Cardano (ADA) is currently trading just below a critical resistance level at $0.33 after a week of intense fear and uncertainty in the market. However, on-chain data from IntoTheBlock suggests that some investors see this as a potential buying opportunity, anticipating a market recovery in the near future.

Despite the broader downturn, certain metrics indicate growing optimism, as a portion of the market appears to be accumulating ADA at these levels. This suggests that investors may expect a reversal soon.

As the market continues to shift, these metrics could offer key insights for those wondering whether Cardano is worth buying at this point or if a deeper correction is likely. With ADA hovering at a critical juncture, investors are closely monitoring price action and data to determine if this could be a turning point for the asset.

Cardano Investors Getting Ready To Buy?

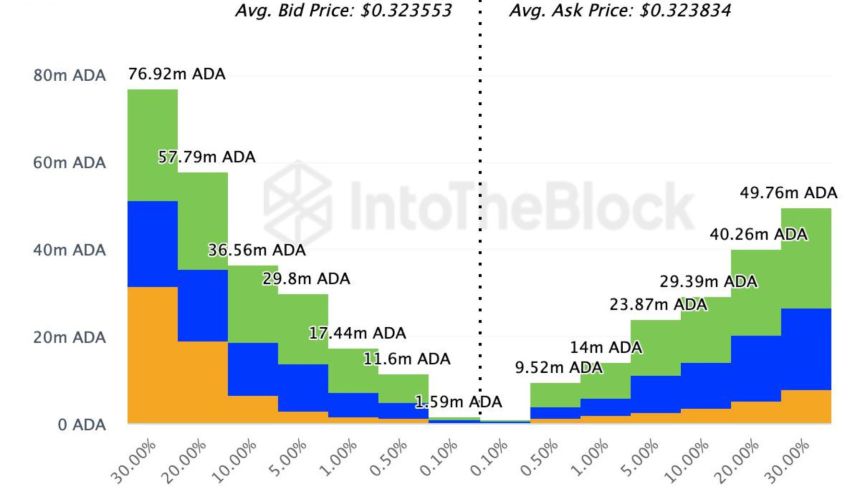

Data from IntoTheBlock reveals that some investors view Cardano (ADA) as a promising buying opportunity ahead of a potential market recovery. One significant indicator supporting this is the Exchange On-chain Market Depth, which tracks order books on the top 20 exchanges. This data shows that participants have placed buy orders for 220 million ADA tokens, amounting to over $70 million at the current market price. In contrast, bearish traders have set sell orders for fewer than 170 million ADA tokens, valued at approximately $52 million.

This disparity between buying and selling volume suggests that Cardano’s price may be poised for an upward movement. When buy orders significantly outweigh sell orders, it often signals that investor sentiment is turning more positive, which can contribute to an increase in price. As long as this trend persists, with buying pressure dominating, Cardano could see a rally in the near term.

However, despite the bullish outlook from some investors, the broader market remains filled with uncertainty, and Cardano still faces resistance at the $0.33 level. The overall market sentiment and external factors will play a crucial role in determining whether ADA can break through this resistance and enter a more sustained uptrend. Still, the current data suggests a favorable environment for a potential recovery if positive sentiment continues.

ADA Price Action

ADA is currently trading at $0.32, facing indecision as it attempts to break the $0.33 resistance, which previously acted as support in early August.

The asset remains under pressure, trading below the 4-hour 200 moving average (MA) at $0.3446. This is a crucial indicator of short-term strength, and its current position signals weakness. For bulls to regain momentum, ADA must break past the $0.33 resistance and reclaim the 4-hour 200 MA as support. Achieving this would strengthen the bullish case, potentially leading to a rally.

However, if ADA fails to clear these resistance levels, the outlook could turn bearish. The next significant support sits at $0.30, and a break below this level would signal further downside potential.

Traders are watching closely as the price action around the $0.33 resistance and 200 MA will determine whether ADA can recover or face a deeper correction. The market’s uncertainty makes these levels pivotal for ADA’s near-term direction.

Featured image from Dall-E, chart from TradingView