The cryptocurrency market continues to navigate choppy waters, with many digital assets experiencing significant price drops. However, XRP seems to be charting a different course. While the broader market sentiment remains cautious, large investors, often referred to as “whales,” have been quietly accumulating XRP. This bullish behavior by whales, coupled with positive technical indicators, has some analysts predicting a potential surge for XRP in the coming months.

XRP Whales Dive Deep: A Sign Of Confidence Or Opportunism?

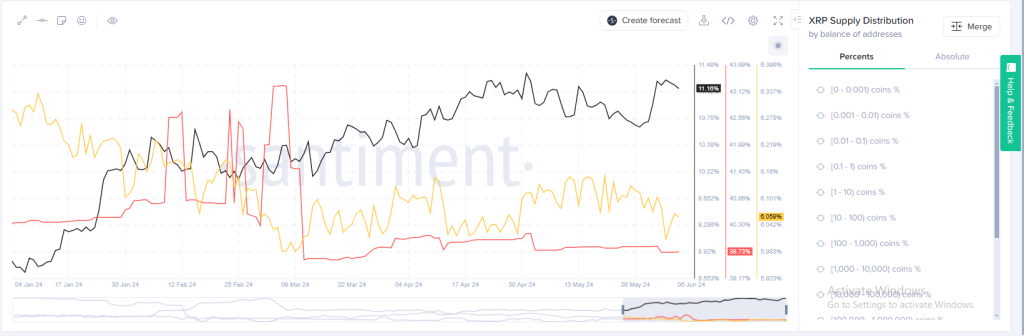

According to data from Santiment, a blockchain analytics firm, the holdings of XRP whales (addresses holding over 1 billion tokens) have grown from nearly 40% in mid-June to 42% at the time of writing. This significant increase in whale accumulation suggests a growing level of confidence in XRP’s future potential.

The recent buying spree by whales could be interpreted in two ways: It could be a sign that they believe XRP is undervalued and poised for a rebound. Alternatively, they might see the current dip as an attractive buying opportunity.

While the intentions behind the whale activity remain unclear, the impact is undeniable. The influx of large buy orders can help stabilize the price and even trigger a short-term rally. However, analysts caution that whale activity alone cannot guarantee a sustained price increase.

Long-Term Holders Stay Put

Beyond whale movements, on-chain analysis offers further insights into XRP’s potential trajectory. Dormant circulation, a metric that tracks the movement of tokens held in long-term storage, paints a promising picture.

Currently, the dormant circulation of XRP is low, indicating that long-term holders are not offloading their assets. This suggests a belief in the long-term viability of the Ripple ecosystem and a potential reluctance to sell at current prices.

The low dormant circulation is a positive sign. It indicates that long-term holders are holding onto their XRP, which can help prevent a further price decline. This could create a solid foundation for a future price increase.

What Do Technical Charts Say?

Technical analysis, which studies historical price data and chart patterns, also offers a glimmer of hope for XRP bulls. The Relative Strength Index (RSI), a momentum indicator, currently suggests that XRP is oversold. This could be a sign that a price rebound is imminent.

The price of XRP was $0.41 at the time of writing, data from Coingecko shows. This is a drop of 4.82% over the previous day. However, given the recent whale activity, the value may level off at the indicated price or maybe move toward $0.45.

A Cautiously Optimistic Projection

While the recent whale accumulation, low dormant circulation, and positive technical indicators paint a cautiously optimistic picture for XRP, the cryptocurrency market remains unpredictable. The success of XRP’s potential surge will hinge on several factors, including broader market sentiment, regulatory clarity surrounding Ripple’s ongoing legal battle with the SEC, and any unforeseen events that could impact the market.

Featured image from Pexels, chart from TradingView