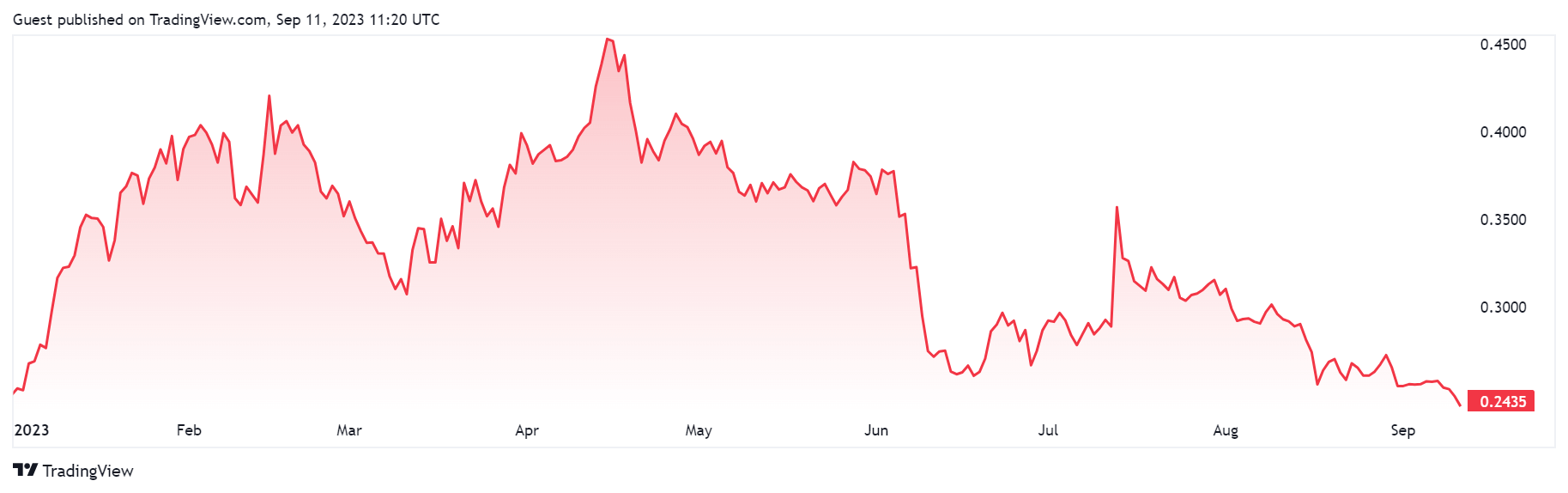

Cardano’s ADA price has fallen to its lowest value in a year after slight declines in decentralized finance activity on the blockchain network.

As per data from CryptoSlate, ADA is currently trading at $0.245, marking a 1.06% decline on the year-to-date metric. Interestingly, this price point represents the lowest value ADA has reached since the beginning of the year, effectively nullifying all the gains it had accrued throughout the year.

Why is ADA price struggling?

When the crypto market was experiencing a steady upward trajectory early in the year, ADA’s value greatly benefited from this run, peaking at around $0.45 in mid-April. However, since that peak, the cryptocurrency has been on a downward trend, with only a minor uptick noted in July.

The digital asset faced significant headwinds when the U.S. Securities and Exchange Commission (SEC) classified it as a security as part of its charges against Coinbase and Binance.

While Cardano’s founder, Charles Hoskinson, and Input Output Global (IOG), the blockchain network’s parent company, have vehemently rejected this classification, ADA has seen a decline in demand due to investor hesitation around assets without clear regulatory status. This has resulted in the token’s value dropping by more than 15% since the classification.

Decline in DeFi activity

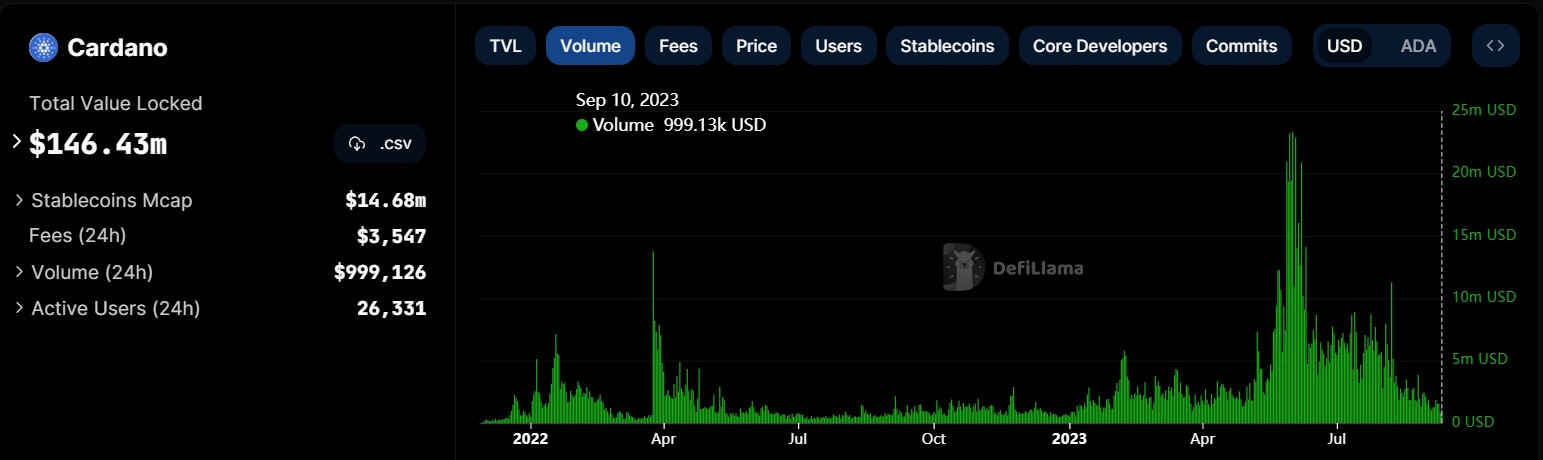

Data from DeFillama further shows that the price decline has coincided with a fall in DeFi activity on Cardano.

Per the data aggregator’s dashboard, Cardano’s transaction volume hit a yearly low on Sept. 9, recording only $821,390. This marks a significant decline from late May and early June when the network consistently processed transactions exceeding $10 million.

However, in August and September, the average transaction volume dwindled to approximately $1.5 million, highlighting a notable downturn in network activity.

Other key metrics for the network also point to the falling network activity. For instance, the blockchain’s daily users have dropped to around 30,000 from an average peak of more than 50,000 recorded earlier this year.

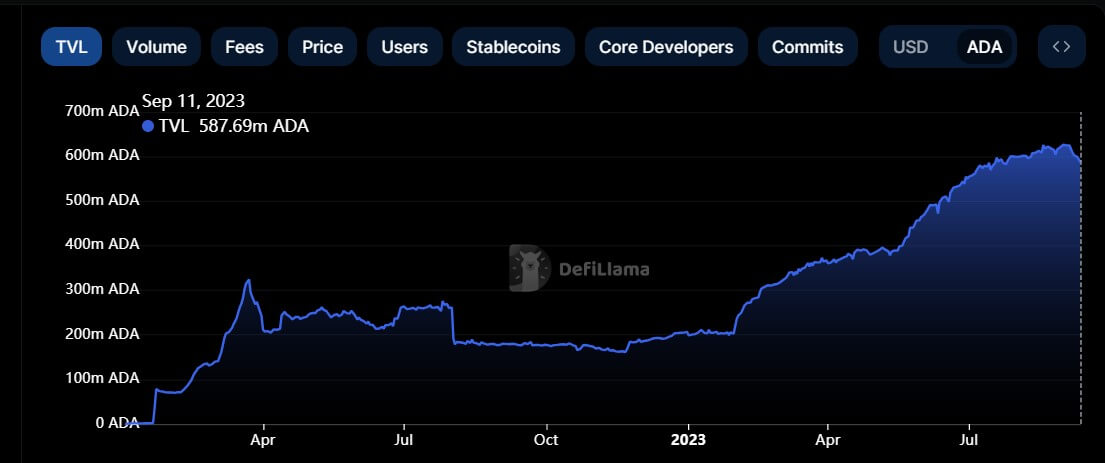

Besides that, the falling U.S. dollar value of the ADA token has seen the total value of assets locked (TVL) on the blockchain dip to $147.89 million from its peak of $166.72 million in July.

Meanwhile, the TVL remains relatively high regarding the ADA token, though it has recently experienced a slight decrease to 587 million from its peak of 621 million tokens.

The post Cardano ADA price hits year-low amid DeFi slump and SEC classification concerns appeared first on CryptoSlate.