Quick Take

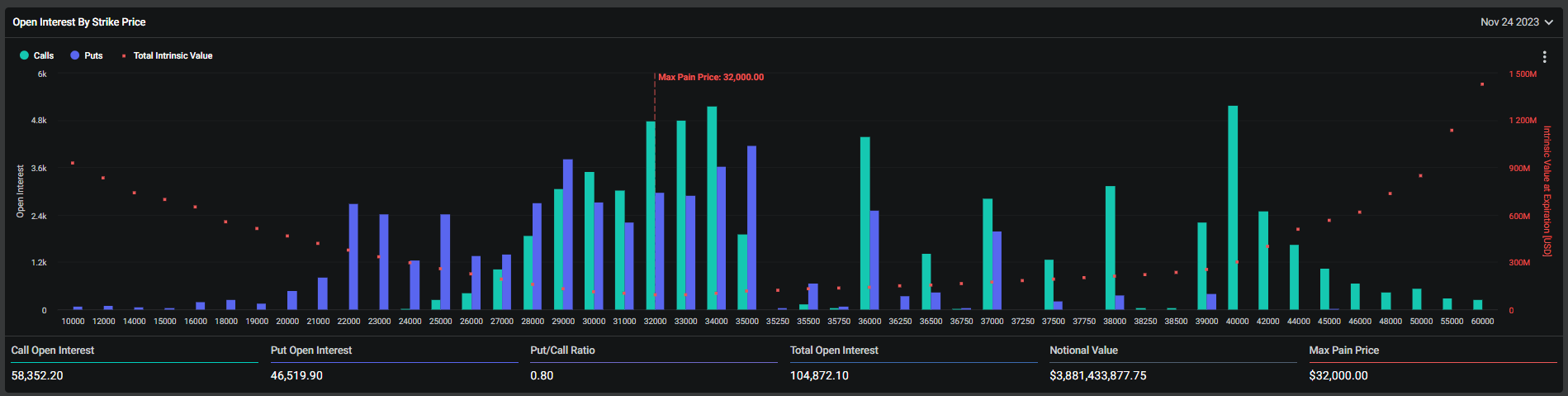

According to Deribit, approximately $3.8 billion in notional value, or 104,000 BTC in open interest, is poised to expire on Nov. 24, the concluding Friday of the month.

With the put/call ratio standing at 0.77, the data indicates a predominantly bullish sentiment, as substantiated by the higher call open interest, approximately 58,000 Bitcoin, compared to the 45,000 Bitcoin put options.

What catches the eye is the ‘max pain price’— a significant metric in the options market — pegged at $32,000, a figure that is currently below Bitcoin’s market price. This suggests a potential pressure on the Bitcoin price as the expiration date nears.

Furthermore, the substantial open interest in strike prices below the current market price may imply that these options are in-the-money (for call options) or indicate an expectation that the price was anticipated to hover around these levels.

The post Call options dominate as Bitcoin gears up for a massive $3.8 billion options expiry appeared first on CryptoSlate.