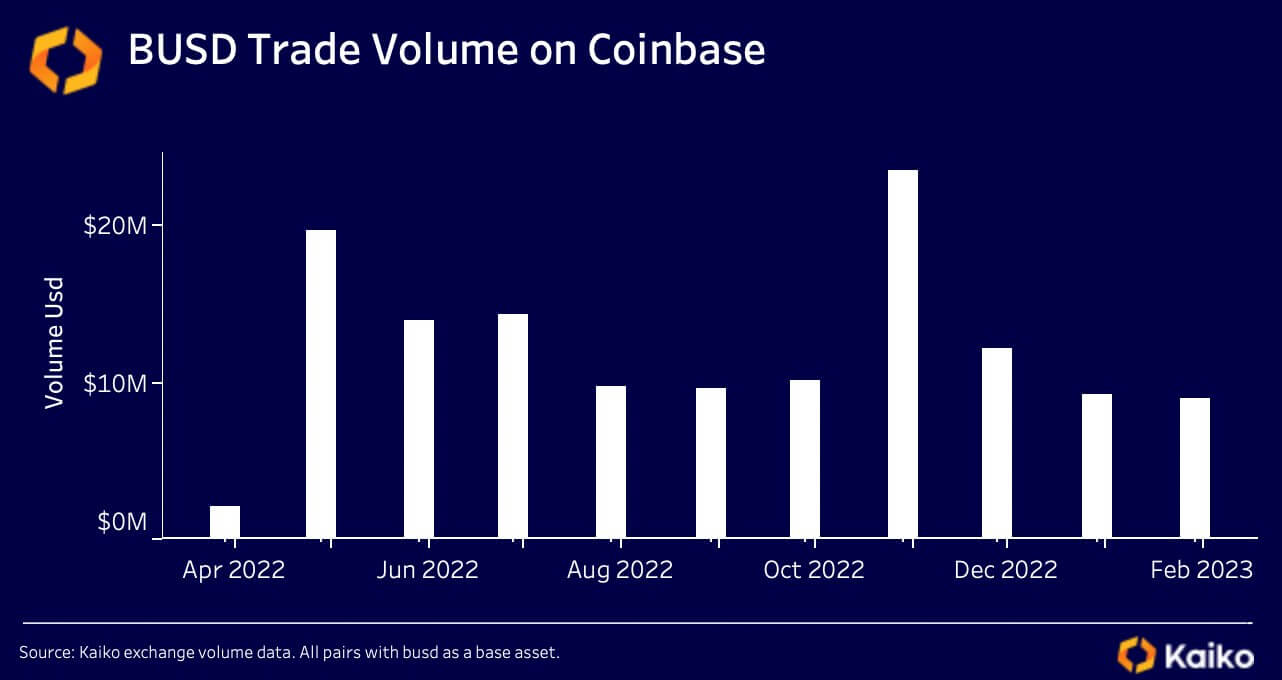

Binance USD (BUSD) stablecoin trading volume dropped to its lowest point since Coinbase listed it in April 2022.

According to data from Kaiko’s research analyst Dessislava Ianeva, the stablecoin’s trading volume in February was $9 million. Ianeva added that BUSD accounted for just 0.02% of Coinbase’s total volume.

Over the past month, BUSD has come under intense regulatory scrutiny. On Feb. 13, BUSD issuer Paxos was ordered to stop other mints of the stablecoin by the New York Department of Financial Services (NYDFS).

Following the news, BUSD whales began rapidly dumping the tokens. At some point, BUSD’s supply shrank by 18.2% — roughly $2.27 billion — over seven days as investors redeemed their holdings. Binance also burnt $2 billion idle BUSD on the BNB Chain.

Glassnode’s data, as analyzed by CryptoSlate, showed that BUSD’s balance on exchanges dropped to under 10 billion within three months.

These actions resulted in the stablecoin dropping out of the top 10 cryptocurrencies by market cap, according to Coingecko’s data.

Meanwhile, Coinbase said it would suspend BUSD trading on its platform from Mar. 13 because it does not meet its listing standards.

The post BUSD’s trading volume dropped to lowest point in February on Coinbase appeared first on CryptoSlate.