SUI is currently testing a crucial supply zone following a massive 95% surge triggered by the Federal Reserve’s recent interest rate cut announcement. The explosive rally, driven by significant buying pressure, has led to volatile price action, raising questions about whether this upward momentum can be sustained.

As SUI hovers near its current highs, market speculation is increasing around the possibility of a correction to lower demand levels, with $1.40 being the key target.

Key data from Coinglass reveals a decline in market demand, signaling a potential slowdown in buying activity. This has left some investors on edge, as they anticipate a price drop in the coming days. The sudden surge has fueled both optimism and caution as traders weigh the potential for continued gains against the risk of a sharp reversal.

With SUI now at a critical juncture, the next few days will be pivotal in determining whether the bullish trend can continue or if the market will retrace to more stable demand levels. Investors are watching closely, ready to adjust their strategies based on the unfolding price action.

SUI Funding Rate Signals Price Drop

SUI is at a critical point after days of extreme price action and significant gains. Following its impressive 95% rally since the Federal Reserve’s interest rate cut announcement, some investors and traders are beginning to take profits, signaling a potential shift in market sentiment. Many now view a correction to $1.40 as inevitable, especially as buying pressure cools down.

Key data from Coinglass suggests a cooling demand, with the funding rate turning negative to -0.067, marking a yearly low. The funding rate is a key indicator in futures trading, representing the periodic payment between traders in long positions (betting on price increases) and those in short positions (betting on price declines).

When an asset’s funding rate turns negative, it indicates that more traders are opening short positions, expecting a drop in price. This shift reflects growing caution in the market as traders start positioning themselves for a potential downturn.

With the funding rate at such a low and demand waning, the market is showing signs of cooling off after SUI’s explosive September rally. As a result, investors and traders are now patiently waiting for a correction to lower demand levels around $1.40, which could present new buying opportunities or signal further declines depending on the broader market conditions.

Key Levels To Watch

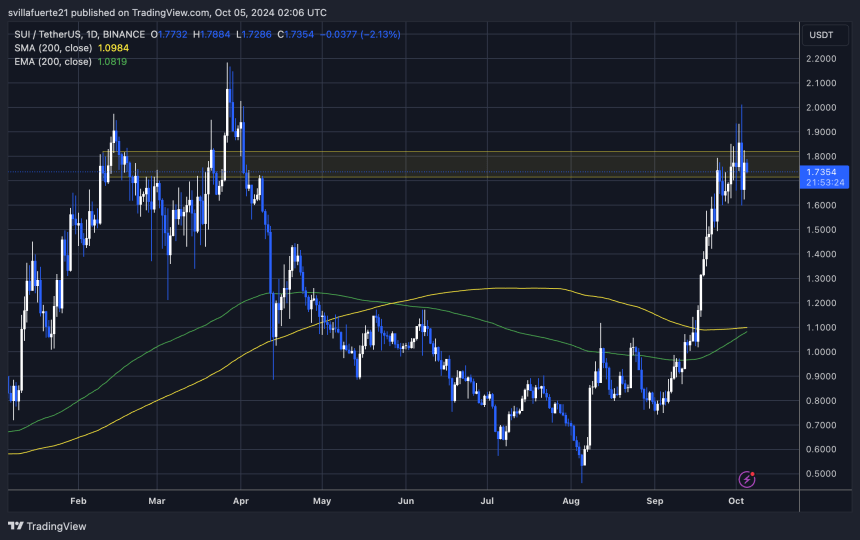

SUI is currently trading at $1.73 after experiencing days of volatile price action. The price surged but halted at the crucial $2 resistance level and has since entered a consolidation phase just below it. This key level has become a barrier for bulls, and a push above $2 is necessary for SUI to regain momentum and confirm a bullish trend.

However, the market remains uncertain, and if the price fails to hold the $1.60 support level, a deeper correction could follow. Analysts predict that a break below $1.60 may lead to a 20% drop, bringing SUI down to the $1.40 demand zone. This level is being closely monitored by investors and traders as a critical support to prevent further downside pressure.

As the market fluctuates, SUI’s price action remains in a delicate balance between potential recovery and further correction. The next moves around these key levels will likely determine whether bulls regain control or if bears continue to push prices lower in the coming days.

Featured image from Dall-E, chart from TradingView