The post Cardano (ADA) Price Prediction For December 27 appeared first on Coinpedia Fintech News

ADA, the native token of the Cardano blockchain, appears to be struggling to maintain its crucial support level amidst market uncertainty. Today, December 27, 2024, the overall cryptocurrency market sentiment appears to be experiencing a price decline, encompassing major assets such as Bitcoin (BTC), Ethereum (ETH), and XRP.

This price decline in major assets has completely shifted market sentiment towards a downtrend.

Cardano (ADA) Current Momentum

At press time, ADA is trading near $0.864, having experienced a price decline of over 6.9% in the past 24 hours. Amid this price decline, the altcoin has reached a crucial level. If this level fails to hold, the asset could tank by 15%, falling below the $0.75 mark.

This bearish price action has infused fear among traders and investors, leading to a decline in trading volume. According to CoinMarketCap data, ADA’s trading volume has dropped by 16% in the past 24 hours.

Cardano (ADA) Technical Analysis and Upcoming Level

According to expert technical analysis, ADA has recently broken down from a bearish head and shoulders price action pattern. Over the past seven days, it has been consolidating below the pattern’s neckline. Amid the recent price decline, ADA’s price has reached the lower boundary of the consolidation zone and is on the verge of a breakdown.

Based on the recent price action, if the altcoin breaches this level and closes a daily candle below the lower boundary of the zone, there is a strong possibility it could decline by 15%, reaching the $0.77 mark in the future.

ADA’s bearish thesis will only hold true if it closes a daily candle below the $0.85 level, which constitutes the lower boundary of the consolidation zone. Otherwise, the bearish scenario may fail to materialize.

On-Chain Metrics Reveals Mixed Sentiment

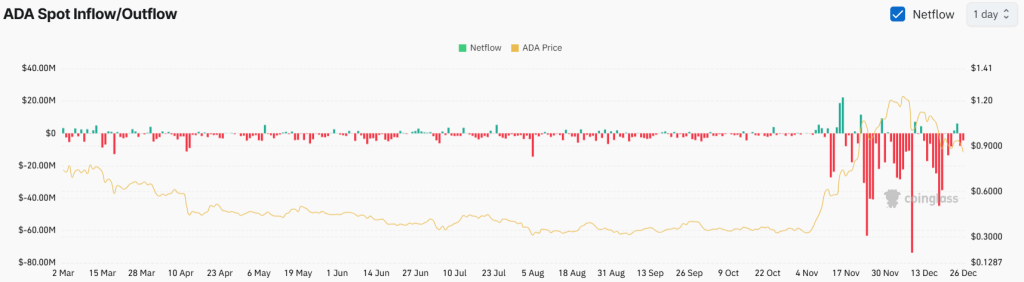

Despite this bearish outlook, long-term holders appear optimistic, while traders seem hesitant to establish new positions, as reported by the on-chain analytics firm Coinglass. Data from ADA spot inflow/outflow reveals that exchanges have witnessed a significant outflow of $4.7 million worth of ADA, suggesting potential accumulation and buying pressure.

Conversely, traders appear to be liquidating their positions, as evidenced by an 8.2% drop in ADA’s open interest within the last 24 hours.