The post Can Bitcoin Rise To $67,000 Or Will Fall Back To $62,000? appeared first on Coinpedia Fintech News

Bitcoin is trying to take a break out from the downwards parallel channel that it has been stuck in for over months. Finally after a long struggle, btc price has once again risen above $61,000. In the last 24 hours the price took a surge of 3.58% and touched $64,280. Soon it faced rejection from the resistance zone. It has started to fall again. Let’s explore what happened in the market in the last few hours and what we can expect.

Bitcoin Stuck In Parallel Channel

The parallel channel started in the second week of March this year is not letting Bitcoin to pass. This causes BTC to keep moving in an overall downwards trend. Currently the price lies at $63,905 and is trying to overcome the resistance pressure at $64,000 zone.

The media of parallel channel prevented bitcoin falling under $60,000 and gave it the required support. The latest support is yet another trend line that started in March as well. This nearest active trend support is also cemented by the presence of Moving Average 100 at the same spot.

Other Market Metrics

Looking at other technical indicators we can see a support for bitcoin price rise. The RSI has risen to 63.74 points from 30 points on October 10. The MACD histogram that was showing reduction in the buyers’ power has started to fill green again. This shows that investors and traders are supporting the price rise. The MACD line was about to cross the signal line however retraced steps and started rising again.

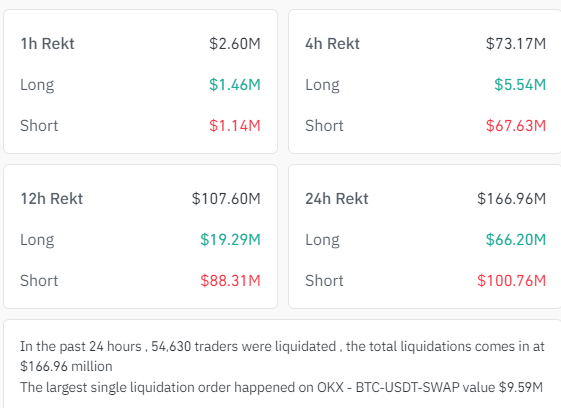

The Liquidation Zone and Data

The sudden rise in the price of Bitcoin caused 54,630 traders to get liquidated. This caused around $167 million in trades to wash out. Most importantly, the major liquidation happened in the last 12 hours causing $107.60 million worth of traders to vanish. Majority of this liquidation happened for the short traders.

What To Expect?

Looking at the chart and other market indicators, it is clear that Bitcoin is trying to cross the $64,000 resistance. This event in the opening week is a great sign and can lead the market above $67,000 till the weekend. However there is a huge chance of rejection, which can lead the price to drop back to $62,000. It all now depends on the hand of investors to support the price.