The post Cardano (ADA) Price Prediction for February 26 appeared first on Coinpedia Fintech News

ADA, the native token of the Cardano blockchain, is poised for a massive price recovery due to its current market structure and price action. After a significant price drop and consecutive strong red candles pushed ADA to the crucial $0.65 level, traders believed it had failed to hold this support. However, the asset has formed a green candle, shifting market sentiment.

The reason ADA has held this level is its strong history of price reversals and the significant buying pressure at the $0.65 level.

Current Price Momentum

However, the price has begun recovering, as ADA’s four-hour chart has witnessed two large green bullish candles, indicating a potential price rebound.

The asset is currently trading near $0.69 and has seen a modest decline of over 0.85% in the past 24 hours. However, during the same period, its trading volume surged by 85%, indicating heightened participation from traders and investors compared to the previous day.

Cardano (ADA) Technical Analysis and Upcoming Level

According to expert technical analysis, ADA appears to be recovering and has formed a bullish morning star candlestick-like pattern on the four-hour chart, indicating an upward move. Based on recent price action and historical patterns, if ADA holds above the $0.65 level, there is a strong possibility that the asset could soar by 21% to reach the $0.83 level in the coming hours.

This bullish price action is further supported by ADA’s technical indicators, which are flashing a bullish divergence on the daily timeframe, suggesting a potential price recovery.

However, despite this bullish outlook, if sentiment shifts and the price falls, closing below the $0.65 level, it could drop by 30% to reach the $0.45 level.

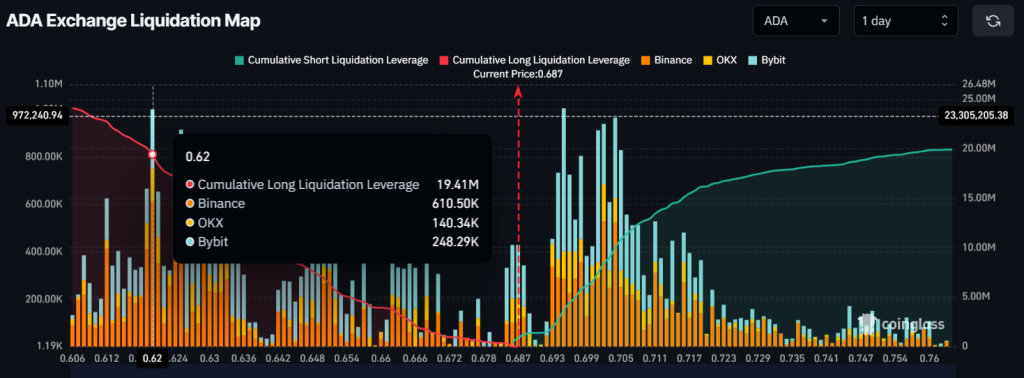

Major Liquidation Levels

Looking at the ongoing price recovery, trader sentiment has begun shifting as they start building their positions on the long side after continuously betting on the short side, as reported by the on-chain analytics firm Coinglass.

Data from the ADA exchange liquidation map shows that traders are currently over-leveraged at $0.695, with $3.70 million worth of short bets, while at $0.62, bulls have built $19.50 million worth of long positions.