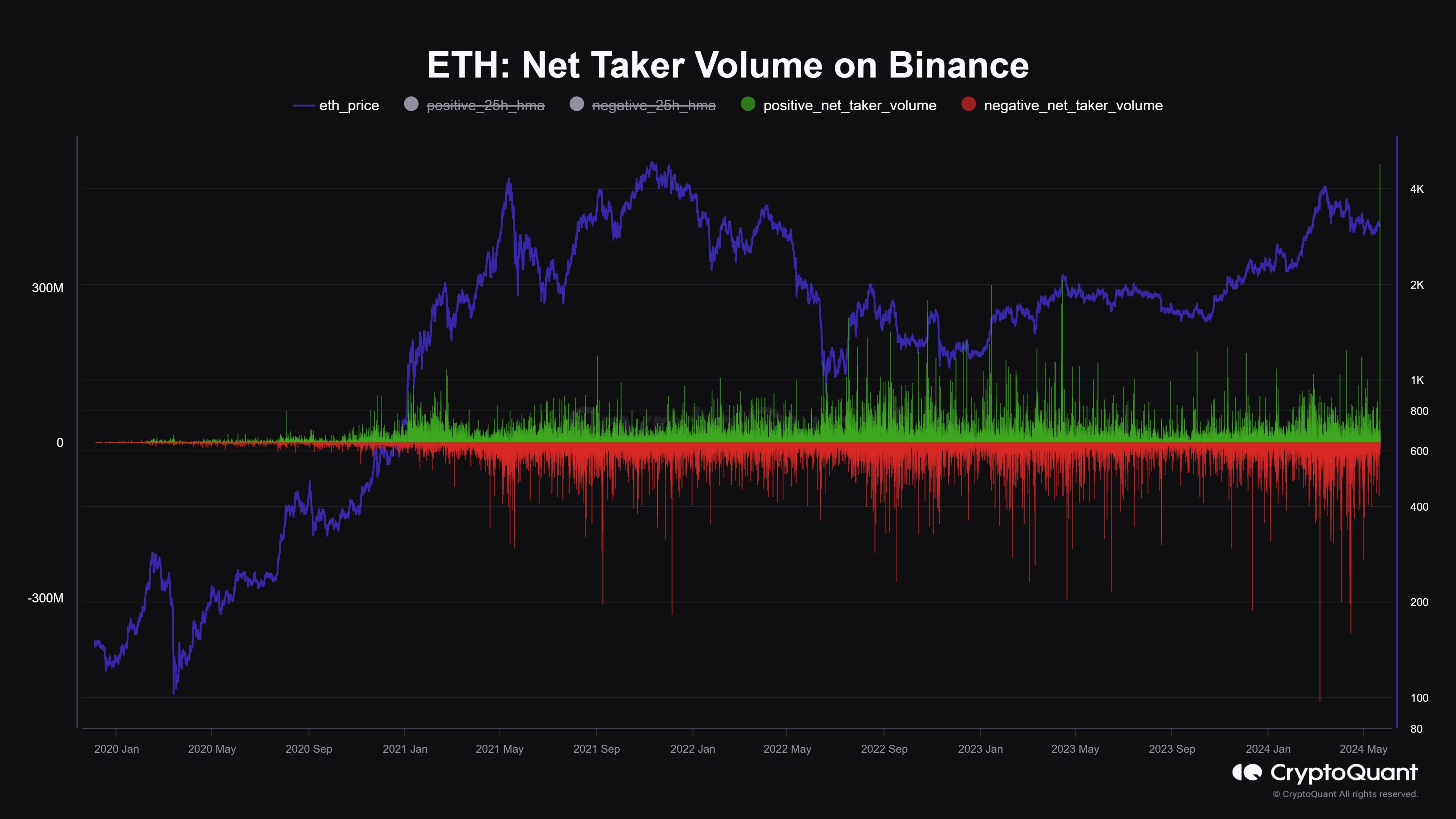

Now, here is a chart that shows the trend in the Ethereum Net Taker Volume on the cryptocurrency exchange Binance over the last few years:

As displayed in the above graph, the Ethereum Net Taker Volume on Binance has just registered a huge positive spike, the implying investors have just opened a large amount of longs on the platform.

More specifically, the indicator’s value during this spike has been $530 million, which, according to the analyst, is the single largest spike the cryptocurrency has ever seen.

“Binance-traders are longing the Ethereum ETF-news like there is no tomorrow,” notes Maartunn. This isn’t particularly surprising, considering the market is very well aware what a spot ETF could mean for the asset after having witnessed what went down for Bitcoin.

The ETF news pre-approval had been bullish for BTC and while the approval itself had initially led to bearish price action, it eventually paid off for the asset as capital started rapidly flowing in through these investment vehicles and the coin enjoyed a rally that led to a new all-time high (ATH).

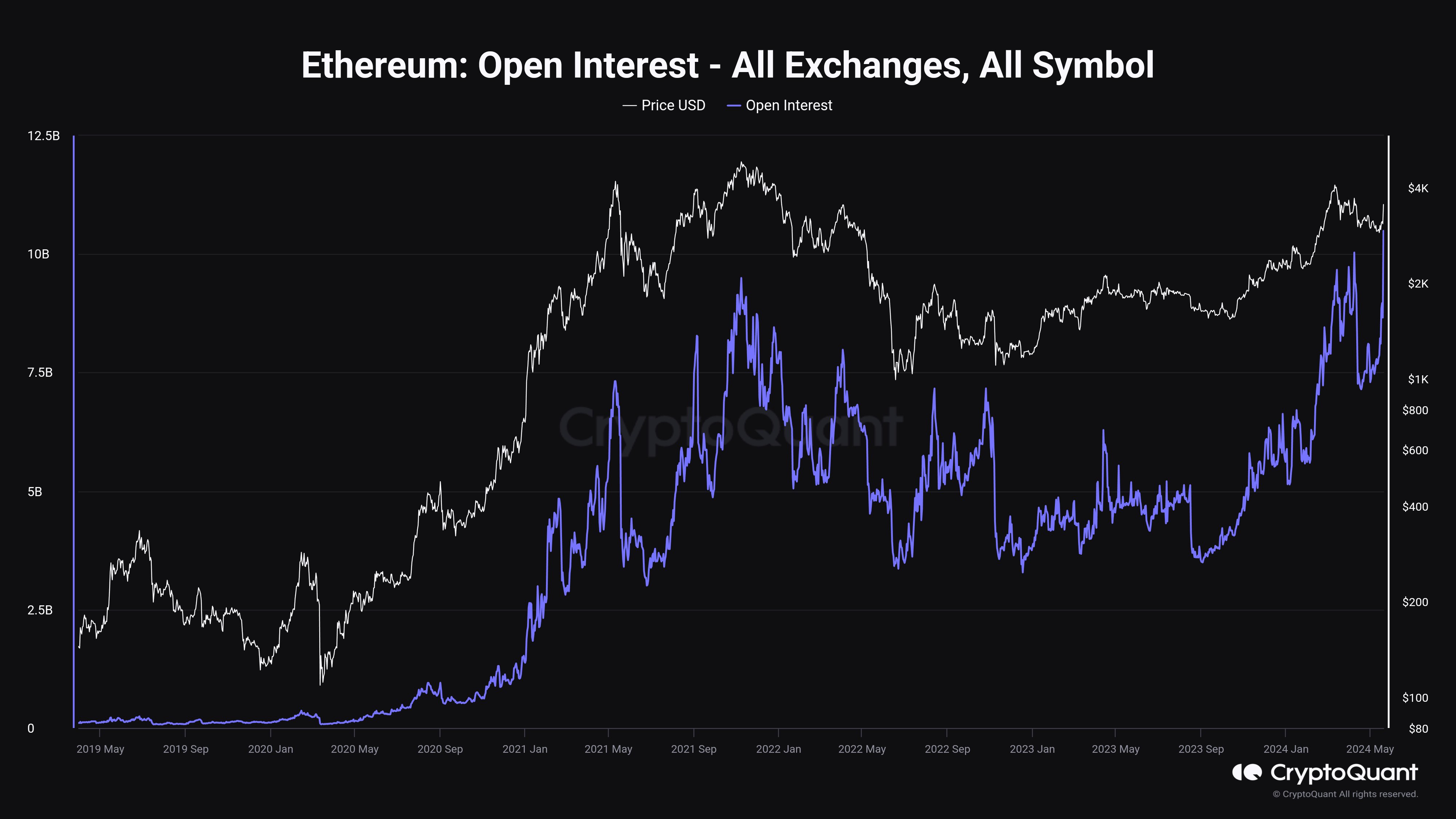

In another X post, the CryptoQuant analyst pointed out that the Ethereum Open Interest has shot up as well. The “Open Interest” measures the total amount of ETH-related positions that are currently open on all derivative exchanges.

This trend isn’t that unexpected, given that derivatives users have been opening a large amount of longs for the asset. With this rapid surge, the Ethereum Open Interest has managed to set a new ATH.

Historically, intense speculation has generally led to more volatility for the coin, as the risk of large liquidations happening can become high in such periods. As such, this Open Interest spike may signal some turbulent times ahead for Ethereum.

ETH Price

So far in the rally fueled by the ETF news, Ethereum has managed to break past the $3,800 level, which is a milestone the coin hadn’t achieved since mid-March.